Understanding interest and inflation rates strategies is pivotal for any individual looking to navigate the world of investing successfully. By customizing your investment portfolio based on these factors, you have the opportunity to maximize returns while safeguarding against potential losses caused by fluctuating market conditions.

Interest and Inflation Rates Strategies

Interest and inflation rates strategies play a crucial role in the world of personal finance. As an individual investor, it is essential to understand how these factors can impact your investment decisions and ultimately your financial goals.

In this article, Forex Prop Reviews will delve into the importance of building a personalized investment portfolio that takes into account interest and inflation rates.

Building a Personalized Investment Portfolio

Creating a personalized investment portfolio entails carefully selecting diverse assets that align with your financial goals and risk tolerance. To begin, you consider the interest and inflation rates strategies in order to make informed decisions.

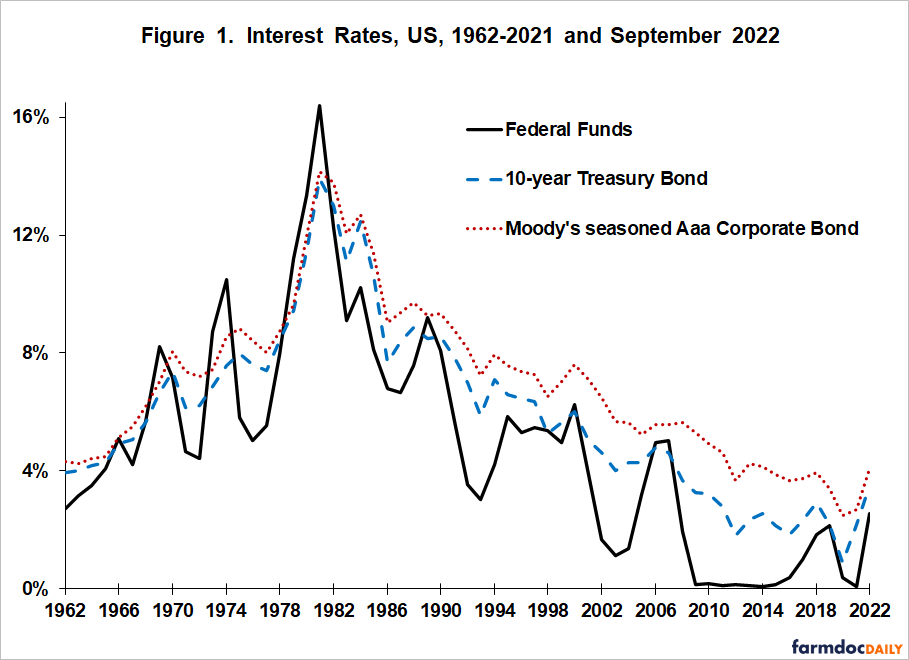

Understanding how interest rates impact different asset classes is crucial for maximizing returns and managing risks. For instance, when interest rates are low, it might be beneficial to invest in stocks or real estate as they tend to perform well under such conditions. On the other hand, bonds or fixed-income securities may be more attractive when interest rates are high.

Additionally, you utilize fundamental analysis strategies to assess the potential of each investment opportunity within your portfolio. By examining factors such as company earnings, market trends, and competitive landscape, you can determine if an asset is undervalued or overvalued. This analysis helps you identify opportunities for growth and mitigate potential risks.

Moreover, by diversifying your investments across various sectors and geographical regions, you reduce the overall risk exposure of your portfolio.

Tax Ramifications and Costs

To fully grasp the implications of taxes and expenses, imagine navigating through a dense forest with hidden traps lurking behind every tree. Just like in this scenario, taxes and costs can be unexpected obstacles that significantly impact your investment returns.

When it comes to taxes, it's important to understand how different investments are taxed and what tax bracket you fall into. For example, capital gains from stocks held for less than a year are typically taxed at a higher rate compared to long-term investments. By being aware of these tax implications, you can make more informed decisions about which investments align with your financial goals.

In addition to taxes, expenses such as transaction fees and management fees can eat away at your investment returns over time. It's crucial to carefully consider the costs associated with different investment strategies before committing your hard-earned money.

While some investments may have lower expense ratios, they might come with other hidden costs or risks that could outweigh any potential benefits. Therefore, conducting thorough research and seeking advice from professionals can help you navigate through these financial complexities and avoid unnecessary losses.

Understanding the tax ramifications and costs associated with investing is essential for building a successful portfolio. By taking into account these factors, you can make more strategic decisions that align with your financial goals while minimizing unnecessary expenses along the way.

Diversification and Risk Management

One key to successful investing is ensuring that you diversify your portfolio and actively manage risk. By spreading your investments across different asset classes, such as stocks, bonds, and real estate, you can reduce the impact of any one investment performing poorly. Diversification helps you achieve a balance between potential returns and risks.

To effectively diversify your portfolio and manage risk, you follow these three strategies:

- Asset Allocation: You allocate your investments across various asset classes based on their historical performance and future growth prospects. This ensures that if one asset class underperforms, others may compensate for it.

- Sector Diversification: Within each asset class, you further diversify by investing in different sectors or industries. This helps you minimize the impact of negative events affecting a particular sector.

- Risk Assessment: You regularly assess the risk level of each investment in your portfolio to ensure it aligns with your financial goals and risk tolerance. By monitoring factors such as volatility and liquidity, you can make informed decisions about adjusting or re-balancing your investments.

:max_bytes(150000):strip_icc()/GettyImages-157311703-b09b9b53d83d4f35bcbedf9ffb6c8a8b.jpg)

Monitoring and Adjusting Investments

Regularly monitoring and adjusting your investments is like steering a ship through choppy waters, ensuring that you stay on course toward maximizing your returns and minimizing risks.

By keeping a close eye on the performance of your investments, you can identify any potential red flags or opportunities for improvement. This allows you to make informed decisions about when to buy, sell, or hold onto certain assets in order to optimize your portfolio's performance.

One key aspect of monitoring and adjusting investments is regularly reviewing market trends. Understanding how different sectors and industries are performing can provide valuable insights into where you should allocate your resources.

For example, if you notice a particular industry experiencing significant growth, it may be an opportune time to invest in related companies or funds.

On the other hand, if there are signs of a market downturn or increased volatility, you may want to consider reducing exposure to riskier assets and shifting towards more stable options.

Understanding Market Trends

Navigating the ever-changing waters of investing requires a keen understanding of market trends and their potential impact on my portfolio. Staying up-to-date with the latest market news, economic indicators, and industry reports allows you to make informed decisions about your investments.

By monitoring market trends, you can identify opportunities for growth and adjust your portfolio accordingly. Whether it's a shift in consumer behavior, technological advancements, or global events, being aware of these factors helps you stay ahead of the curve and mitigate potential risks. Understanding market trends is an essential step toward achieving long-term investment success.

In order to effectively navigate through the ups and downs of the market, you rely on various resources to gather information about current trends. I regularly read financial publications, follow reputable analysts' opinions, and participate in investment forums to gain insights from other investors.

Long-Term Investment Strategies

As I delve into the world of long-term investing, a solid understanding of market trends lays the groundwork for building a successful investment portfolio. By closely analyzing and interpreting market trends, I can identify potential opportunities and make informed decisions that align with my long-term goals.

This involves studying historical data, monitoring economic indicators, and keeping an eye on industry developments.

To gain an edge in long-term investing, I prioritize diversification as one of my key strategies. By spreading out my investments across different asset classes such as stocks, bonds, and real estate, I can reduce the overall risk in my portfolio. Additionally, within each asset class, I further diversify by selecting investments from various sectors or industries. This approach helps me mitigate the impact of market volatility on any single investment.

Furthermore, another important aspect of your long-term investment strategy is to regularly review and re-balance your portfolio. As market conditions change over time, some investments may perform better than others. To maintain an optimal balance between risk and return, it's crucial to periodically reassess your holdings and make necessary adjustments.

Maximizing Returns and Minimizing Losses

To optimize your returns and minimize losses, you must carefully select investments like a skilled gardener tending to a blooming garden. Just as a gardener chooses the right combination of plants based on their growth patterns and maintenance needs, an investor should consider various factors before making investment decisions.

It is essential to diversify your portfolio by investing in different asset classes such as stocks, bonds, real estate, or commodities. This diversification helps spread the risk and reduces the impact of any individual investment's performance on your overall returns.

Furthermore, it is crucial to conduct thorough research and analysis before investing your hard-earned money. Keep an eye on market trends, economic indicators, and company financials to identify potential opportunities and risks. By staying informed about the latest developments in different industries, you can make more informed investment choices.

Conclusion

In conclusion, Interest and Inflation Rates Strategies is crucial for maximizing returns and minimizing losses. By diversifying your investments and understanding market trends, you can effectively manage risks and make informed decisions