Whether you're a seasoned trader or just starting out, understanding how to manage risk effectively can make all the difference in your trading journey.

The Ultimate Guide to Day Trading Risk Management

Day trading can be an exhilarating and potentially lucrative endeavor, but it also comes with its fair share of risks. That's why day trading risk management is crucial for anyone looking to navigate the fast-paced world of trading successfully.

By implementing effective risk management strategies, traders can protect their capital, minimize losses, and increase their chances of long-term profitability.

In this article, Forex Prop Reviews will delve into the importance of day trading risk management and provide valuable tips and strategies to help you navigate the volatile market with confidence.

Why is Day Trading Risk Management so important?

Day trading risk management is crucial because it helps you protect your hard-earned money and avoid potential financial disasters. When engaging in day trading, You’re constantly exposed to market volatility and unpredictable price movements. Without a proper risk management strategy in place, you could easily lose a significant portion of your capital in just a single trade.

This is why it's essential to carefully plan and implement effective day trading risk management techniques. By incorporating day trading risk management into your overall trading strategy, you can minimize the potential losses and maximize the potential gains. It allows you to set clear parameters for each trade, such as determining the maximum amount of money you’re willing to risk on any given trade.

Tips and Strategies to Manage Risk in Trading

When it comes to managing risk in trading, there are several key points that I always keep in mind.

Determine the risk/exposure upfront

Before you start day trading, it's essential to calculate your risk exposure upfront. This means determining how much money you’re willing to lose on each trade and setting a maximum loss that you can tolerate.

By doing this, you can avoid taking on too much risk and potentially blowing up your account. Calculating your risk exposure also helps you determine the position size for each trade. This way, even if a trade goes against you, the potential loss is controlled and won't have a significant impact on your overall account balance.

Calculating your risk exposure upfront allows you to set realistic expectations and plan accordingly. It helps you evaluate whether the potential reward justifies the risk involved in a particular trade. By knowing your maximum acceptable loss beforehand, you can make more informed decisions about which trades to take and which ones to avoid.

Optimal stop-loss level

Determining the optimal stop loss level is key to safeguarding your trades and maximizing your potential profits. The stop loss level acts as a safety net, allowing you to automatically exit a trade if it starts moving against you beyond a certain point. This helps protect your capital from significant losses and ensures that you don't hold onto losing positions for too long.

To determine the optimal stop loss level, it's important to consider factors such as market volatility, support and resistance levels, and risk tolerance. A tight stop loss may limit potential losses but could also result in frequent exits due to minor market fluctuations.

On the other hand, a loose stop loss may give your trades more room to breathe but can expose you to larger losses if the market turns sharply against you. Striking the right balance is crucial.

Diversify your portfolio: the lower the correlation, the better the diversification

To optimize your investment strategy, it's essential to diversify your portfolio by seeking assets with low or negative correlations. By doing so, you can enhance the effectiveness of your risk management and create a vivid tapestry of financial opportunities.

When assets in your portfolio have low or negative correlations, their movements tend to be independent of each other. This means that when one asset is performing poorly, another may be performing well, balancing out any potential losses. This diversification helps protect against significant downturns in any single investment and reduces the overall volatility of my portfolio.

By diversifying your holdings across different asset classes such as stocks, bonds, commodities, and real estate, you can spread out the risk and potentially increase returns over the long term.

It's important to note that not all assets will move in perfect correlation or anti-correlation with each other at all times. However, by conducting thorough research and analysis on historical price movements and market trends, you can identify assets that tend to have lower correlations with one another.

Keep your risk consistent and manage your emotions

Maintaining a consistent level of risk and effectively managing my emotions is crucial in optimizing my investment strategy. Day trading strategies can be an emotional rollercoaster, with constant fluctuations in the market and the pressure to make quick decisions. To navigate this challenging landscape, I've found the following strategies to be invaluable.

- Stick to a pre-determined risk threshold: By setting a specific percentage or dollar amount that I'm willing to lose on each trade, I'm not exposing myself to excessive risk. This disciplined approach helps me stay focused on long-term success rather than being swayed by short-term market fluctuations.

- Practice self-awareness: Emotions can easily cloud judgment when it comes to day trading. I need to recognize any biases, fears, or greed that may influence my decision-making process. By taking regular breaks, practicing mindfulness techniques, and seeking support from fellow traders, I can better manage my emotions and make rational choices.

- Learn from mistakes: Losing trades are inevitable in day trading. Instead of dwelling on them or letting them affect my confidence, I use each loss as an opportunity for growth. Keeping a journal where I document the reasons behind failed trades helps me identify patterns and adjust my strategy accordingly.

By maintaining a consistent level of risk and effectively managing my emotions, I create a solid foundation for successful day trading.

Maintaining a positive risk-to-reward ratio

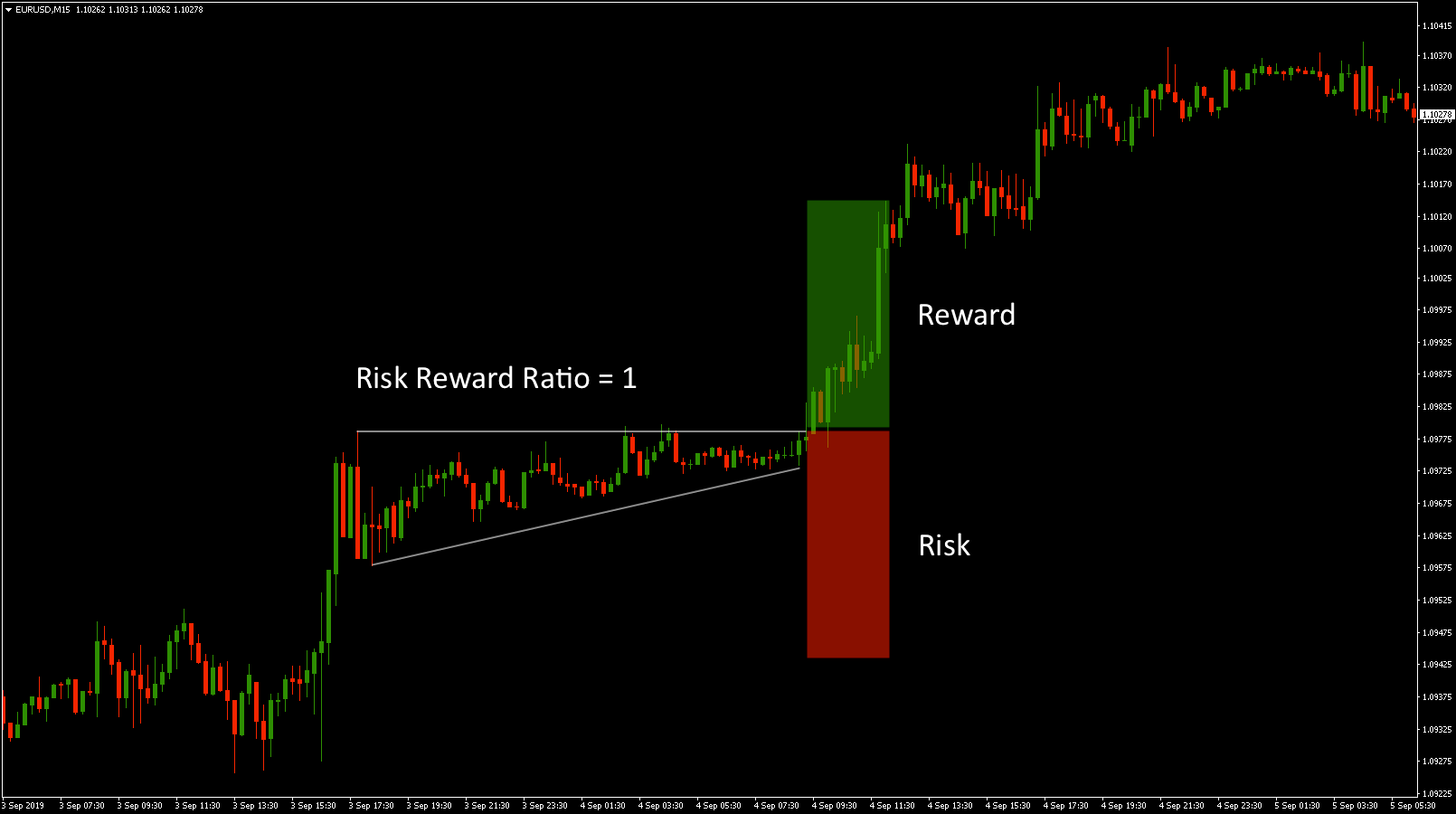

Achieving profitable trades while minimizing unnecessary capital exposure requires a careful balance between the potential rewards and the associated risks. One important aspect of this balance is maintaining a positive risk-to-reward ratio. This means that for every trade you take, you aim to have the potential reward outweigh the potential risk.

By doing so, you ensure that even if some trades result in losses, your overall profitability remains intact.

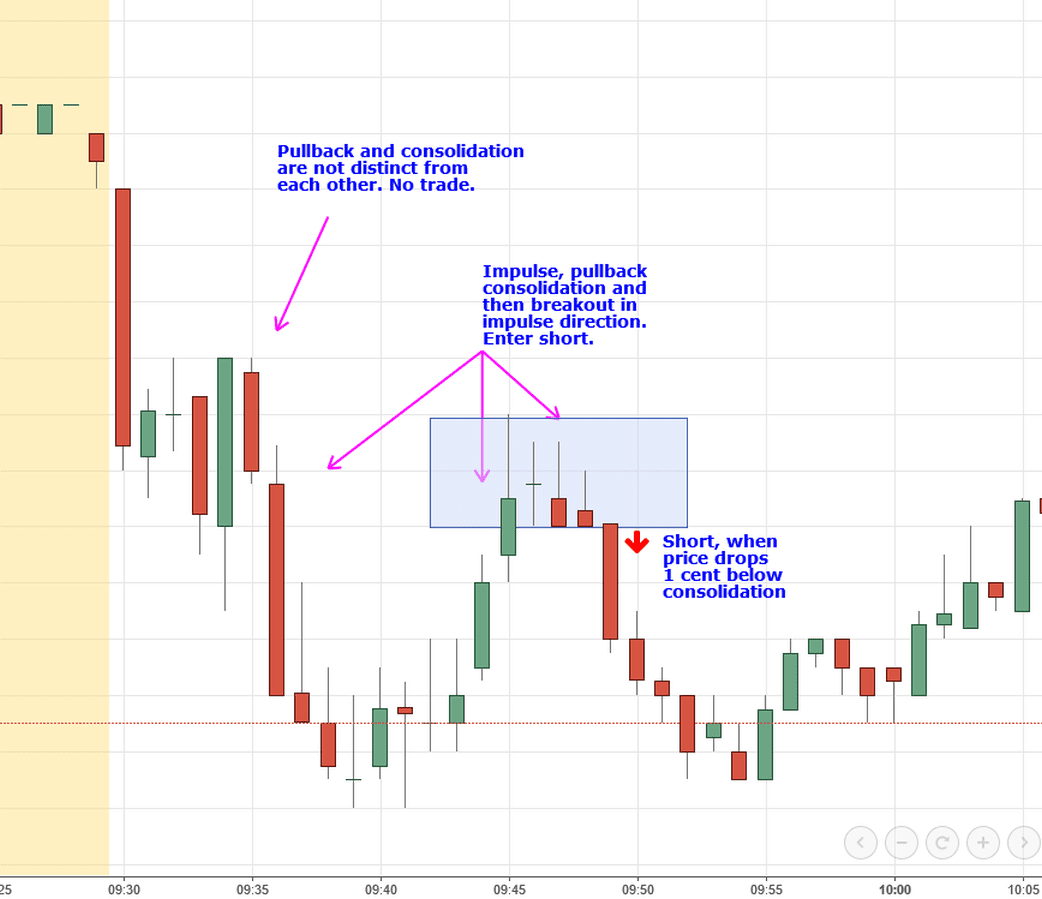

To maintain a positive risk-to-reward ratio, you carefully analyze each trade setup before entering a position. You identify clear entry and exit points based on technical analysis and market trends. Additionally, you set realistic profit targets that are larger than your stop-loss levels.

Day Trading Risk Management Tools

When it comes to managing risk in day trading, there are several tools that I find extremely helpful.

Normal Stop Loss

To effectively manage risk in day trading, it's crucial to use a normal stop-loss order. A normal stop loss is a predetermined level at which you'll exit a trade if it moves against you. It acts as a safety net, protecting your capital from substantial losses.

By setting a normal stop loss, you can limit the amount of money you're willing to lose on any given trade. This helps prevent emotional decision-making and ensures that losses are kept within acceptable limits.

Using a normal stop loss allows you to have control over your risk management strategy. It provides discipline and structure to your trading approach, ensuring that you stick to your predefined risk tolerance levels.

Guaranteed Stop Loss

With a normal stop loss, there is always a risk that the price will gap down and my order will be executed at a significantly lower level than anticipated. This can lead to substantial losses and frustration.

However, with a guaranteed stop loss, you have the assurance that even if there is a sudden drop in price or an unpredictable event occurs, your exit will happen exactly where you set it.

Having this type of safety net allows you to focus on analyzing potential trades without constantly worrying about adverse market movements. It gives you the confidence to execute trades and take calculated risks knowing that your downside is protected.

Trailing Stop Loss

With a Trailing Stop Loss, instead of setting a fixed price at which to sell if the market moves against you, you set a dynamic stop loss level that adjusts as the market moves in your favor. It's like having an automatic protection mechanism that locks in profits while still allowing for potential upside.

Here's why I believe everyday traders should consider using a Trailing Stop Loss:

- Locks in profits: By continuously adjusting the stop loss level as the market moves in your favor, you can effectively lock in profits without having to constantly monitor and manually adjust your trades.

- Allows for potential upside: Unlike a traditional stop loss order that would trigger immediately when the market reaches a certain price point, the trailing stop loss allows you to capture additional gains if the market continues to move favorably.

- Reduces emotional decision-making: With a trailing stop loss in place, You’re less likely to make impulsive decisions based on fear or greed. The system takes care of automatically adjusting your stop loss levels based on predetermined parameters, removing any emotional bias from your trading decisions.

Conclusion

Day trading risk management is crucial for any trader looking to maximize their profits and minimize their losses. By implementing effective risk management strategies and utilizing the right tools, traders can significantly improve their chances of success in the volatile world of day trading.