You must have come across several chart patterns as a technical trader. They are an essential component of technical analysis, particularly for discretionary traders. However, what exactly is a chart pattern trading strategy? Let's delve into it right now.

What are Chart Patterns Strategies? Types, Rules

Chart patterns are an essential tool for traders in the financial markets. They provide valuable insights into market trends and can help predict future price movements.

As a trader, I have come to appreciate the significance of chart patterns in my decision-making process. By understanding these patterns and employing effective strategies, I have been able to enhance my trading performance.

In this article, Forex Prop Reviews will delve into the world of chart pattern strategies and explore their importance in trading.

What are chart patterns?

So, you're probably wondering what chart patterns are, right?

Well, they're these awesome visual formations on a price chart that can help you predict future market movements.

Chart patterns are an essential part of technical analysis strategies used by traders and investors in the financial markets.

These patterns can be identified by studying historical price data and analyzing the recurring shapes and formations that appear on a chart.

There are various types of chart patterns, such as triangles, rectangles, head and shoulders, double tops or bottoms, and many more.

Each pattern represents a specific market sentiment and provides valuable insights into potential price trends.

By recognizing these patterns early on, traders can anticipate whether prices are likely to continue in their current direction or reverse course.

This knowledge allows them to develop effective chart pattern strategies for entering or exiting trades at optimal times.

Now that you have an idea of what chart patterns are all about, let's dive into why they are so important for traders.

Are chart patterns important?

Did you know that understanding and recognizing certain visual cues can significantly impact your trading success? Chart patterns are one of those visual cues that can provide valuable insights into market trends and help traders make more informed decisions.

These patterns, formed by price movements over a specific period, can indicate potential reversals or continuations in the market. By studying chart patterns, traders can identify key levels of support and resistance, spot trend changes, and anticipate future price movements.

Chart patterns are important for several reasons:

- They provide a framework for analyzing price action. Chart patterns offer a structure to analyze the behavior of financial instruments. They allow traders to interpret market sentiment and identify potential entry or exit points based on historical price patterns.

- They help in risk management. Understanding chart patterns can assist in setting stop-loss orders at appropriate levels. Traders can place their stops below or above key support/resistance areas identified through chart patterns, helping them manage their risk effectively.

- They offer trading opportunities. Chart patterns often present lucrative trading opportunities with favorable risk-to-reward ratios. By identifying reliable chart formations like double tops, head, and shoulders, or triangles, traders can capitalize on potential breakouts or breakdowns in the market.

Types of chart patterns traders should know

Explore these powerful chart formations that can revolutionize your trading game and give you a competitive edge in predicting market trends and making profitable trades.

There are several types of chart patterns that traders should know to maximize their chances of success.

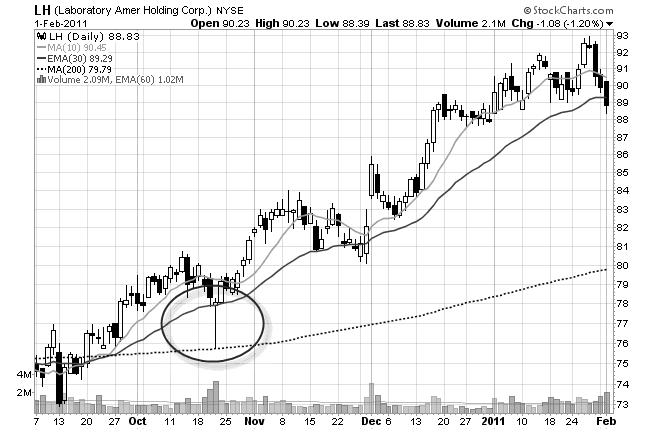

One common type is the reversal pattern, which signals a change in the direction of a trend. This pattern includes formations like head and shoulders, double tops, and double bottoms. By recognizing these patterns early on, traders can anticipate when a trend is about to reverse and take appropriate action to capitalize on the upcoming price movements.

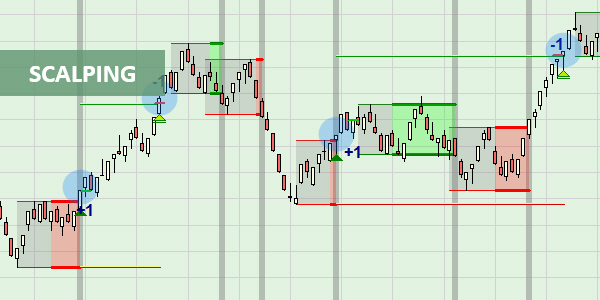

Another type is the continuation pattern, which indicates that the current trend is likely to continue after a brief pause or consolidation period. Examples include flags, pennants, and triangles. Identifying these patterns allows traders to enter positions at optimal times and ride the momentum of an ongoing trend.

How chart patterns work

Understanding how chart patterns function is crucial for traders who want to improve their decision-making and increase their chances of success in the market. Chart patterns are visual representations of price movements that occur on a stock chart. They can provide valuable insights into future price trends and help traders identify potential entry and exit points.

To fully grasp how chart patterns work, it's important to consider the following:

- Formation: Chart patterns are formed when prices reach certain levels or exhibit specific price action characteristics. These formations can take various shapes, such as triangles, rectangles, or head and shoulders.

- Confirmation: Once a pattern is identified, traders look for confirmation signals to validate its reliability. This may involve analyzing volume indicators, trend lines, or other technical indicators that align with the pattern's formation.

- Price Targets: Chart patterns also provide potential price targets based on the pattern's structure and previous price behavior. Traders often use these targets to set profit targets or determine stop-loss levels.

Understanding these aspects of chart patterns allows traders to make more informed decisions regarding their trades. By recognizing the formation, confirming its validity, and setting appropriate price targets, traders can enhance their trading strategies and increase their profitability.

Rules of chart patterns strategies

To effectively implement chart pattern strategies, you must adhere to specific rules that dictate your decision-making and increase your chances of success in the market. These rules serve as guidelines to ensure that you’re making informed and calculated trading decisions based on the patterns that emerge.

Firstly, it's crucial to wait for confirmation before acting on a chart pattern. This means waiting for the price to break out of the pattern or reach a certain level before entering a trade. By doing so, you can avoid false signals and reduce the risk of entering trades prematurely.

Secondly, you need to set clear stop-loss orders to manage potential losses. Setting a stop-loss order helps you define my maximum acceptable loss before exiting a trade. This ensures that you don't hold onto losing positions for too long, protecting your capital and preventing further losses.

Additionally, it's essential to have realistic profit targets when trading chart patterns. By setting achievable goals, you can take profits at predetermined levels and avoid being greedy or holding onto trades for too long.

Following these rules when implementing chart pattern strategies increases your chances of success in the market by providing structure and discipline in your decision-making process. Waiting for confirmation, setting stop-loss orders, and having realistic profit targets are all essential components of effective trading strategies based on chart patterns.

By adhering to these rules consistently, you can improve your overall performance as a trader and make more informed decisions in the dynamic world of financial markets.

Conclusion

Overall, mastering chart patterns strategies can greatly enhance a trader's ability to make informed decisions in the dynamic world of finance. With practice and experience, traders can become proficient in identifying profitable opportunities using these powerful tools.

So, whether you're a beginner or an experienced trader, taking the time to understand and apply chart patterns can significantly improve your chances of success in the financial markets.