With a daily trading volume of $6.6 trillion, the FX market is the world's largest financial market. It is a highly dynamic market that is influenced by a variety of factors such as economic indicators, central bank policies, and geopolitical events. In this post, we will look at how geopolitical events affect forex markets and how traders can mitigate their risks.

What are Geopolitical Events? How they can affect on Forex market

Conflicts, elections, and policy changes can all have a substantial impact on forex markets and currency volatility. These occurrences can cause market uncertainty and shift market sentiment, resulting in currency value volatility and greater trading possibilities. In this post, Forex Prop Reviews will look at the connection between geopolitical events and forex markets, as well as tactics for trading during times of increased geopolitical risk.

What are Geopolitical Events?

Do you ever wonder how geopolitical events can impact the stability of your money and the economy? Geopolitical events refer to significant occurrences on a global scale that involve political, economic, and social factors.

These events can include wars, conflicts, political transitions, trade disputes, or natural disasters. As an individual investor or trader, understanding and analyzing geopolitical events is essential in making informed financial decisions.

Geopolitical events have a direct influence on the global economy and financial markets. By following fundamental analysis strategies, investors can assess the potential impact of these events on various currencies and asset classes.

For example, if there's a sudden escalation of tensions between two countries, it could lead to increased market volatility and uncertainty. This may cause investors to sell off riskier assets and seek safe-haven currencies such as the US dollar or Japanese yen.

Furthermore, geopolitical events can also affect specific industries or companies within a country. For instance, if trade negotiations between two major economies break down, it could result in tariffs or trade barriers being imposed. This would directly impact businesses involved in international trade and may lead to lower profits or even bankruptcy for some companies.

Geopolitical events play a crucial role in shaping the stability of our money and the overall economy. It's important for individuals involved in financial markets to stay informed about these events and understand their potential implications. By incorporating fundamental analysis strategies into our decision-making process, we can better navigate the impacts of geopolitical events on forex markets without compromising our financial well-being.

Impact of Geopolitical Events on Forex Markets

The impact of geopolitical events on forex markets can cause significant fluctuations in currency exchange rates. Geopolitical events such as political upheavals, trade disputes, and military conflicts can create uncertainty and volatility in the global financial markets.

For example, when there's tension between two countries, investors may lose confidence in their currencies and shift their investments to safer havens. This can result in a depreciation of the affected country's currency relative to others.

Geopolitical events also influence the supply and demand dynamics of currencies. Economic sanctions or trade restrictions imposed on a country can impact its ability to import goods and services, leading to a decrease in its currency's value. On the other hand, geopolitical stability or positive developments can attract foreign investment and strengthen a country's currency.

To navigate these fluctuations caused by geopolitical events, traders employ various strategies. One common approach is to closely monitor news releases and statements from policymakers to gauge the potential impact on exchange rates. Additionally, traders may diversify their portfolios by investing in multiple currencies or hedging their positions through derivative products like options or futures contracts.

Geopolitical events have a profound influence on forex markets by creating volatility and uncertainty in currency exchange rates. Traders need to stay informed about global political developments and adapt their strategies accordingly to manage risks effectively.

Geopolitical Risk Management Strategies in Forex Trading

One effective way for forex traders to mitigate the impact of geopolitical risks is by closely monitoring global political developments and adjusting their trading strategies accordingly.

Geopolitical events such as political unrest, trade wars, or military conflicts can have a significant impact on currency values and market volatility. By staying informed about these events and understanding how they may affect different currencies, traders can make more informed decisions and manage their risk effectively.

To effectively manage geopolitical risks in forex trading, traders should consider the following strategies:

- Diversification: One key strategy is to diversify your portfolio by trading various currency pairs from different countries. This helps spread the risk across multiple currencies and reduces the potential impact of any single geopolitical event on your overall trades.

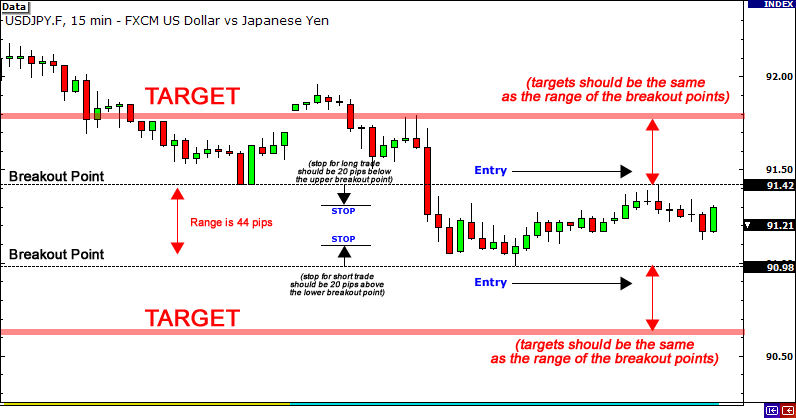

- Stop-loss orders: Implementing stop-loss orders can be an effective risk management tool during times of heightened geopolitical uncertainty. These orders automatically close out a trade if the price reaches a predetermined level, limiting potential losses in case of adverse market movements.

- Fundamental analysis: It is crucial to conduct a thorough fundamental analysis when considering trades affected by geopolitical events. Understanding economic indicators, government policies, and political stability can provide valuable insights into how certain currencies are likely to respond to specific events.

Frequently Asked Questions

How do geopolitical events impact other financial markets besides the forex market?

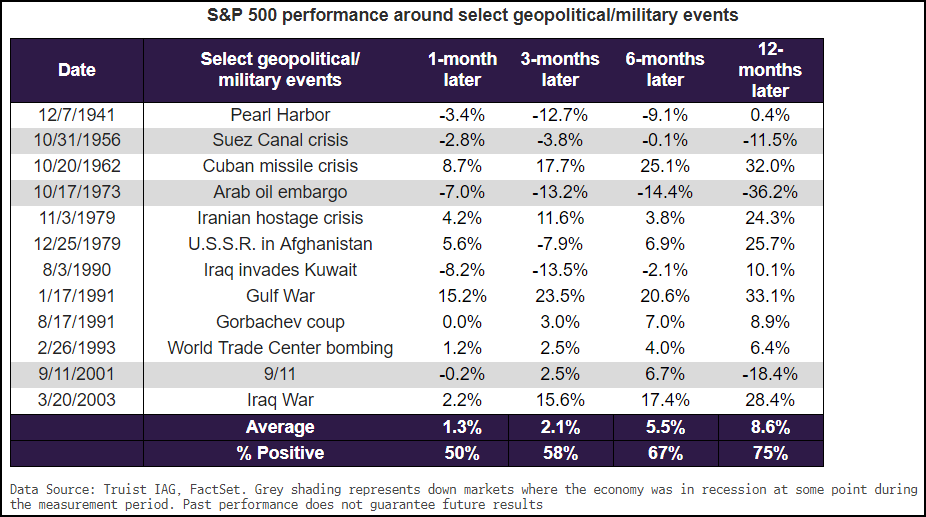

Geopolitical events have a significant impact on various financial markets beyond the forex market. These events can trigger volatility and uncertainty, which often leads to fluctuations in stock prices, bond yields, and commodity markets.

For instance, heightened tensions between countries or political instability can create fear among investors, causing them to sell off stocks and seek safer assets like government bonds.

Additionally, geopolitical events can disrupt global supply chains and trade relationships, affecting the prices of commodities such as oil or agricultural products.

Moreover, changes in international relations can influence investor sentiment towards specific industries or countries, leading to shifts in capital flows and investment patterns.

Therefore, it's crucial for investors to closely monitor geopolitical developments as they have the potential to significantly impact financial markets worldwide.

What are some examples of recent geopolitical events that have had a significant impact on forex markets?

Some recent geopolitical events have had a significant impact on forex markets. One example is the ongoing trade tensions between the United States and China. As these two economic powerhouses engage in tit-for-tat tariff impositions, it creates uncertainty in global markets and affects investor sentiment.

This uncertainty can lead to fluctuations in currency values as investors seek safe-haven assets or move their investments away from countries involved in the dispute.

Another example is Brexit, which has caused volatility in the British pound. The negotiations between the United Kingdom and the European Union have created uncertainty about future trade relations and economic stability, leading to sharp movements in currency exchange rates.

Geopolitical events like these can have far-reaching effects on forex markets, highlighting how interconnected global economies are and how sensitive currencies are to political developments.

How do central banks respond to geopolitical events and what role do they play in managing the impact on forex markets?

Central banks play a crucial role in managing the impact of geopolitical events on forex markets. When faced with such events, central banks closely monitor market conditions and assess the potential risks to their country's economy.

They have various tools at their disposal to respond effectively, including adjusting interest rates, implementing monetary policy measures, and conducting market interventions. By carefully analyzing the situation and making strategic decisions, central banks aim to stabilize their currency and mitigate any disruptive effects on the forex markets.

Their actions can influence exchange rates and help maintain stability amidst turbulent geopolitical developments.

Can geopolitical events have long-term effects on currency exchange rates, and if so, how do traders navigate these prolonged uncertainties?

Geopolitical events can indeed have long-term effects on currency exchange rates, and as a forex trader, navigating these prolonged uncertainties requires careful analysis and strategic decision-making.

When geopolitical events unfold, they often create significant uncertainty in the global markets, leading to fluctuations in currency values.

As a trader, you would closely monitor the news and analyze the potential impact of these events on various currencies. This involves studying political developments, economic indicators, and market sentiment to anticipate how exchange rates may be affected in the long run.

Conclusion

Overall, recognizing the relationship between geopolitical events and the forex market is crucial for anyone involved in forex trading. The ability to anticipate and react to these events effectively can lead to better financial outcomes.