When it comes to navigating the world of forex trading, understanding the terminology is key. As a trader myself, I know how important it is to grasp the basic concepts and jargon that are commonly used in this market.

The Important Forex Trading Terminology That Traders Should Know

In this article, Forex Prop Reviews will explore some of the essential forex trading terminology that every aspiring trader should be familiar with. In the first paragraph, we'll delve into trading basics and discuss about them.

Forex Basics

Are you ready to dive into the exciting world of forex trading and learn the basics that'll set you on the path to financial success? Well, buckle up because we're about to embark on a journey that'll open your eyes to the vast opportunities within this market.

So, what is forex trading? Forex trading, also known as foreign exchange trading, is all about buying and selling currencies in order to make a profit. It's like playing the stock market, but instead of stocks, you're dealing with different countries currencies. The goal is simple: buy low and sell high. By understanding how currency values fluctuate and keeping an eye on economic indicators, you can make informed decisions that could potentially lead to substantial gains.

Currency Pairs

Currency pairs are like dynamic duos in the world of finance, where they team up to create endless opportunities for traders to make a profit. In forex trading, a currency pair consists of two currencies that are traded against each other. The first currency is called the base currency, while the second one is the quote currency.

These pairs represent the exchange rate between the two currencies and allow traders to speculate on whether the value of one currency will rise or fall relative to the other. Understanding currency pairs is crucial for forex traders as it determines how much of one currency is needed to purchase another.

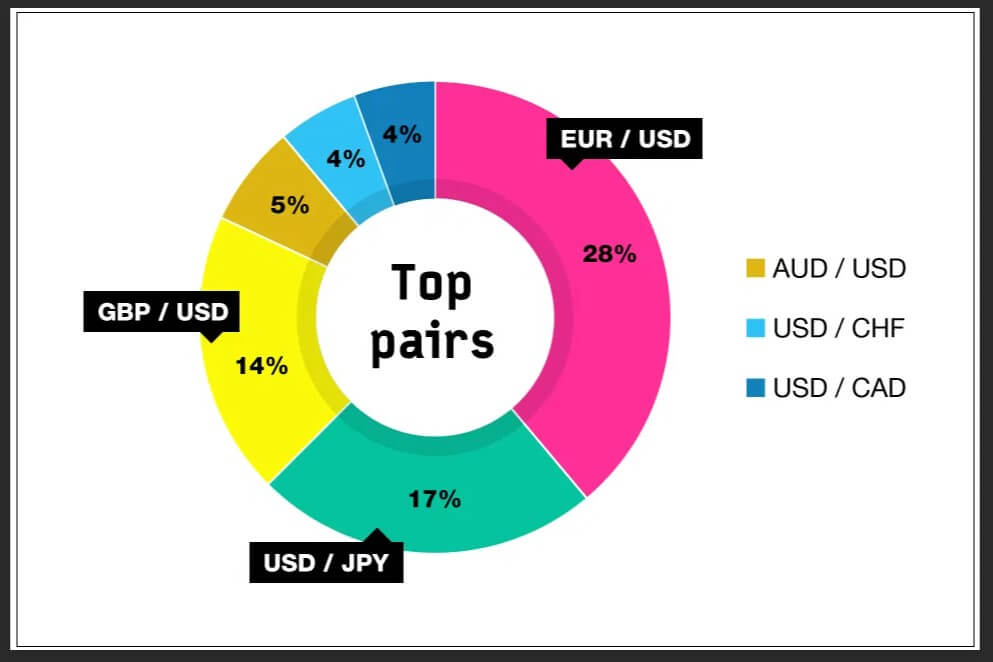

Popular currency pairs include EUR/USD, GBP/USD, and USD/JPY, among others. Each pair has its own characteristics and factors that influence its movement in the market. By analyzing these factors such as economic indicators, geopolitical events, and central bank policies, traders can make informed decisions on when to buy or sell a particular currency pair.

Exchange Rate

The exchange rate is a key factor in determining the value of one currency relative to another, and it can fluctuate based on various economic factors and market conditions. It represents the price at which one currency can be exchanged for another in forex trading. For example, if the exchange rate between the US dollar and the euro is 1.15, it means that 1 US dollar is equivalent to 1.15 euros.

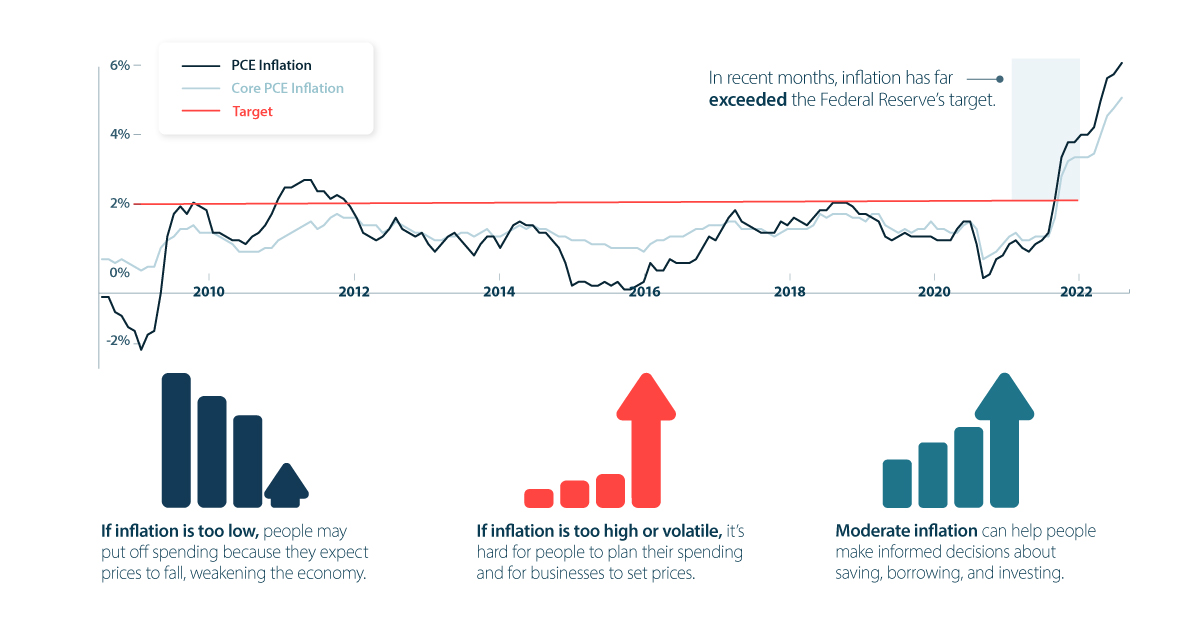

Exchange rates are constantly changing due to several factors such as interest rates, inflation, political stability, and economic performance. Central banks play a crucial role in influencing exchange rates through monetary policies like adjusting interest rates or implementing quantitative easing measures. Additionally, market demand and supply also impact exchange rates as traders buy and sell currencies based on their expectations of future movements.

Understanding how exchange rates work is essential for forex traders as it helps them make informed decisions about when to buy or sell currencies.

Now let's delve into the concept of 'bid and ask' prices to gain further insights into forex trading dynamics.

Bid and Ask

To fully comprehend the intricacies of forex trading dynamics, you must familiarize yourself with the concept of bid and ask prices.

When engaging in forex trading, you will encounter two different prices for currency pairs: the bid price and the asking price. The bid price represents the highest price that a buyer is willing to pay for a particular currency pair at any given moment, while the asking price represents the lowest price at which a seller is willing to sell that same currency pair. These two prices are constantly fluctuating based on supply and demand in the market.

Understanding bid and ask prices is essential because they play a crucial role in determining your entry and exit points when trading currencies. As a trader, you will always buy at the higher ask price and sell at the lower bid price. The difference between these two prices is known as the spread, which essentially represents your cost of executing trades. It's important to note that spreads can vary from one currency pair to another and can also differ between brokers.

By grasping how bid and ask prices work, you gain insight into how forex markets function and can make informed trading decisions. The concept of spreads naturally follows this understanding, as it directly relates to your transaction costs.

With this foundation in place, let's dive deeper into understanding spreads and their significance in forex trading dynamics without skipping a beat!

Spread

Imagine yourself as a ship navigating through the vast ocean of forex markets, with spreads acting as the winds that determine the speed and direction of your trading journey. Just like wind pushes a ship forward or slows it down, spreads in forex trading play a crucial role in determining how profitable a trade can be.

Here are four points to help you understand the concept of spread:

- Spread definition: In forex trading, spread refers to the difference between the bid price (the price at which you sell) and the asking price (the price at which you buy) for a currency pair. It's essentially the cost of executing a trade.

- Widening spreads: Spreads can vary depending on market conditions. During periods of high volatility or low liquidity, spreads tend to widen, making it more expensive to enter or exit trades.

- Impact on profitability: The wider the spread, the more challenging it becomes to make profits from small price movements. A narrow spread allows traders to capture smaller price fluctuations and potentially generate higher returns.

- Importance of choosing a broker with competitive spreads: Since spreads directly impact your trading costs, it's important to choose a broker that offers competitive spreads. Lower spreads mean lower transaction costs, leaving you with more room for potential profits.

Now let's sail towards our next destination in understanding forex trading - leverage!

Leverage

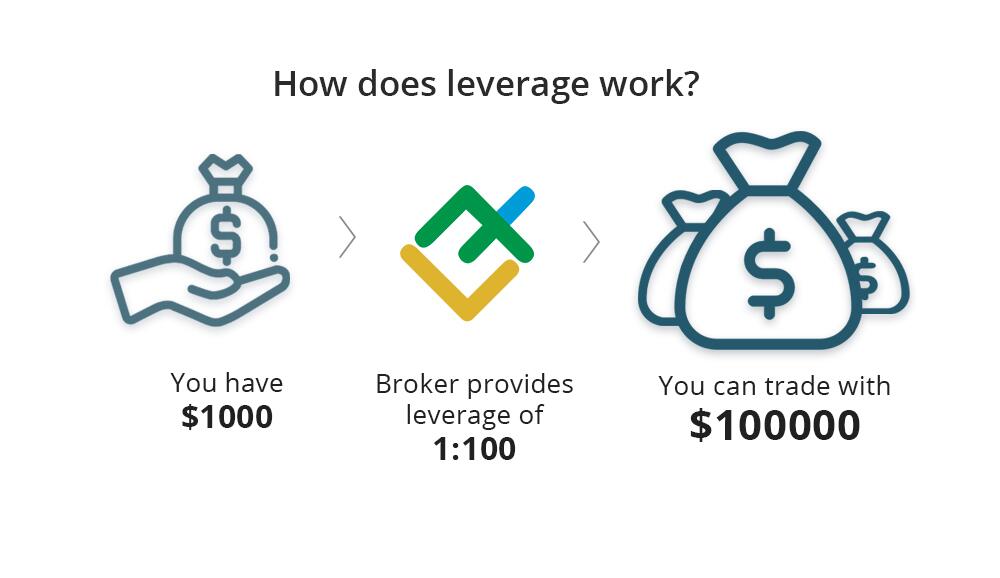

Navigating through the vast ocean of forex markets, leverage sets sail as a powerful tool that amplifies your trading potential. In simple terms, leverage allows you to control a larger position in the market with only a fraction of the total value required.

For example, if your broker offers you a leverage of 1:100, it means that for every dollar you deposit into your trading account, you can trade up to $100 in the market. This magnification effect can significantly increase both profits and losses.

Leverage is like a double-edged sword; while it can enhance your gains, it also exposes you to higher risks. It's important to understand that using high leverage means taking on more debt and potentially losing more than what you initially invested. Therefore, it's crucial to use leverage wisely and manage risk effectively by setting appropriate stop-loss orders and practicing sound money management techniques.

With leverage as our ally in the forex world, let's now sail smoothly into the next section about 'margin' which further explores how we can maximize our trading opportunities without getting stranded in deep waters.

Margin

With margin, you have the opportunity to amplify your trading potential by using borrowed funds to open larger positions in the market, but it's important to remember that this also increases both your potential profits and losses.

Margin is a way for traders to increase their buying power and take advantage of fluctuations in currency exchange rates. It allows traders to control a larger position than what they would be able to with their own capital alone. However, it's crucial to understand that trading on margin involves taking on additional risk. If the market moves against you, losses can exceed your initial investment.

Now, let's move on to another important concept in forex trading: pips.

Pip

Get ready to ride the rollercoaster of profits and losses, because in forex, every pip counts! A pip, short for 'percentage in point,' is a unit of measurement used in forex trading to quantify the change in value between two currencies. It represents the smallest possible incremental movement a currency pair can make.

For most currency pairs, one pip is equivalent to 0.0001 or 0.01% of the quoted price. However, there are exceptions like the Japanese Yen pairs where one pip is equal to 0.01 or 1%.

Understanding pips is crucial as they directly impact your potential profits and losses. Knowing how to calculate pips accurately allows you to determine your potential gains or losses before entering a trade. For example, if you buy a currency pair at 1.2500 and it moves up by 50 pips to 1.2550, you've made a profit of 50 pips. Conversely, if the price moves against you by 50 pips down to 1.2450, it results in a loss of 50 pips.

Pips play an important role not only in determining profit targets but also when setting stop-loss orders – an essential risk management tool that helps limit potential losses during adverse market conditions.

With an understanding of pips under our belt, let's delve into another critical aspect of forex trading – stop loss strategies!

Stop Loss

Protect your investments by implementing a stop-loss strategy, as it's an essential tool for managing risk and ensuring you limit potential losses in the forex market.

A stop-loss order is a predetermined level at which you're willing to exit a trade if the market moves against you. By setting a stop loss, you can protect yourself from substantial losses and prevent emotions from getting in the way of rational decision-making.

One benefit of using a stop loss is that it helps you maintain discipline in your trading approach. It allows you to define your maximum acceptable loss before entering a trade, preventing you from holding onto losing positions for too long in hopes of a turnaround.

Additionally, implementing a stop loss can help reduce the negative impact of sudden price movements or market volatility. This feature becomes particularly important during times of high uncertainty or economic news releases when prices can fluctuate rapidly.

Transitioning into the next section about 'take profit', it's important to note that while stop losses help limit potential losses, take profit orders allow traders to secure their profits by automatically closing trades once they reach a certain level of profitability.

Take Profit

Maximize your potential gains and secure your profits in the forex market by setting a take-profit order. This order automatically closes trades once they reach a desired level of profitability. A take-profit order is an essential tool for traders as it allows them to lock in their profits and avoid missing out on potential gains.

By setting a specific price level at which to exit a trade, you can ensure that you capture the maximum profit available without constantly monitoring the market.

Setting a take-profit order is simple and can be done when placing a trade or modifying an existing one. Once the specified price level is reached, the trade will automatically close, ensuring that you don't miss out on any potential gains.

It provides peace of mind knowing that even if you're not actively monitoring the market, your profits are protected. Taking profit orders also helps remove emotions from trading decisions since they are executed automatically based on predetermined criteria. This allows for more disciplined trading and prevents traders from holding onto winning positions for too long or getting greedy.

Using take-profit orders is crucial in forex trading to maximize profits and minimize risk. By setting specific price levels at which trades will automatically close, traders can secure their gains without constantly monitoring the market.

It creates discipline in trading decisions and removes emotions from the equation, leading to more successful and consistent results. So next time you enter a forex trade, make sure to set a take-profit order to protect your hard-earned profits.

Frequently Asked Questions

What are the most common mistakes made by beginner forex traders?

The most common mistakes made by beginner forex traders include not having a proper trading plan, overtrading, letting emotions drive decisions, not managing risk effectively, and neglecting to continuously educate oneself.

How can I determine the best time to enter a forex trade?

To determine the best time to enter a forex trade, you analyze market trends and use technical indicators. While it may seem overwhelming at first, with practice and patience, you can develop a solid strategy that suits your trading style.

Are there any risks associated with using leverage in forex trading?

There are risks associated with using leverage in forex trading. It can amplify both profits and losses, so it's important to use it wisely and have a solid risk management strategy in place.

What are some effective strategies for managing risk in forex trading?

To effectively manage risk in forex trading, I employ a wide range of strategies that are so powerful they can practically guarantee profits. From setting stop-loss orders to diversifying my portfolio, I never leave anything to chance.

How can I stay updated with the latest news and events that may impact forex markets?

You can stay updated with the latest news and events that may impact forex markets by regularly checking financial news websites, following reputable traders on social media, and subscribing to market analysis newsletters.

Conclusion

Well, after diving deep into the world of forex trading terminology, I have to say, it's a piece of cake! Who needs all these fancy words and complex concepts anyway? Surely, anyone can just jump right into the forex market and start making millions without even knowing what a currency pair is.

In conclusion, forex trading terminology is definitely something you can ignore if you want to be successful in this field. After all, who needs knowledge or understanding when it comes to making informed decisions? Just trust that everything will work out magically in your favor. Good luck!