Economic calendar strategies are a valuable tool for organizations to stay updated about major financial events and trends. You may make more informed decisions about their investments, strategy, and operations by tracking forthcoming events and data releases.

How to use Economic Calendar Strategies

As a trader, staying informed about the latest economic events and their potential impact on the market is crucial for making successful trading decisions. That's where economic calendar strategies come into play.

In this article, Forex Prop Reviews will guide you through the importance of understanding key economic indicators and how to develop a trading plan that incorporates these events.

Understanding Key Economic Indicators

Understanding key economic indicators is crucial for making informed financial decisions and avoiding potential pitfalls. As a trader who relies on economic calendar strategies and fundamental analysis strategies, I understand the importance of staying updated on these indicators.

Economic indicators provide valuable insights into the health of an economy, such as GDP growth rates, unemployment rates, inflation levels, and consumer confidence. By analyzing these indicators, you can gauge the overall strength or weakness of an economy and adjust your trading strategies accordingly.

Incorporating economic indicators into your analysis allows you to identify potential market trends and make more accurate predictions about future price movements. For example, if you notice a strong GDP growth rate in a particular country, it may indicate that their currency will strengthen against others. Armed with this information, you can develop trading plans to take advantage of such opportunities.

Understanding key economic indicators allows you to stay ahead of market trends and react quickly to any changes that may affect your trades.

Developing a Trading Plan

To effectively develop a trading plan, it's crucial to first grasp the intricacies and nuances of the subject matter. Developing a trading plan involves careful analysis and consideration of various factors that can impact the market. Here are three key points to keep in mind when creating your trading plan:

- Define your goals: Clearly identify what you aim to achieve through your trades. Whether it's short-term profits or long-term growth, having well-defined goals will help guide your decision-making process.

- Assess risk tolerance: Understand how much risk you're willing to take on and consider factors such as capital preservation and potential losses. It's important to strike a balance between risk and reward that aligns with your personal financial situation.

- Conduct thorough research: Stay informed about economic events, news releases, and market trends that may affect the instruments you trade. By staying up-to-date with current affairs and analyzing past data, you can make more informed decisions.

By considering these aspects while developing your trading plan, you can increase the likelihood of achieving success in the markets.

Analyzing Market Reactions to Economic Events

When analyzing market reactions to economic events, it's crucial to grasp the intricacies of how these events shape the landscape of trading.

Economic events such as interest rate decisions, GDP reports, and employment data can have a significant impact on the financial markets. Traders need to understand how these events are likely to influence market sentiment and adjust their strategies accordingly.

For example, if a central bank announces a surprise interest rate hike, it could lead to a strengthening of the currency and potentially a sell-off in stocks. Traders aware of this possibility can position themselves accordingly by buying the currency or shorting stocks before the announcement. Similarly, positive employment data might lead to increased consumer confidence and higher spending, which could be beneficial for retail stocks.

By analyzing market reactions to economic events, traders can identify patterns and trends that can inform their trading decisions. This analysis involves studying historical data and observing how different economic indicators have affected various asset classes in the past. By understanding these relationships, traders can develop strategies that take advantage of potential opportunities presented by economic calendar events.

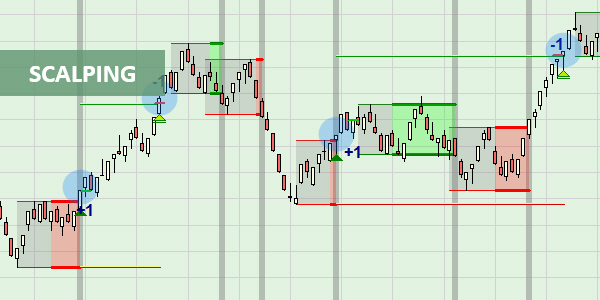

Using Technical Analysis in Conjunction with Economic Calendar

By incorporating technical analysis alongside the economic calendar, you can enhance your understanding of market dynamics and make more informed trading decisions. Technical analysis involves studying historical price patterns, trends, and indicators to predict future price movements.

When combined with the knowledge of upcoming economic events from the calendar, you can better anticipate how these events may impact the market and adjust your trading strategies accordingly.

Here are a few ways in which technical analysis can complement the use of an economic calendar:

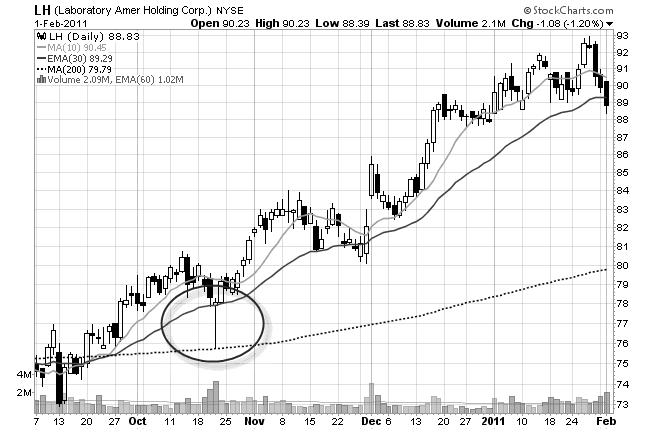

- Trend analysis: By analyzing charts and identifying key support and resistance levels, you can determine if an upcoming economic event will likely reinforce or reverse an existing trend. This helps you gauge whether it's a good time to enter or exit a trade.

- Oscillators and indicators: Technical indicators such as moving averages, MACD (Moving Average Convergence Divergence), or RSI (Relative Strength Index) provide additional insights into market sentiment. They help you assess whether an economic event is likely to cause overbought or oversold conditions, indicating potential reversals.

- Breakout patterns: By studying chart patterns like triangles, rectangles, or head-and-shoulders formations, you can identify potential breakout points. If there's a high-impact economic event on the horizon that could trigger significant volatility, these patterns may indicate potential entry or exit points for trades.

- Candlestick patterns: Analyzing candlestick patterns provides valuable information about market psychology and investor sentiment. Combined with knowledge of upcoming economic events from the calendar, certain candlestick formations like doji or engulfing patterns near key support/resistance levels can signal impending market reactions.

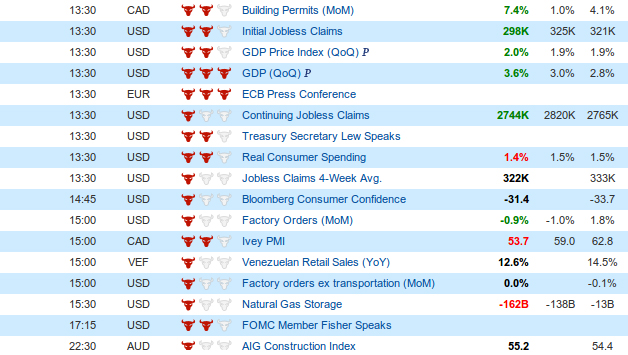

Identifying High-Impact Events

Utilizing technical analysis in conjunction with an economic calendar allows you to identify high-impact events and make more informed trading decisions. By analyzing price patterns, trend lines, and indicators, you can gain insights into market sentiment and potential price movements.

However, it's important to understand that technical analysis alone may not provide a complete picture of the market. This is where the economic calendar comes in. The economic calendar provides a schedule of upcoming economic releases, such as interest rate decisions, GDP figures, or employment reports. These events have the potential to significantly impact the financial markets.

By being aware of these high-impact events and their scheduled release dates, you can better prepare yourself for potential volatility or trend reversals. This knowledge allows you to adjust your trading strategy accordingly and avoid unnecessary risks.

Managing Risk and Position Sizing

To effectively manage your risk and position sizing, it's crucial to carefully assess your exposure to potential market volatility and adjust your trades accordingly. Here are four key considerations to keep in mind:

- Determine your risk tolerance: Before entering any trade, it's important to understand how much risk you're willing to take on. This will help you determine the appropriate position size for each trade and ensure that you don't exceed your comfort level.

- Use stop-loss orders: Implementing stop-loss orders can be a valuable tool in managing risk. These orders automatically close out a trade if the price reaches a predetermined level, limiting potential losses. By setting stop-loss levels based on technical analysis or key support/resistance levels, you can protect yourself from significant downside moves.

- Diversify your portfolio: Spreading your investments across different asset classes or markets can help reduce overall risk. By diversifying, you minimize the impact of any single event or position on your portfolio's performance. It's important to note that diversification doesn't guarantee profits or protect against losses, but it can help manage risk over time.

- Regularly review and adjust: Market conditions and volatility can change rapidly, so it's essential to regularly review and adjust your positions as needed. Keep an eye on economic events and news releases that may impact the markets you're trading in order to make informed decisions about adjusting your positions.

By incorporating these risk management strategies into your trading approach, you can better navigate market volatility and protect yourself from excessive losses.

Incorporating Economic Calendar Strategies into Your Trading Routine

Discover how you can seamlessly integrate economic events into your trading routine and never miss out on potential opportunities. Incorporating economic calendar strategies into your trading routine can provide valuable insights into market movements and help you make informed trading decisions.

By staying up to date with important economic releases, such as interest rate decisions, employment reports, and GDP data, you can anticipate potential market volatility and position yourself accordingly.

To incorporate economic calendar strategies into your trading routine effectively, start by identifying the key economic events that are relevant to the markets you trade. Create a schedule or use an online economic calendar tool to keep track of upcoming releases.

Prioritize events that have historically had a significant impact on the markets or align with your trading strategy. Once you have identified the relevant events, allocate time in your daily or weekly routine to review their potential impact on the markets. This could involve analyzing historical data, reading expert analysis, or even attending webinars or conferences related to these events.

By proactively incorporating these steps into your routine, you will be better prepared for market-moving news and be able to adjust your positions accordingly.

Integrating economic calendar strategies into your trading routine is essential for staying informed about important market events and making well-informed trading decisions. By dedicating time and effort to understanding the potential impact of economic releases on the markets you trade, you can position yourself strategically and capitalize on potential opportunities.

Conclusion

In conclusion, incorporating economic calendar strategies into my trading routine has been a game-changer for me. By understanding key economic indicators and their impact on the market, you can develop a solid trading plan and make informed decisions.