Mitrade has become my go-to trading platform due to its comprehensive range of financial instruments, user-friendly interface, fast execution speeds, excellent customer support, and robust security measures.

What is Mitrade? Review Mitrade exchange

As a trader in today's dynamic financial markets, finding a reliable and user-friendly trading platform is essential. That's why I was thrilled to discover Mitrade, a cutting-edge online trading platform that offers an array of exciting features for both novice and experienced traders.

Whether you're new to trading or an experienced trader looking for a reliable platform to enhance your trading journey - Mitrade is definitely worth considering.

What is Mitrade?

So, if you're wondering what Mitrade is, it's a platform that allows you to trade financial markets with ease and confidence. With Mitrade, you can access a wide range of global financial instruments such as forex, commodities, indices, and cryptocurrencies.

It provides a user-friendly interface where you can easily execute trades and monitor your positions in real time. One of the key features of Mitrade is its market review section. This section offers comprehensive analysis and insights into various financial markets. You can stay updated on the latest market trends, news, and events that may impact your trading decisions.

This information is crucial for making informed trading choices and maximizing your potential profits.

Pros and Cons of Mitrade

When using Mitrade, you'll find that the pros include a user-friendly interface and access to a wide range of financial instruments. The platform is designed to be intuitive and easy to navigate, making it suitable for both beginners and experienced traders. It provides a seamless trading experience with real-time market data and advanced charting tools that assist in making informed decisions.

Additionally, Mitrade offers a diverse selection of financial instruments to trade, including forex, commodities, indices, cryptocurrencies, and more. This variety allows users to diversify their portfolios and take advantage of different market opportunities.

With Mitrade's extensive range of assets available for trading, users can tailor their strategies based on their individual preferences and risk appetite.

However, it's important to note that the cons of using Mitrade may involve potential risks associated with leveraged trading. While leverage can amplify profits when used wisely, it can also magnify losses if not managed properly. Traders need to be cautious as high leverage increases the exposure to market volatility.

Therefore, it is crucial for users of Mitrade or any other leveraged trading platform to have a solid understanding of risk management techniques and exercise caution when utilizing leverage in their trades.

Products traded on Mitrade

Currently, Mitrade offers 5 main product groups, including Forex, Indices, Commodities, Stocks, and Cryptocurrencies.

- Forex: There are 60 currency pairs available, including major, minor, and exotic currency pairs.

- Indices: Mitrade provides 12 of the most popular indices from the US, Australia, Europe, and Asia, such as UK100, HK50, NAS100, GER30, FR40, EU50, US30, AUS200, etc.

- Commodities: Mitrade offers 13 types of commodities, including precious metals, energy, and oil.

- Stocks: This category includes 60 stocks of leading global companies such as JNJ, Google, Amazon, Facebook, etc.

Mitrade account types

Currently, Mitrade offers only one type of account, which is the Standard account. To open a Standard account, traders need to deposit a minimum of $50. This account type is suitable for both new traders and experienced investors.

The Standard account allows traders to access global financial trading instruments under favorable conditions, such as flexible leverage, low trading fees, no commission charges, and competitive spreads.

Additionally, for those who want to experience Mitrade's trading environment and platform, they can register for a Demo account with a virtual balance of up to $50,000. With this amount, traders can comfortably practice trading and place orders without risking real funds.

Mitrade trading platform

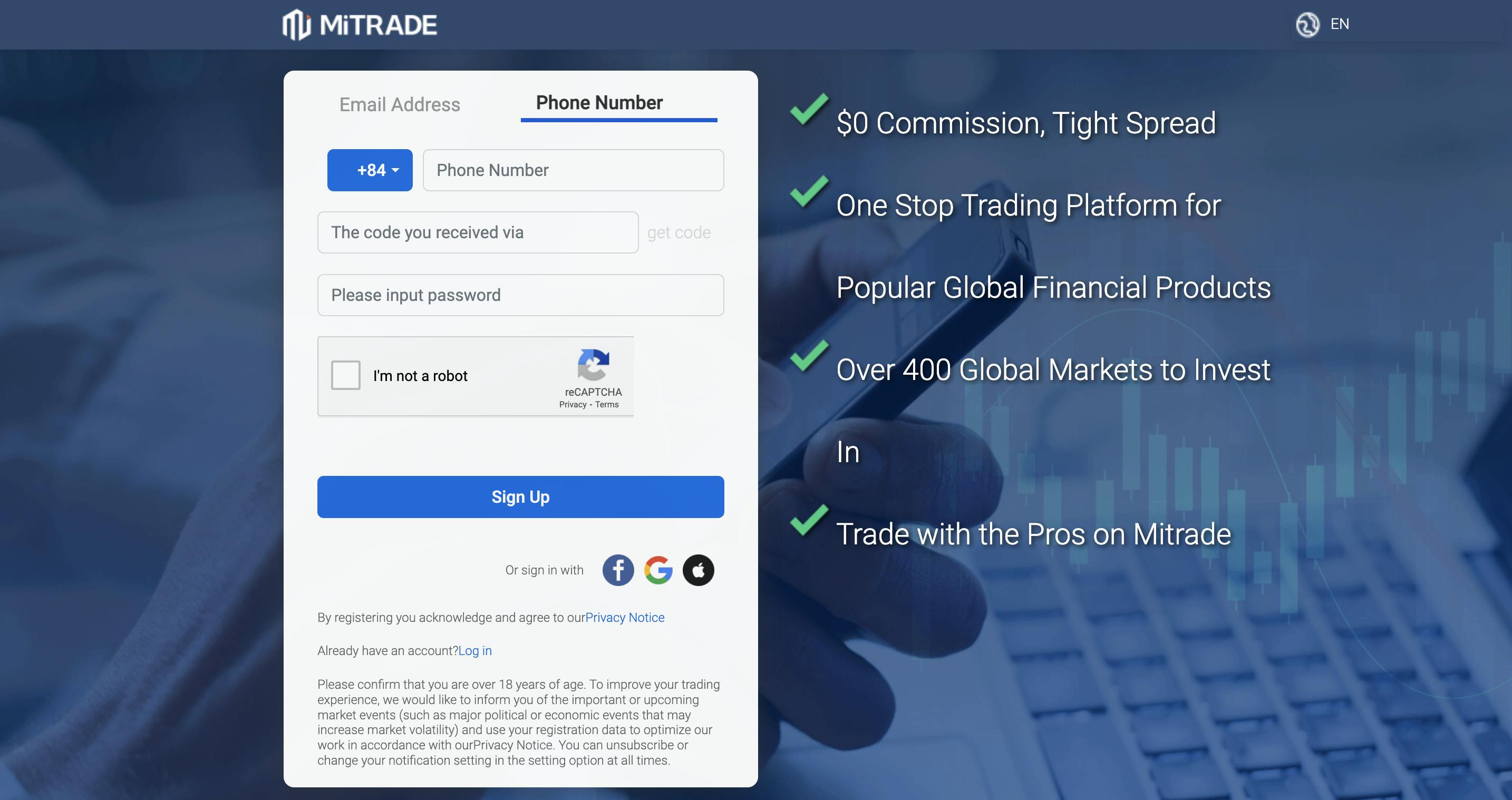

Unlike other reputable forex brokers, Mitrade does not use the MT4/MT5 platform but instead offers its own proprietary trading platform. This trading platform has received numerous prestigious awards.

Currently, Mitrade's platform is available in two main versions: the web platform and the mobile application (for iOS and Android operating systems). It features a simple, intuitive, and user-friendly interface that caters to the needs of all traders. However, the platform may not have the same level of diversity and comprehensive analysis tools as the MT4 platform.

Here are some key features of the Mitrade trading platform for your reference:

The Mitrade platform offers two types of price charts: bar charts and Japanese candlestick charts.

- Supports 10 timeframes ranging from 1 minute to 1 month.

- Provides 7 chart types, including 3 candlestick charts, bar chart, line chart, area chart, and baseline chart.

- Supports drawing tools such as trendlines, similar to those found on TradingView.

- Does not support automated trading with Expert Advisors (EAs).

- Deposit and withdrawal functions are available directly on the platform.

You can search for the Mitrade app on the App Store or Google Play, or scan the QR code on the website to download the app and trade freely anytime, anywhere.

Leverage and trading fees on Mitrade

Leverage and trading fees are important considerations for many traders, as they directly impact the trading capital. The leverage and trading fees at Mitrade are as follows:

Leverage at Mitrade

Mitrade allows traders to trade with leverage of up to 1:200. However, the leverage varies for different products as follows:

- For forex products, the maximum leverage is 1:200.

- Commodity products have a maximum leverage of 1:100.

- Stocks: Maximum leverage provided is 1:10.

- Indices: Maximum leverage is 1:200.

Mitrade's Commission Fees

All trades on Mitrade do not incur any commission fees, and there are no hidden fees. This is an advantage that attracts many traders to participate on the platform.

Spread at Mitrade

Mitrade uses the difference between the buying and selling price as a service fee known as the spread. The spread fee is reflected in the quoted prices and is calculated when you open a position. However, each trading product has a different spread. For example, forex pairs have spreads starting from 0.0001 pips, commodities from 0.06 pips, stocks from 1 pip, indices from 1.6 pips, and cryptocurrencies from 1.65 pips.

Overnight Fees at Mitrade

In the event that a trader holds a position past 10:00 PM (GMT), the account may incur overnight interest corresponding to each product.

For a currency pair, there are two currencies involved in overnight fees. With the currency you buy, you may receive interest, while with the currency you sell, you may have to pay interest. The interest rate differential on the currency pair determines whether you will be charged or receive overnight fees corresponding to the investment product.

Conclusion

Through Forex Prop Reviews's article, Mitrade is a user-friendly trading platform that offers several advantages for both experienced and novice traders. With its intuitive interface and comprehensive range of financial instruments, Mitrade provides an accessible avenue for individuals to enter the world of online trading.