Price Action Trading Indicators are essential tools that help traders analyze and interpret price movement in the financial markets. As a trader myself, you have found these indicators to be incredibly valuable in identifying potential trading opportunities and making informed decisions.

3 Most Commons Price Action Trading Indicators for Traders

In the world of trading, Price Action Trading Indicators focus on analyzing historical price data rather than relying on complicated mathematical formulas or lagging indicators.

This approach allows you to understand how buyers and sellers interact in the market, providing you with a clearer picture of market sentiment. By observing patterns such as candlestick formations, trend lines, and chart patterns, you can anticipate future price movements with greater accuracy.

Whether you are a novice trader looking to expand your knowledge or an experienced trader seeking new insights into the markets' behavior – understanding Price Action Trading Indicators is crucial for success in today's dynamic financial landscape.

What are Price Action Trading Indicators?

Price Action Trading Indicators are tools that I use to analyze market movements and make informed trading decisions. These indicators help me understand the price patterns, trends, and potential reversals in the market.

By using price action trading indicators, Forex Prop Reviews can identify key support and resistance levels, as well as entry and exit points for my trades. These indicators are an essential part of my technical analysis strategies.

One of the main advantages of using price action trading indicators is that they provide a clear visual representation of the market's behavior. Instead of relying solely on fundamental analysis or news events, these indicators allow me to see how buyers and sellers are interacting with each other in real time. This helps me gauge market sentiment and make more accurate predictions about future price movements.

3 Most Common Price Action Trading Indicators

Moving Averages, Bollinger Bands, and Price Volume Trend are three of the most common price action trading indicators.

Moving Averages

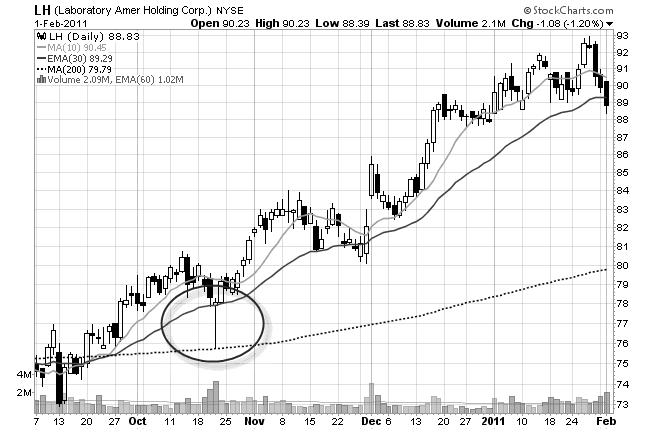

Surprisingly, incorporating moving averages can greatly enhance your trading strategy. Moving averages are one of the most widely used technical indicators in price action trading. They smooth out the price data over a specified period and help identify trends and potential reversals in the market.

Here are four reasons why moving averages can be beneficial for your trading:

- Trend identification: By plotting a moving average on your chart, you can easily determine whether the market is in an uptrend or downtrend. When the price is consistently above the moving average, it indicates an uptrend, while prices below the moving average suggest a downtrend.

- Support and resistance levels: Moving averages act as dynamic support and resistance levels. Traders often use them to identify areas where prices may bounce off or breakthrough. The longer-term moving averages, such as 50-day or 200-day, tend to carry more significance as support or resistance levels.

- Entry and exit points: Moving averages can serve as entry and exit signals for trades. For instance, when the price crosses above a shorter-term moving average from below, it may indicate a buy signal. Conversely, when the price falls below a moving average from above, it could be a sell signal.

- Confirmation of trends: Moving averages can confirm trend strength by measuring how far prices deviate from the average value over time. Widening gaps between multiple moving averages suggest stronger trends while converging or overlapping lines indicate weakening momentum.

Bollinger Bands

Get ready to discover the power of Bollinger Bands and how they can revolutionize your trading strategy!

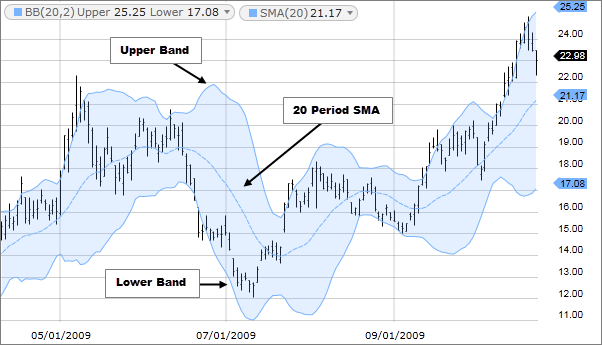

Bollinger Bands are a popular technical analysis tool used by traders to identify potential price reversals, volatility patterns, and market trends. They consist of three lines: the middle band, which is a simple moving average (typically 20 periods), and two outer bands that are placed two standard deviations away from the middle band.

The width between the outer bands expands or contracts based on market volatility.

Bollinger Bands provide valuable information about overbought and oversold conditions in the market. When the price touches or moves outside the upper band, it suggests that the market is overbought, indicating a potential reversal or correction may occur soon.

Conversely, when the price touches or moves outside the lower band, it indicates that the market is oversold, signaling a possible upward reversal.

Traders often look for price action signals such as candlestick patterns or chart formations in conjunction with these band touches to confirm potential entry and exit points. By incorporating Bollinger Bands into your trading strategy, you can gain insights into market conditions and make more informed trading decisions.

Price Volume Trend

The Price Volume Trend indicator provides a valuable perspective on market dynamics by considering both price movements and trading volume. It's a technical analysis tool that helps traders identify the strength and direction of trends in the market.

By combining price data with volume data, it allows you to analyze the buying and selling pressure behind price movements.

The Price Volume Trend indicator calculates a cumulative value based on the relationship between price changes and volume over a given period. If prices are rising and there is an increase in volume, it suggests strong buying pressure and confirms the uptrend. On the other hand, if prices are falling but there is low volume, it indicates weak selling pressure and may signal a potential reversal or consolidation phase in the market.

This information helps you make more informed trading decisions as you can gauge whether a trend is likely to continue or reverse based on the strength of buying or selling pressure.

Frequently Asked Questions

How do Price Action Trading Indicators differ from other indicators?

Price action trading indicators differ from other indicators by focusing solely on the movement of price itself, without considering any additional factors such as volume or time.

These indicators are based on the belief that price patterns and trends can provide valuable insights into future market movements.

Unlike other indicators that may use complex mathematical formulas or calculations, price action trading indicators rely on simple chart patterns and candlestick formations to identify potential buying or selling opportunities.

By studying the behavior of price alone, traders using these indicators aim to understand market sentiment and make informed decisions based on real-time market conditions.

Can price action indicators be used in conjunction with other technical analysis tools?

Yes, price action indicators can be used in conjunction with other technical analysis tools. By incorporating price action indicators into my overall trading strategy, I'm able to gain a more comprehensive view of the market and make better-informed trading decisions. These indicators provide valuable insights into the behavior of price movements and help me identify key levels of support and resistance, trend reversals, and potential entry or exit points.

When combined with other technical analysis tools such as moving averages, oscillators, or Fibonacci retracements, price action indicators enhance my ability to analyze market trends and patterns effectively. This integrated approach allows me to validate signals from different sources and increase the probability of successful trades.

Are there any specific timeframes that are more suitable for using price action indicators?

There are no specific timeframes that are more suitable for using price action indicators. The effectiveness of these indicators depends on various factors such as market conditions, trading style, and personal preferences.

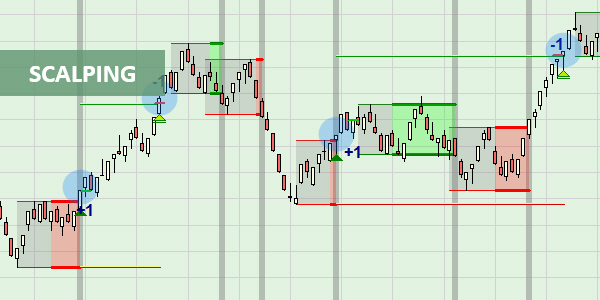

Some traders may find shorter timeframes like 5-minute or 15-minute charts more suitable for quick scalping trades based on price action signals, while others may prefer longer timeframes like daily or weekly charts to identify long-term trends and patterns.

Ultimately, it's important to experiment with different timeframes and find the one that aligns with your trading strategy and goals.

What are some common mistakes to avoid when using price action indicators?

Some common mistakes to avoid when using price action indicators are relying solely on indicators without considering other factors, such as market conditions or news events. It's important to remember that indicators are just tools and should not be used in isolation.

Another mistake is overcomplicating the trading strategy by using too many indicators or conflicting signals. It's better to focus on a few reliable indicators and understand how they interact with each other.

Additionally, traders should avoid chasing after every signal generated by the indicator, as this can lead to impulsive and emotional decision-making. Patience and discipline are key in effectively using price action indicators.

Conclusion

Price action trading indicators are essential tools for traders to analyze and interpret market movements. They provide valuable insights into the behavior of prices and help identify potential trading opportunities.