Fundamental analysis is one of two ways to trade Forex. It heavily focuses on monitoring the performance of currency economies. And one method to do so is through the news. In this post, we'll discuss some of the top Forex news trading strategies.

3 News Trading Strategies: Importance, Tips

As a trader in the financial markets, I have come to understand the significance of news trading strategies. These strategies play a crucial role in navigating the ever-changing landscape of the market and making informed decisions. By keeping an eye on relevant financial news and utilizing effective fundamental analysis strategies, traders can maximize their profits and minimize potential risks.

In this article, Forex Prop Reviews will delve into the importance of news trading strategies and explore how specific financial news influences these strategies. I will also discuss three top news trading strategies that have proven to be successful in various market conditions.

The Importance of News Trading Strategies

News trading strategies involve using information from financial news to make trading decisions. These strategies are based on fundamental analysis, which is the study of economic and political factors that can affect financial markets. By understanding how news events can impact market movements, traders can take advantage of opportunities and minimize risks.

News trading strategies are important because they allow traders to stay ahead of market trends and react quickly to changing conditions. Traders who rely solely on technical analysis may miss out on important information that could significantly impact their trades. By incorporating news into their analysis, traders can better predict potential price movements and adjust their positions accordingly.

Financial news that influences trading strategies includes economic indicators such as GDP growth rates, interest rate changes, and employment reports. Political events like elections or policy changes can also have a significant impact on market sentiment. By staying informed about these news events and analyzing their potential effects on the markets, traders can make more informed decisions.

Understanding the importance of news trading strategies is vital for any trader looking to succeed in the finance industry. By incorporating fundamental analysis into their trading approach and staying updated with financial news, traders can gain an edge in this fast-paced environment. With proper knowledge and implementation of these strategies, traders will be well-equipped to navigate the ever-changing world of finance successfully.

Financial News That Influences Trading Strategies

Uncovering the latest financial information can be like stumbling upon a hidden treasure chest for savvy investors. Financial news plays a crucial role in shaping trading strategies, as it provides valuable insights into market trends, economic indicators, and company performance.

For example, news about interest rate changes by central banks can have a significant impact on currency exchange rates and global markets. Similarly, announcements of corporate earnings reports can influence stock prices and investment decisions. By staying updated with financial news, traders can gain an edge in the market and make informed decisions based on current events.

Keeping track of the latest financial news is essential for successful trading strategies. However, it is equally important to identify which news events are most influential. Some key financial news that influences trading strategies include major economic indicators such as GDP growth rate, inflation data, and employment figures. These indicators provide valuable insights into the overall health of an economy and can guide investment decisions accordingly.

Additionally, geopolitical events such as trade disputes or political elections can also have significant implications for global markets. By understanding how these events may impact various sectors or countries, traders can adjust their strategies accordingly to maximize profits or minimize risks.

Top 3 News Trading Strategies

In this discussion, Forex Prop Reviews will be exploring the top 3 news trading strategies.

The Classic Strategy

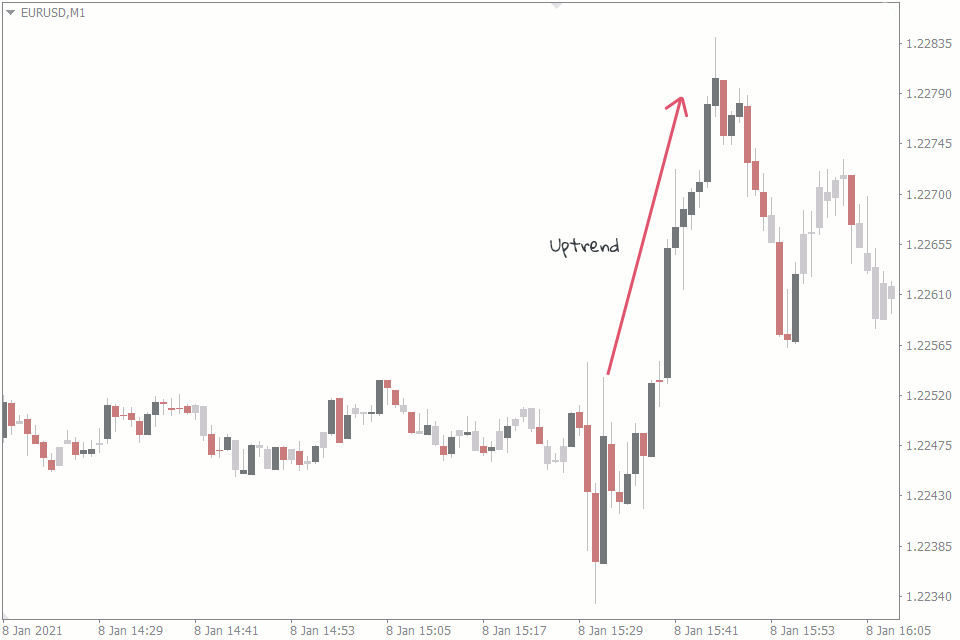

The Classic Strategy for news trading involves carefully analyzing market trends and making informed decisions based on the available information. This strategy relies on identifying patterns and trends in the market leading up to a major news event, such as an economic report or central bank announcement.

By studying historical data and monitoring key indicators, traders can anticipate how the market may react to the upcoming news release.

To implement the Classic Strategy effectively, here are some key steps:

- Research: Conduct thorough research on the upcoming news event and its potential impact on the market.

- Technical Analysis: Use technical analysis tools to identify support and resistance levels, trend lines, and other important price patterns.

- Risk Management: Determine your risk tolerance level and set appropriate stop-loss orders to protect your capital.

- News Monitoring: Stay updated with real-time news feeds and economic calendars to be aware of any unexpected developments that could affect your trades.

- Timing: Enter the trade just before or after the news release, depending on your analysis of how the market will react.

The Breakout (Straddle) Strategy

Get ready to explore the exciting Breakout (Straddle) Strategy, which will help you make informed decisions and potentially profit from market volatility.

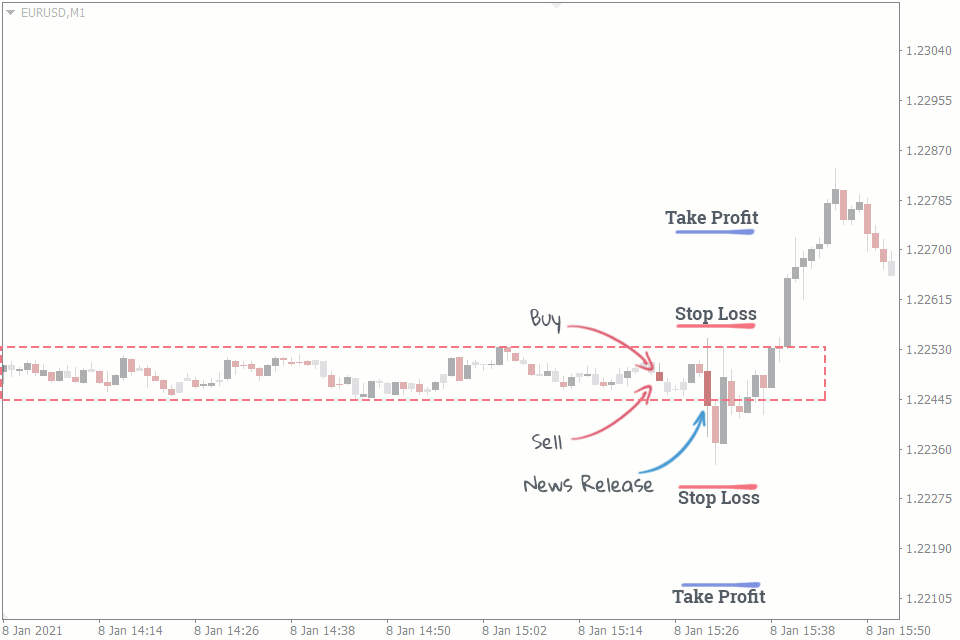

The Breakout Strategy involves placing two orders before a major news release - one to buy above the current price and one to sell below the current price. This allows you to take advantage of any significant movement in either direction.

When using the Breakout Strategy, you closely monitor key support and resistance levels to determine where to place your orders. Once the news is released and triggers one of your orders, you can quickly close out the other order for a profit. This strategy works best when there is high market volatility during news events, as it increases the likelihood of a breakout.

Hedging Strategy

Now, let's explore the hedging strategy, a powerful technique that allows you to protect your investments and minimize potential losses by opening opposite positions in related assets.

Hedging involves taking two offsetting positions in the market to reduce risk. For example, if you have a long position on a particular stock, you can hedge it by simultaneously opening a short position on another stock that moves inversely with the first one. By doing so, you can limit my exposure to market fluctuations and ensure that any losses incurred from one position are offset by gains in the other.

Using the hedging strategy provides several benefits for news trading strategies:

- Risk reduction: Hedging allows you to protect your investments from adverse price movements in the market. By opening opposite positions, you can limit potential losses if one of the trades goes against me.

- Diversification: Through hedging, you can diversify your portfolio and spread out risks across different assets or markets. This helps you avoid putting all your eggs in one basket and increases the chances of overall profitability.

- Flexibility: The hedging strategy gives you flexibility in managing your trades. If you see signs of impending volatility or uncertainty due to news events, you can quickly hedge your positions to mitigate potential losses.

With an understanding of how hedging works and its benefits for minimizing risk, let's now move on to some tips for effective news trading strategies.

Tips for Effective News Trading Strategies

Start by identifying key news events that are likely to have a significant impact on the market. This involves staying up-to-date with economic indicators, central bank announcements, and geopolitical developments.

By keeping track of these events, you can anticipate how they may affect the market and plan your trading strategy accordingly. It's important to focus on high-impact news events that are known for causing volatility in the markets, such as interest rate decisions, GDP releases, and employment reports.

Once you've identified the key news events, it's crucial to conduct thorough research and analysis. This includes studying historical price patterns during similar news releases and examining market sentiment leading up to the event.

By understanding how the market has reacted in the past, you can better gauge potential outcomes and make more informed trading decisions. Additionally, monitoring market sentiment through indicators like investor surveys or social media sentiment can provide valuable insights into how other traders are positioning themselves.

Effective news trading strategies require careful planning and analysis. Start by identifying key news events that are likely to impact the market significantly, then conduct thorough research and analysis to understand historical price patterns and market sentiment.

By following these tips, you can improve your chances of success in news trading strategies.

Conclusion

In conclusion, news trading strategies play a vital role in the success of traders in the financial markets. By staying updated with relevant and impactful financial news, traders can make informed decisions and capitalize on market opportunities.