What is Forex Trading? It's known as the foreign exchange market, involves trading currencies rather than stocks. Read on to find out more about the information regarding forex trading.

What Is Forex Trading? Things You Should Know About Forex Trading

Forex trading, oh the thrilling world of foreign exchange! It's like diving headfirst into a sea of endless possibilities, where currencies rise and fall with every breath.

Imagine riding the waves of volatility, harnessing the power of global factors, and earning profits from the comfort of your own home. That's what forex trading is all about!

In this article, we'll explore what is forex trading and uncover trading basics. Forex Prop Reviews dives deep into the factors that drive currency movements and create daily excitement in the markets.

So buckle up, fellow adventurers, as we embark on this wild ride together!

What is Forex Trading?

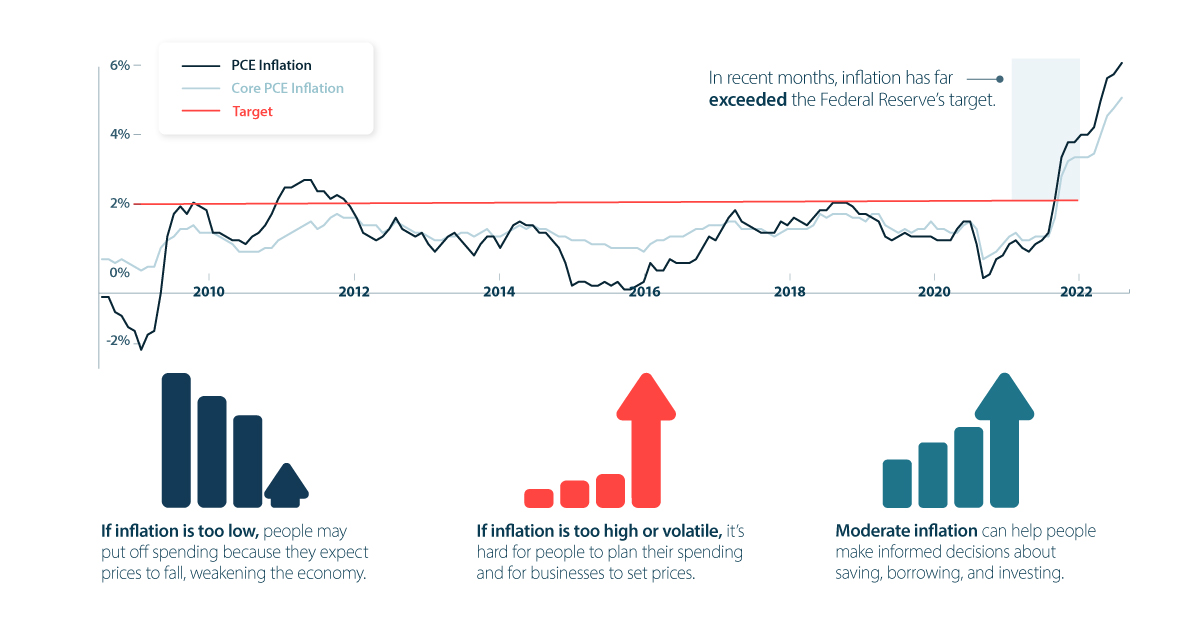

Forex trading, also known as foreign exchange trading, involves factors like interest rates and economic strength, creating daily volatility in the markets and providing opportunities to profit from currency fluctuations.

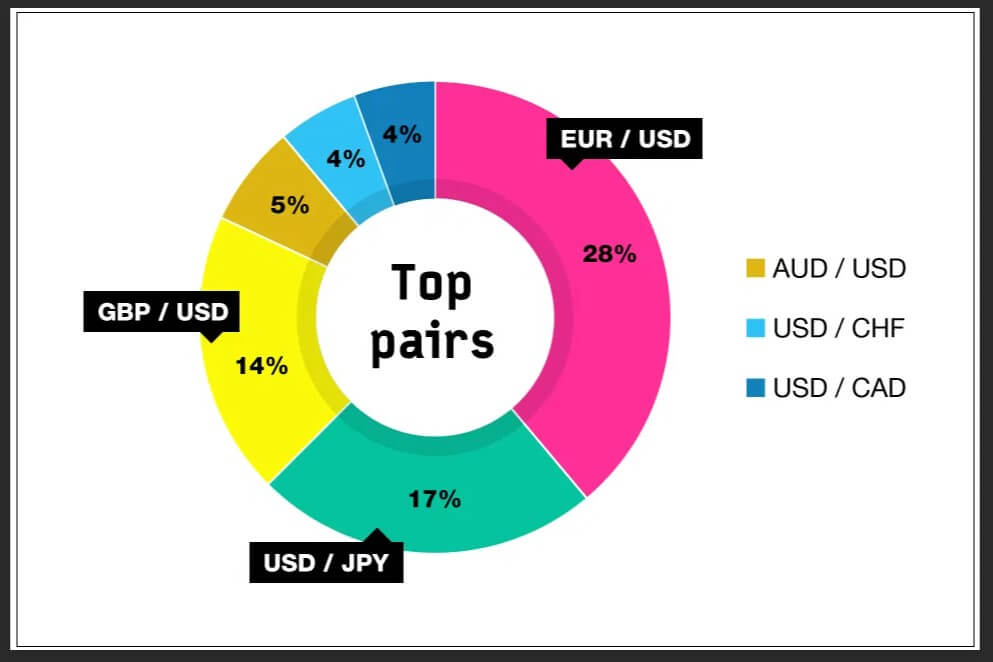

It is a decentralized market where participants buy and sell currencies with the aim of making a profit. The forex market is the largest financial market in the world, with trillions of dollars being traded every day. In forex trading, traders speculate on the value of one currency against another currency.

For example, if you believe that the Euro will strengthen against the US Dollar, you can buy Euros and sell Dollars.

If your prediction is correct and the Euro does indeed strengthen, you can then sell my Euros at a higher price and make a profit.

On the other hand, if your prediction is wrong and the Euro weakens, you may incur losses.

Factors such as interest rates, trade flows, tourism, economic strength, and geopolitical risk all affect supply and demand for currencies.

Factors and Volatility

Familiarize yourself with factors influencing volatility in currency markets, such as interest rates, trade flows, tourism, economic strength, and geopolitical risk, to make informed trading decisions. These factors create daily volatility, offering both opportunities and risks for traders.

For example, if a country's economy is performing well and its interest rates are high, it may attract foreign investors looking to take advantage of higher returns. This increased demand for the country's currency can cause its value to rise compared to other currencies.

Political instability or economic downturns can cause investors to lose confidence in a country's currency, causing a decrease in its value. Understanding these factors helps traders make informed decisions, anticipating changes that may affect one currency's value and assuming the other currency will strengthen.

By understanding these factors and their potential impacts on currency values, traders can develop strategies that align with their trading goals. However, it's important to remember that volatility in forex markets can be unpredictable at times. Emotional equilibrium is crucial when dealing with the emotional roller coasters and unanswered questions that come with forex trading.

Transition: Now that we've covered the factors influencing volatility in forex trading, let's move on to discussing how you can get started in this exciting market without feeling overwhelmed by all the information available.

Trading Strategies

Mastering different trading strategies is essential for maximizing profits and effectively managing risks in the dynamic world of currency trading. With a multitude of strategies available, it's important to find ones that align with your trading style, risk tolerance, and market conditions.

By diversifying your approach, you can adapt to various market scenarios and increase your chances of success.

One commonly used strategy in forex trading is trend following. This strategy involves identifying and capitalizing on market trends by entering trades in the direction of the prevailing trend. Traders using this strategy aim to ride the momentum of a currency pair as it moves in a specific direction, whether upward or downward. Trend-following strategies often utilize technical indicators or chart patterns to confirm the strength and sustainability of a trend.

Another popular strategy is range trading. In range-bound markets where prices consolidate within a defined range, traders seek opportunities to buy at support levels and sell at resistance levels. This strategy aims to profit from price reversals at key levels by anticipating bounces off these areas. Range-trading strategies typically involve setting tight stop-loss orders to minimize potential losses if the price breaks out of the range.

By mastering different trading strategies like trend following and range trading, you can enhance your ability to navigate the forex markets with confidence and precision. These strategies allow you to adapt to diverse market conditions and take advantage of profitable opportunities when they arise.

Understanding these strategies will provide a strong foundation as we delve into exploring types of charts that assist in analyzing market movements.

Now let's explore how different types of charts can aid us in identifying trends, patterns, and potential entry or exit points in forex trading without losing our emotional equilibrium.

Types of Charts in Forex Trading

Now that we've covered some basic trading strategies, let's dive into the different types of charts used in forex trading.

These charts are essential tools for analyzing price movements and making informed trading decisions. The three main types of charts used in forex trading are line charts, bar charts, and candlestick charts.

Line charts provide a simple representation of price trends over time. They connect the closing prices of each period with a line, allowing traders to identify the overall direction of the market. Line charts are particularly useful for identifying long-term trends and can be used to gauge whether a currency pair is generally moving up or down.

Bar charts, on the other hand, provide more detailed information about price movements. Each bar represents a specific time period (such as an hour or a day) and contains four key pieces of information: the opening price, the closing price, the highest price reached during that period (represented by the top of the bar), and the lowest price reached (represented by the bottom of the bar). Bar charts allow traders to assess not only trends but also volatility within each time period.

Lastly, we have candlestick charts which are widely popular among forex traders due to their visual appeal and ease of interpretation. Candlestick charts display similar information to bar charts but in a more visually appealing way. Each 'candle' represents a specific time period and is colored differently depending on whether prices moved up or down during that period. Traders look for specific formations and shapes in these candlesticks to identify the market direction and potential reversals.

Understanding how to read these different types of charts is crucial for successful forex trading as they provide valuable insights into market dynamics. By analyzing historical price data using these charting techniques, traders can make more informed decisions about when to enter or exit trades.

With our knowledge about different charting techniques now in place, let's move on to discussing some pros and cons of forex trading compared to other financial markets.

Pros and Cons of Trading Forex

To truly understand the potential advantages and disadvantages of engaging in forex trading, it's important for you to consider the pros and cons. Here are four key points to keep in mind:

- High liquidity: One of the major benefits of forex trading is its high liquidity. The forex market is the most liquid financial market in the world, with trillions of dollars being traded daily. This means that you can easily enter and exit trades at any time without worrying about getting stuck in a position. The high liquidity also ensures that there is always a buyer or seller available for any currency pair, allowing for quick execution of trades.

- Availability 24/7: Unlike other financial markets, such as stocks or commodities, forex trading operates 24 hours a day, five days a week. This provides traders with flexibility and allows them to trade at their convenience, regardless of their location or time zone. You don't have to wait for markets to open or worry about missing out on opportunities due to limited trading hours.

- Potential for rapid multiplication of capital: Forex trading offers the potential for significant profits due to leverage. Leverage allows traders to control larger positions with a smaller amount of capital. While this can amplify profits, it's important to note that it can also magnify losses if not managed properly. Therefore, it's crucial to use leverage cautiously and employ risk management strategies.

- Decentralized nature: The decentralized nature of the forex market means that there is no central exchange or regulatory body overseeing all transactions. This provides traders with more freedom and flexibility compared to regulated markets like stocks or futures. However, it also means that there is less regulation and oversight, which may increase the risks associated with fraudulent activities or unscrupulous brokers.

Forex trading has its advantages and disadvantages that traders should carefully consider before getting involved in this market. It offers high liquidity, availability 24/7, the potential for rapid multiplication of capital through leverage, and a decentralized nature. However, it's important to be aware of the risks involved, such as volatility due to leverage, the need for understanding economic fundamentals and indicators, and the lack of regulation compared to other markets.

Conclusion

Forex trading is a dynamic market with the potential for profit from currency fluctuations. Understanding factors and developing a sound trading strategy can capitalize on price movements.

Risks like volatility and economic fundamentals can be managed through proper risk management techniques. Reputable brokers adhere to industry standards and regulations. Despite the potential high risk, proper education and risk management strategies can mitigate losses and maximize gains. Investing time in learning about the market is crucial for effectively navigating risks and capitalizing on potential rewards.