Day trading is the act of buying and selling a financial instrument on the same day, sometimes many times during the day. Taking advantage of modest price movements can be a profitable game if done right. However, it can be harmful to rookies and anyone who does not follow a well-thought-out approach. In this article, we'll discuss effective day trading techniques.

7+ Day Trading Techniques for Beginners

Day trading is an exhilarating and fast-paced endeavor that requires a deep understanding of the markets and a set of effective techniques. As someone who has been actively involved in day trading for several years, I have learned firsthand the importance of employing various strategies to navigate the ever-changing landscape of financial markets.

In this article, Forex Prop Reviews will share some valuable insights into different day trading techniques that can help you maximize your profits and minimize risks.

Scalping: A Popular Day Trading Technique

If you're looking for a fast-paced and adrenaline-pumping way to trade stocks, scalping might just be the technique for you. Scalping is one of the most popular day trading techniques used by traders all over the world.

It involves making multiple trades throughout the day, aiming to profit from small price movements in a stock. The goal is to buy at the bid price and sell at the asking price, taking advantage of the spread between these two prices. This technique requires quick decision-making skills and the ability to execute trades swiftly.

Scalping can be highly profitable if done correctly, but it also comes with its fair share of risks. Since scalpers aim to make small profits from each trade, they need to have a high win rate and tight risk management strategies in place.

It's important to have a solid understanding of technical analysis strategies and indicators that can help identify short-term price movements. Patterns such as support and resistance levels, candlestick formations, and moving averages can be useful for scalp traders. By combining these day trading techniques with swing trading strategies, scalpers can increase their chances of success.

Momentum Trading: Capitalizing on Price Trends

To capitalize on price trends, you gotta ride the momentum and make those profits stack up. Momentum trading is all about taking advantage of the continuous upward or downward movement in a stock's price.

It involves identifying stocks that are experiencing significant price changes and then jumping on board to ride the wave until it starts to lose steam. The key here is to enter trades early and exit before the trend reverses. This strategy requires quick thinking and decisive action, as you need to constantly monitor the market for potential opportunities.

By staying focused and disciplined, you can potentially make substantial profits by riding the momentum.

Technical Analysis: Identifying Entry and Exit Points

When identifying entry and exit points, you can visualize the stock market as a map with various indicators guiding you toward profitable opportunities. It's like being a detective, carefully analyzing charts and patterns to determine the best time to enter or exit a trade.

Technical analysis plays a crucial role in this process, as it involves studying historical price data and using indicators such as moving averages, support and resistance levels, and trend lines.

By looking at these indicators, you can get valuable insights into whether a stock is overbought or oversold, if there is a potential trend reversal on the horizon, or if it's just experiencing temporary fluctuations.

To add depth to this analysis, here are four key elements I consider when identifying entry and exit points:

- Trend Confirmation: You look for confirmation of an established trend before making any moves. This could involve waiting for the price to break through a significant resistance level or observing multiple higher highs and higher lows in an uptrend (or lower lows and lower highs in a downtrend).

- Volume Analysis: Volume provides insight into market sentiment. Higher volume during an upward move suggests strength in buying pressure, while high volume during a downward move may indicate increased selling pressure.

- Candlestick Patterns: Candlestick patterns offer visual representations of price action that can signal potential reversals or continuations. For example, a doji candlestick may indicate indecision among traders.

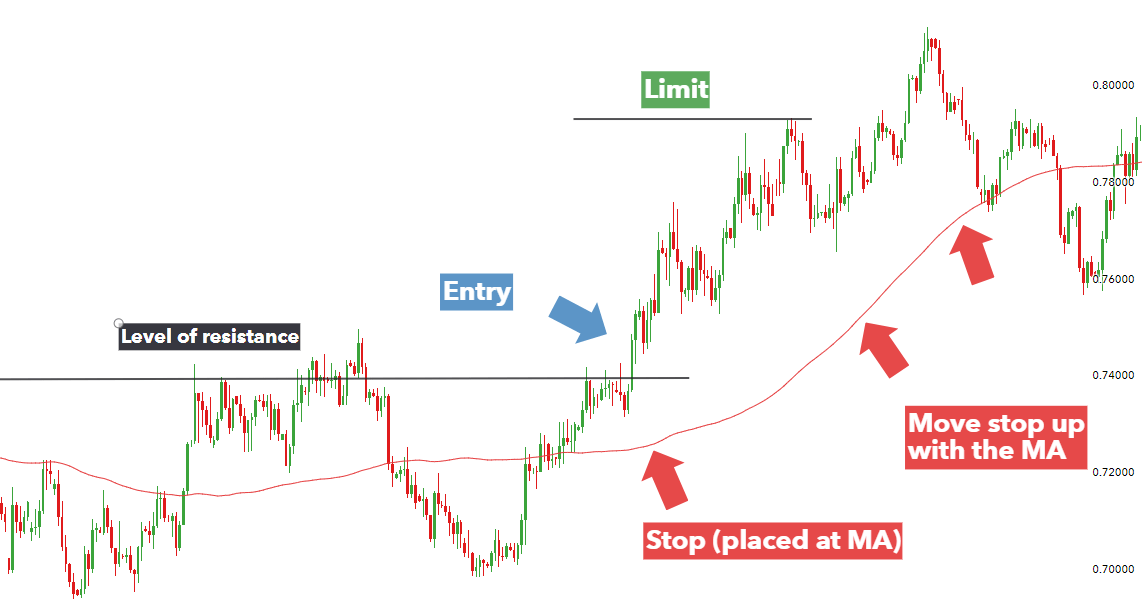

- Support and Resistance Levels: These levels act as barriers where prices tend to reverse or consolidate. When approaching these levels, you pay close attention to how the stock behaves – does it bounce off support or break through resistance?

With technical analysis tools at hand and careful consideration of these elements, you’re able to make more informed decisions about when to enter or exit trades effectively.

Swing Trading: Profiting from Short-Term Price Swings

Swing trading allows you to profit from short-term price swings by capitalizing on market fluctuations and making strategic moves based on technical analysis. This technique involves identifying stocks or other financial instruments with a predictable pattern of price movement within a certain range.

You look for opportunities to enter trades when the price is at the lower end of the range and exit when it reaches the upper end. By doing so, you can take advantage of upward trends and downward corrections, maximizing your potential gains.

To successfully swing trade, you rely heavily on technical indicators such as moving averages, trend lines, and support/resistance levels. These tools help you identify potential entry and exit points with a higher probability of success.

Additionally, you closely monitor market news and events that may impact the stock or market overall, as they can cause sudden shifts in price direction. By staying informed and disciplined in my approach, you can consistently profit from short-term price swings.

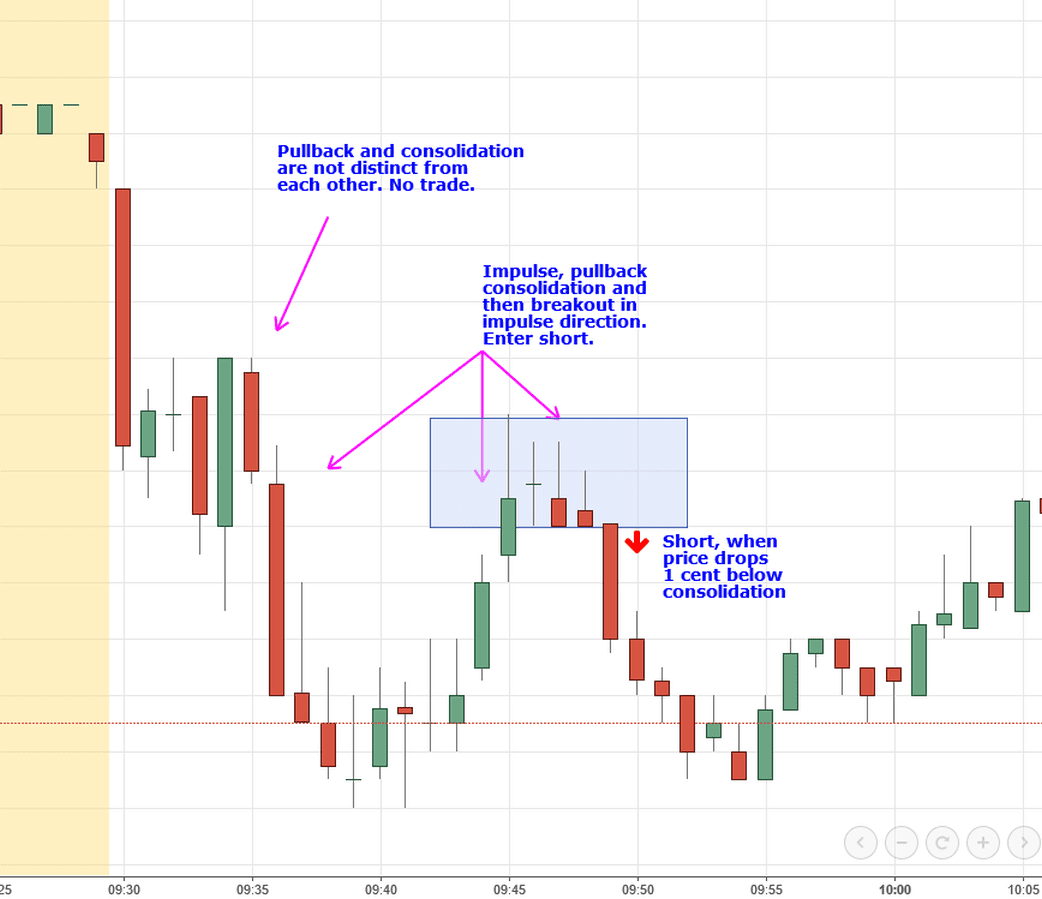

Breakout Trading: Taking Advantage of Price Breakouts

Breakout trading allows you to capitalize on price breakouts, seizing the opportunity for potential profit and excitement in the market. When a stock breaks through a key level of support or resistance, it signals a potential change in trend and opens up opportunities for quick gains. By entering trades at the right time, you can take advantage of these breakouts and ride the momentum for maximum profit.

In breakout trading, there are a few key techniques that I use to increase my chances of success:

- Identifying strong levels: Before entering a trade, I carefully analyze the chart to identify strong levels of support or resistance where breakouts are likely to occur. These levels can be identified using various technical indicators such as moving averages, trendlines, or Fibonacci retracements.

- Confirming with volume: Volume plays a crucial role in confirming the validity of a breakout. When there is high volume accompanying a breakout, it suggests that there's significant buying or selling pressure behind the move, increasing the likelihood of further price movement in that direction.

- Setting proper stop-loss orders: Breakouts can sometimes fail and result in false signals. To protect myself from potential losses, I always set stop-loss orders just below or above the breakout level depending on whether I'm going long or short. This helps me manage risk and exit trades if they don't go as planned.

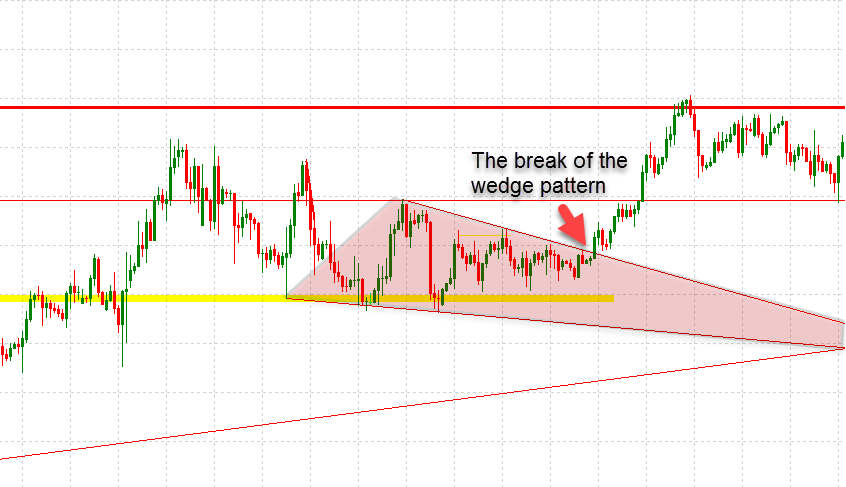

Trend Trading: Riding the Waves of Market Trends

To ride the waves of market trends and maximize your profits, trend trading is a strategy that allows you to identify and capitalize on the prevailing direction of price movements.

By analyzing charts and using technical indicators, you can spot patterns in the market that indicate an upward or downward trend. Once you have identified a trend, you can enter trades in the direction of that trend, aiming to profit from the continued movement of prices.

Trend trading offers several advantages over other day trading techniques. Firstly, it allows you to take advantage of longer-term price movements, which can result in larger profits compared to shorter-term trades. Secondly, by following the overall market trend, you’re aligning yourself with the forces driving price movements, increasing your chances of success.

However, it's important to note that not all trends are created equal. Some trends may be short-lived or lack strength, so it's crucial to use additional analysis tools to confirm their validity before entering trades. Understanding how to identify and trade trends effectively is essential for any day trader looking for consistent profits.

Risk Management: Protecting Your Capital

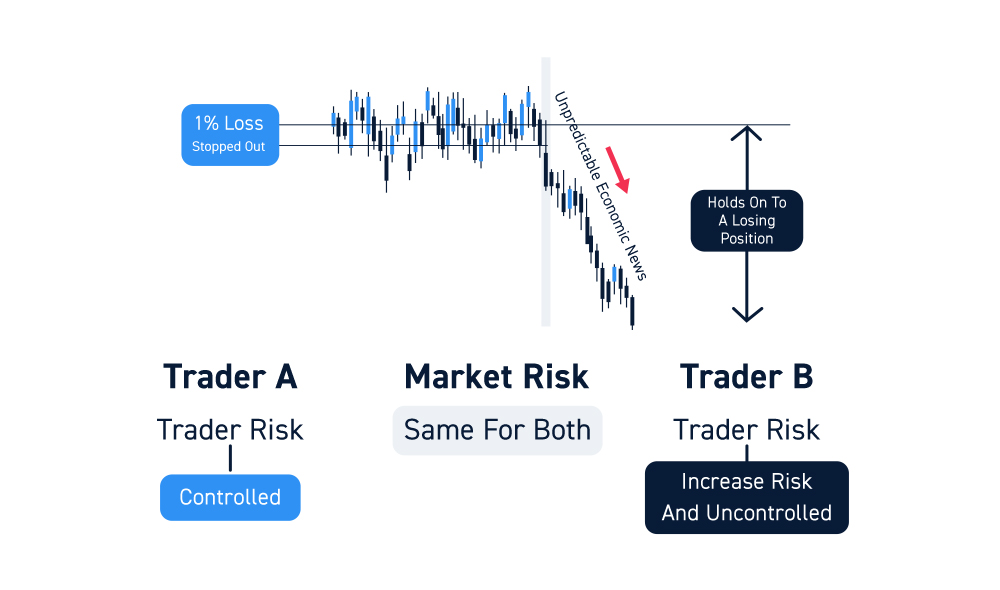

One crucial aspect of successful trading is effectively managing the risk to protect your capital. As a day trader, it's important to have strategies in place that minimize potential losses and maximize potential gains.

Here are three key risk management techniques that I employ:

- Setting Stop Loss Orders: This technique involves setting predetermined levels at which you will exit a trade if it moves against you. By placing stop-loss orders, you can limit your losses and protect your capital from significant declines.

- Diversifying Your Portfolio: Instead of putting all your eggs in one basket, diversifying your portfolio allows you to spread your risk across different trades or assets. By investing in a variety of stocks or markets, you can reduce the impact of any single trade on your overall capital.

- Implementing Position Sizing: Position sizing refers to determining how much capital to allocate to each trade based on its perceived risk and potential reward. By carefully considering the size of each position, you can ensure that no individual trade has an outsized impact on your overall portfolio.

By effectively implementing these risk management techniques, you’re able to protect your capital and minimize potential losses.

Developing a Trading Plan: Setting Goals and Strategies

Now that we've discussed the importance of risk management in day trading strategies and how it helps protect our capital, let's move on to developing a trading plan.

This is where we set our goals and strategies to guide us in making informed trading decisions. As a day trader, having a well-defined plan is crucial to achieving consistent profitability.

In developing a trading plan, the first step is to set clear and realistic goals. These goals should be specific, measurable, achievable, relevant, and time-bound (SMART). For example, you may set a goal of earning a certain percentage return on your capital within a specific timeframe. By setting these goals, you give yourself something concrete to work towards and can track your progress along the way.

Once you have established your goals, the next step is to develop strategies that align with those objectives. Strategies can include technical analysis techniques such as trend following or momentum trading, as well as fundamental analysis approaches like news-based trading or earnings plays.

It's important to consider your strengths and weaknesses as a trader when selecting your strategies. Remember that not every strategy will work for everyone; what works for one person may not work for another.

By setting clear goals and developing effective strategies in your trading plan, you increase your chances of success as a day trader. This allows you to approach each trade with confidence and discipline rather than relying solely on luck or intuition.

So take the time to develop your trading plan and stick to it consistently - it could be the key difference between being profitable or losing money in day trading.

Conclusion

In conclusion, day trading techniques offer a variety of strategies for traders to capitalize on short-term price movements in the financial markets. From scalping to breakout trading, each technique has its own unique approach and can be tailored to fit individual trading styles and preferences