Blog

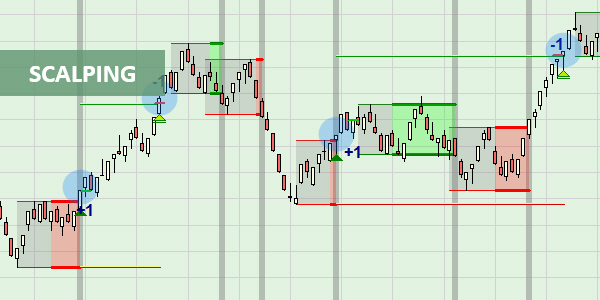

Having an effective scalping chart setup is crucial for success. By using the right timeframe, incorporating moving averages, and leveraging technical indicators, you can make informed trading decisions and maximize your potential for profit in the forex market.

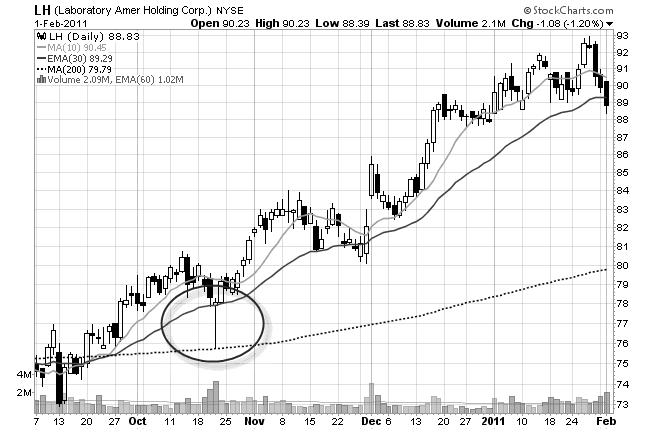

In this article, we’ll dive in and discover the key elements of a swing trading chart setup that will empower you on your journey as a trader.

Central bank policies hold a significant influence over the economic landscape, playing a crucial role in managing fluctuations and ensuring price stability. As the manager of a nation's money supply, central banks have distinct responsibilities that set them apart from other financial institutions.

Economic calendar strategies are a valuable tool for organizations to stay updated about major financial events and trends. You may make more informed decisions about their investments, strategy, and operations by tracking forthcoming events and data releases.

Price Action Trading Indicators are essential tools that help traders analyze and interpret price movement in the financial markets. As a trader myself, you have found these indicators to be incredibly valuable in identifying potential trading opportunities and making informed decisions.

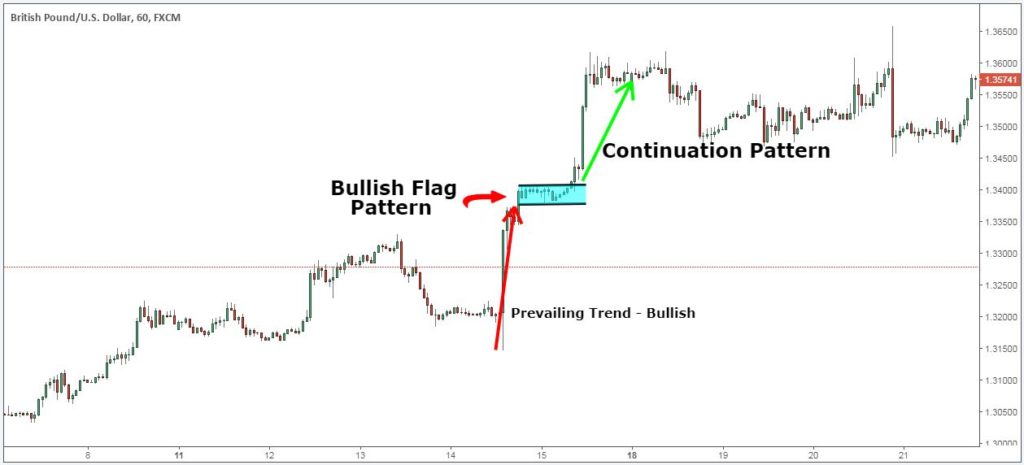

You must have come across several chart patterns as a technical trader. They are an essential component of technical analysis, particularly for discretionary traders. However, what exactly is a chart pattern trading strategy? Let's delve into it right now.

In this article, Forex Prop Reviews will dive deep into the world of candlestick pattern strategies to enhance our trading skills and improve our chances of success.

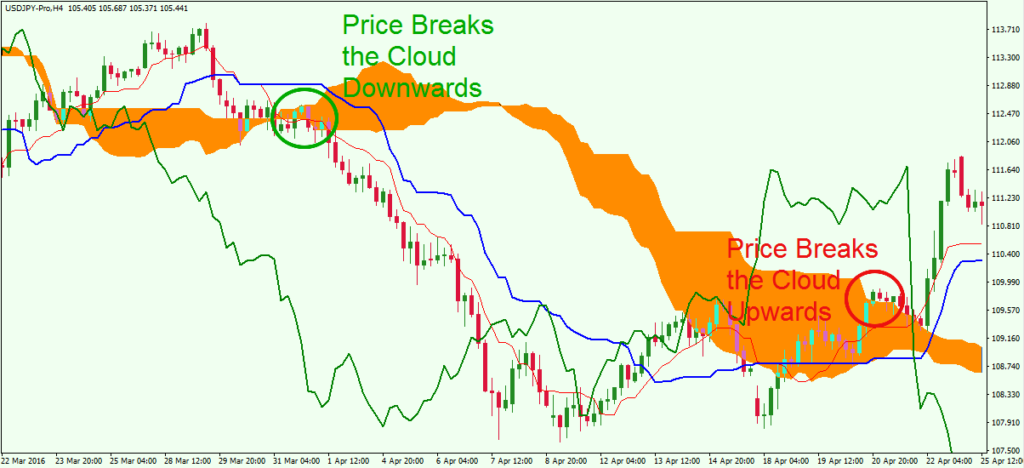

Ichimoku is a Japanese trading system that utilizes a range of indicators to analyze price action and forecast potential market trends. The beauty of Ichimoku strategies lies in their comprehensive nature, as they take into account multiple components and indicators to provide a holistic view of market conditions.

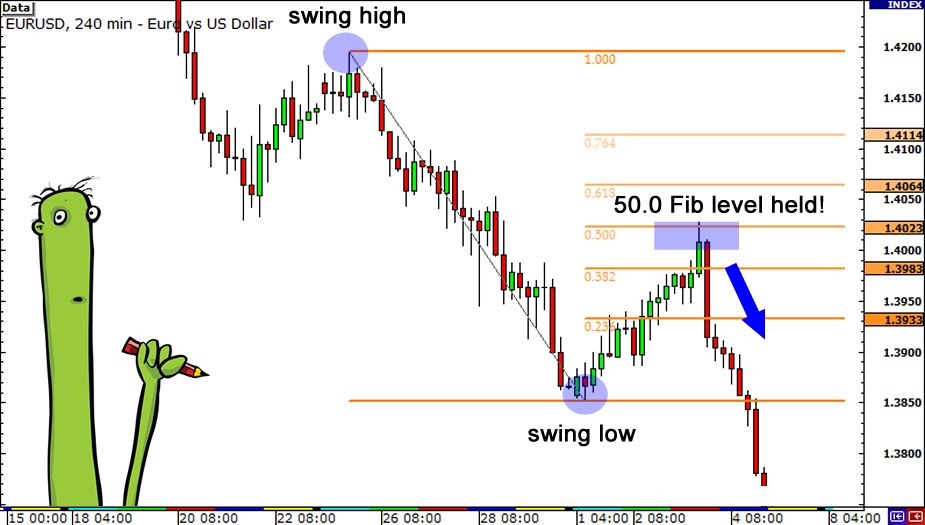

Fibonacci Retracement Strategies can provide objective and quantifiable levels for analysis. Fibonacci retracement ratios are derived from mathematical calculations that remain constant across different time frames and markets. This consistency helps me in identifying high-probability trade setups with predefined risk-reward ratios.

The RSI strategies will help traders identify overbought or oversold conditions in a particular asset, which can be valuable information when making trading decisions.

.jpg)

.jpg)