Whether you're completely new to trading or looking to enhance your existing skills, this article will provide you with the knowledge and tools necessary to enter the world of forex with confidence.

How to Trade Forex for Beginners

Trading forex can seem intimidating at first, but with the right knowledge and guidance, anyone can learn how to navigate this exciting market successfully.

In this article, Forex Prop Reviews will guide you on how to trade Forex step-by-step, giving you the confidence to embark on your trading journey. From selecting a currency pair to making buy or sell decisions, setting stops and limits, opening your first trade, and monitoring your position, we will cover all the fundamental aspects of forex trading.

When it comes to getting started in forex trading, it's crucial to have a solid understanding of the basics. By following these steps and learning about the key concepts involved in forex trading basics, you can start making informed decisions that may lead to profitable trades.

So let's dive in and discover how you can trade forex like a pro!

How to Get Started Trading Forex

Now that we've covered how to get started with forex trading, let's dive into choosing a currency pair...

Choosing a Currency Pair

When picking a currency pair, you'll want to go for the one that makes your heart race like a Formula 1 racecar speeding down the track. This means choosing a pair that has high volatility and offers plenty of trading opportunities.

Some popular currency pairs that fit this criterion are EUR/USD, GBP/USD, and USD/JPY. These pairs tend to have large price movements and are heavily traded in the forex market.

To further narrow down your options, consider these factors within each currency pair:

- Economic Factors: Look at the economic indicators and news releases from both countries involved in the pair. This will give you an idea of how their economies are performing and whether there may be potential opportunities for growth or decline.

- Time Zone: Consider the time zone you'll be trading in and choose a currency pair that aligns with your trading schedule. For example, if you're based in Europe and prefer to trade during European market hours, focusing on EUR/USD or GBP/EUR would make more sense.

Now that you've chosen your currency pair, it's time to decide whether to 'buy' or 'sell'. By analyzing various technical indicators such as support and resistance levels, moving averages, or chart patterns, you can determine which direction the price is likely to move. This decision will depend on your analysis of market trends and your trading strategy.

You can learn more about forex trading in this article "What is Forex Trading".

Deciding to Buy or Sell

Now comes the exciting part - determining whether I should hop on the 'buy' or 'sell' train to kickstart my trading adventure. Making this decision is crucial as it sets the direction for my trade.

When deciding to buy or sell in forex trading, I need to analyze the market and consider various factors such as economic indicators, geopolitical events, and technical analysis.

If I believe that a currency pair's value will increase in the future, I would choose to 'buy.' This means purchasing the base currency while selling the quote currency. On the other hand, if I anticipate a decline in value, I would opt to 'sell,' which involves selling the base currency and buying the quote currency. To make an informed decision, it's essential to conduct thorough research and utilize tools like charts and technical indicators.

The decision to buy or sell is not only based on current market conditions but also relies on my personal trading strategy and risk tolerance. It's important to set realistic goals and establish a clear plan before entering a trade. Once I have decided whether to buy or sell, it's time to move on to setting stops and limits – an integral part of managing risk and potential profits.

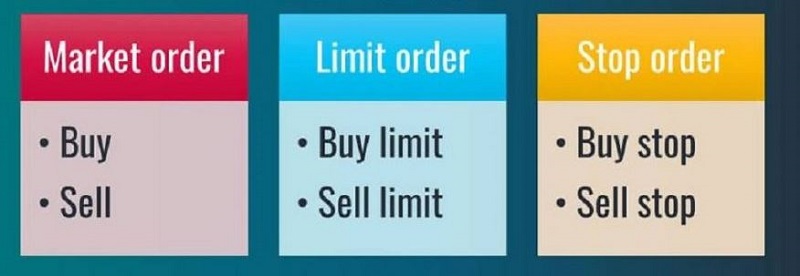

Now that we have determined whether to buy or sell, let's focus on setting stops and limits for our trade. By setting stops, which are predetermined price levels at which our position will automatically close if reached, we can protect ourselves from excessive losses. Conversely, by setting limits – predetermined price levels at which we will take profits – we ensure that we capture gains before they potentially reverse.

By combining our chosen entry point with carefully placed stops and limits, we can effectively manage risk-reward ratios in forex trading. This allows us to control potential losses while maximizing potential gains within our desired parameters.

So let's dive into setting these vital levels that will help guide our trading journey further toward success.

Setting Stops and Limits

By strategically placing stops and limits, I can effectively manage risk and maximize potential gains in my trading journey. Stops and limits are crucial tools that help me control the amount of money I'm willing to risk on a trade and ensure that I exit the market at a predetermined level.

Here are some reasons why setting stops and limits is essential:

- Protection against large losses: By setting stop-loss orders, I can limit the amount of money I'm willing to lose on a trade. This helps me protect my capital and prevent significant financial setbacks.

- Locking in profits: Setting profit targets with limited orders allows me to secure my gains when the market moves in my favor. It ensures that I don't let greed take over, allowing me to lock in profits at predetermined levels.

- Emotional control: Placing stops and limits helps me overcome emotional biases such as fear or greed. It provides a clear plan for exiting trades, eliminating impulsive decisions based on short-term market fluctuations.

- Consistency in trading strategy: Setting stops and limits allows me to stick to my trading plan consistently. It helps me avoid making impulsive decisions based on market noise or emotions, ensuring that I stay disciplined in executing my strategy.

Now that I've set my stops and limits, it's time to move on to opening my first trade.

Opening Your First Trade

To start your forex trading journey, it's time to dive into the exciting world of opening that very first trade. After carefully analyzing the market and choosing a currency pair to trade, you need to make a decision on whether to 'buy' or 'sell'.

This decision is based on your prediction of how the price will move. If you believe the value of the base currency will rise against the quote currency, you would choose to 'buy'. Conversely, if you predict that the value will fall, you would opt to 'sell'.

Once you have decided whether to 'buy' or 'sell', it's time to execute your trade. You can do this through your chosen forex trading platform by entering the relevant details such as the currency pair, position size (the amount of base currency you want to buy or sell), and any additional parameters like stop-loss and take-profit levels.

These parameters help manage risk by automatically closing your trade if it reaches a certain level of loss or profit.

With all the necessary information entered and confirmed, click on the button to open your trade. Congratulations! You have now successfully opened your first forex trade.

It's important to remember that forex trading involves both risks and rewards, so closely monitor your position as it progresses. In the next section about monitoring your position, we will explore how to keep an eye on market movements and make informed decisions regarding when to close or adjust your trade without missing profitable opportunities along the way.

Monitoring Your Position

After opening my first forex trade, it's crucial for you to closely monitor your position and make informed decisions based on market movements.

Monitoring your position allows you to stay aware of any changes in the market that may affect the value of your trade. By keeping a close eye on the price movements, You can identify potential trends or patterns that may indicate whether you should hold onto your position or consider closing it.

One way I monitor my position is by using technical analysis tools, such as charts and indicators. These tools help me analyze past price data and identify potential future price movements. By studying these charts, I can spot key support and resistance levels, trend lines, and other patterns that may influence the direction of the currency pair I'm trading. This information helps me make more informed decisions about when to enter or exit a trade.

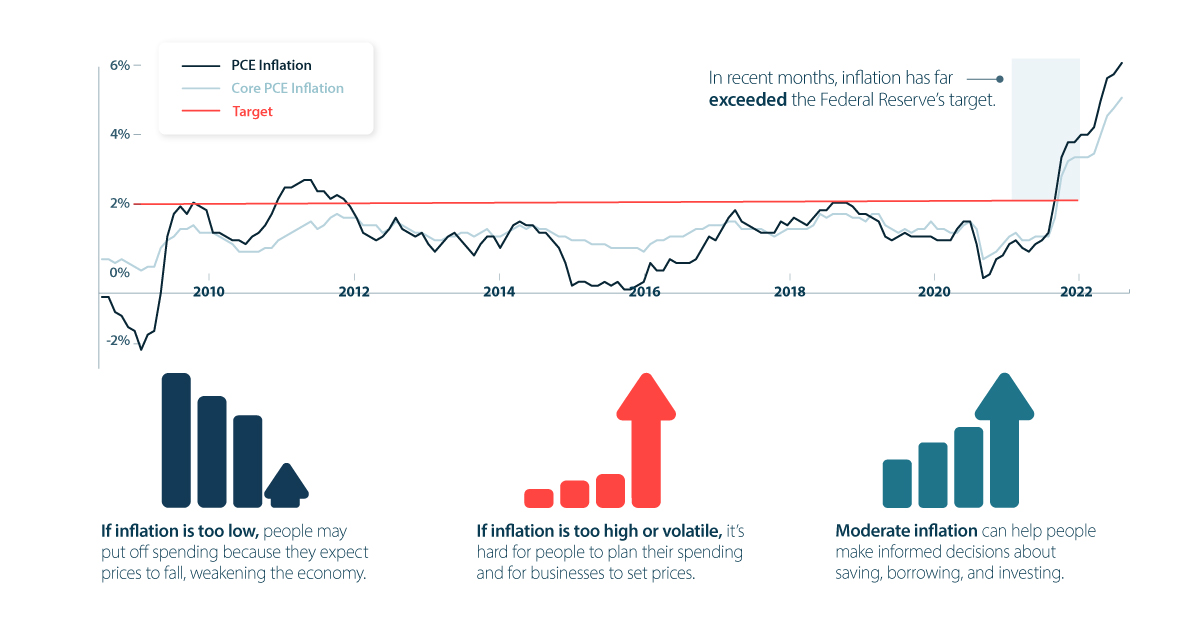

Additionally, staying updated with relevant news and economic events is essential when monitoring your forex position. Economic indicators such as interest rate announcements, GDP reports, or geopolitical news can greatly impact currency prices. By keeping track of these events and understanding their potential impact on the market, you can adjust your trading strategy accordingly.

By closely monitoring my forex position through technical analysis tools and staying updated with economic events, I'm better equipped to make informed decisions about managing my trades. These strategies allow me to adapt to changing market conditions and maximize potential profits while minimizing risks.

In the next section about "tips for successful trading, I'll share some valuable insights that have helped me become a more successful trader without writing "step".

Tips for Successful Trading

Maximize your trading success with these valuable tips that'll help you navigate the market and achieve your financial goals.

- Stay informed: To be successful in forex trading, it's crucial to stay updated on market trends, economic news, and political events that can impact currency values. Keep an eye on financial news websites, follow relevant social media accounts, and read expert analyses to make informed trading decisions.

- Develop a trading plan: Having a well-defined trading plan is essential for successful forex trading. Determine your risk tolerance, set realistic goals, and establish clear entry and exit points for each trade. Stick to your plan and avoid making impulsive decisions based on emotions or short-term fluctuations in the market.

- Manage risk effectively: Risk management is a key aspect of successful forex trading. Set stop-loss orders to limit potential losses and use trailing stops to protect profits as the market moves in your favor. Additionally, avoid risking more than a small percentage of your account balance on any single trade.

- Learn from mistakes: Forex trading involves trial and error. It's important to learn from your mistakes rather than getting discouraged by them. Analyze unsuccessful trades to identify where you went wrong and adjust your strategy accordingly. Continuous learning and adapting are vital for long-term success in the forex market.

By following these tips, you can increase your chances of achieving success in forex trading. Remember that consistency, discipline, and patience are key traits of successful traders. So keep learning, stay focused on your goals, and never stop improving your skills in this dynamic market environment!

Conclusion

In conclusion, trading forex can be an exciting and rewarding endeavor. With the right knowledge and strategy, you can navigate the market with confidence and potentially achieve financial success.

Just like a skilled sailor navigating through rough seas, you must stay vigilant and adapt to changing conditions in order to make informed decisions.

Remember that just like a skilled sailor who never stops learning how to master their craft amidst unpredictable waters, becoming a successful forex trader requires continuous education, adaptability, and perseverance.