Because of its capacity to earn quick profits from short-term market swings, swing trading is a popular approach among many traders. It does, however, come with its own set of dangers that must be carefully handled in order to maximize profits while minimizing losses. We will discuss the fundamental principles of swing trading risk management in this tutorial, so you can start trading with confidence and stay ahead of the game.

The Important Guide to Swing Trading Risk Management

Swing trading can be an exhilarating and potentially lucrative endeavor, but it also comes with its fair share of risks. As someone who has dabbled in swing trading myself, I understand the importance of effective risk management to safeguard your investments and maximize your gains.

In this article, Forex Prop Reviews will delve into the world of swing trading risk management and provide you with essential techniques and strategies that will help you navigate these unpredictable waters with confidence.

What is Swing Trading?

Swing trading, a potentially lucrative but risky endeavor, involves holding stocks for a few days to a few weeks and requires careful risk management to navigate the unpredictable market volatility. As a swing trader, I understand the importance of implementing strategic risk management techniques to minimize losses and maximize gains.

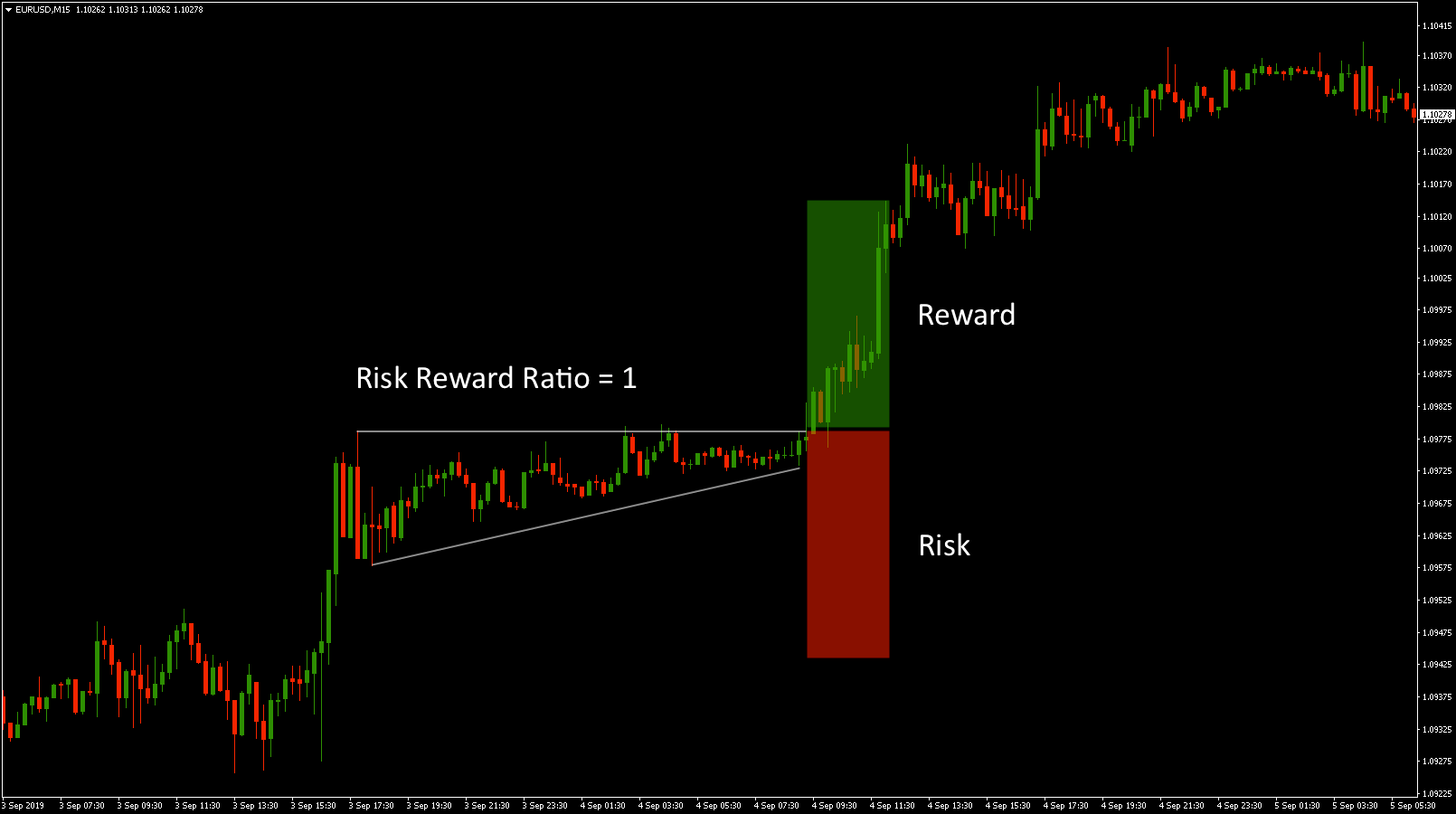

By employing various swing trading strategies such as setting stop loss orders, using risk-reward ratios, conducting technical and fundamental analysis, and practicing proper position sizing, I aim to mitigate potential risks and protect my capital.

In swing trading risk management, it's crucial to keep emotions in check and maintain discipline throughout the trading process. Having a solid trading plan that outlines entry and exit points helps me make informed decisions based on market trends and indicators.

Additionally, I utilize trailing stop-loss orders to secure profits by automatically adjusting them as the stock price moves in my favor. By entering and exiting trades at the right time according to my predetermined plan, I can effectively manage risks while aiming for optimal returns.

With these risk management strategies in place, I'm able to navigate the challenging nature of swing trading while keeping potential losses limited.

Now let's delve into different types of risks associated with swing trading without wasting any time.

Types of Risks

When engaging in this investment strategy, it's crucial to understand the various types of risks that can arise.

Swing trading involves holding stocks for a few days to a few weeks, and during this time, there are different risks that traders must be aware of.

One type of risk is market risk, which refers to the potential for losses due to fluctuations in the overall stock market or specific sectors.

Another type is credit risk, which arises when a company or individual fails to meet their financial obligations.

Liquidity risk is also important as it relates to the ease of buying or selling assets without causing significant price movements.

Lastly, operational risk involves factors such as technological failures or human error that could impact the execution of trades.

Understanding these risks allows swing traders to develop appropriate strategies for managing them effectively.

By diversifying their portfolios across different asset classes and sectors, traders can mitigate market risk by reducing exposure to any single investment.

Additionally, setting stop-loss orders helps limit potential losses by automatically closing out trades at predetermined levels.

Position sizing is another important aspect of risk management as it determines how much capital should be allocated to each trade based on an individual's risk tolerance and overall portfolio size.

By considering these various types of risks and implementing appropriate strategies, swing traders can navigate the markets with more confidence and increase their chances of success.

Market volatility plays a significant role in swing trading risk management.

Market Volatility

Take a moment to envision yourself in the midst of a bustling market, where prices are constantly fluctuating and uncertainty hangs in the air like a thick fog. This is what market volatility feels like. It refers to the unpredictable and uncertain nature of financial markets.

Here are three key points to understand about market volatility:

- Rapid Price Changes: Highly volatile markets can lead to rapid price changes in stocks and other assets. Prices can swing up or down within short periods, presenting both opportunities for quick profits and risks of significant losses.

- Impact of Events: Market volatility is influenced by economic events, geopolitical developments, and even rumors circulating in the market. Any news or information that creates uncertainty can cause increased volatility.

- Profit Opportunities: While stable markets may not provide quick profit opportunities, highly volatile markets offer potential gains for traders who can accurately predict price movements and take advantage of them.

Setting Stop Loss Orders

Ensure you protect your investments and minimize potential losses by implementing stop loss orders, a crucial tool that automatically closes out trades at a predetermined loss level. Setting stop-loss orders is an essential risk management technique in swing trading.

By establishing a specific price point at which to exit a trade if it moves against you, you can limit your losses and prevent larger ones. This helps maintain discipline and reduces emotional decision-making, as the order will be executed automatically without any hesitation.

However, it's important to note that stop-loss orders may not always be executed at the desired price due to market volatility or gaps in price movements. It's crucial to regularly monitor your trades and adjust your strategies accordingly.

Additionally, keeping a record of your trades allows you to stay organized and track your progress over time. With effective use of stop loss orders, you can protect your investments and transition into the subsequent section about diversification strategies, which further enhance risk management in swing trading.

Diversification Strategies

Maximize your chances of success by diversifying your portfolio with various assets, as this can help reduce your exposure to potential losses. Diversification is a risk management strategy that involves spreading your investments across different assets, such as stocks, bonds, commodities, and currencies. By investing in a range of assets that have a low or negative correlation with each other, you can potentially offset losses in one area with gains in another. This helps to mitigate the impact of market volatility on your overall portfolio.

When diversifying your portfolio, consider the following strategies:

- Asset Allocation: Allocate your investments across different asset classes based on their risk and return characteristics. This involves determining the percentage of your portfolio that should be allocated to stocks, bonds, cash equivalents, and other assets.

- Correlation Analysis: Evaluate the correlation between different assets before adding them to your portfolio. Correlated assets tend to move in the same direction, while uncorrelated or negatively correlated assets move in opposite directions. Including uncorrelated or negatively correlated assets can help reduce the overall risk of your portfolio.

- Sector Diversification: Spread your investments across different sectors or industries within an asset class. This helps protect against downturns in specific sectors and allows you to take advantage of opportunities in others.

By diversifying your portfolio effectively, you can manage risk more efficiently and increase the likelihood of achieving consistent returns over time.

Monitoring and Adjusting Trades

When it comes to managing risk in swing trading, diversification strategies are crucial. By spreading our investments across multiple assets, we can reduce our exposure to any single investment and minimize potential losses.

It's important to consider the correlation between assets when diversifying. Correlated assets move in the same direction, while uncorrelated assets move in opposite directions. This allows us to create a balanced portfolio that can withstand market fluctuations.

However, diversification alone is not enough. Monitoring and adjusting trades is also essential for effective risk management. As swing traders, we need to regularly check the status of our trades and be prepared to make adjustments as needed.

This involves keeping a close eye on market conditions, economic events, and any other factors that may impact our trades. By staying vigilant and proactive, we can respond quickly to changing circumstances and protect ourselves from unnecessary risks.

Record Keeping

Maintaining accurate and organized records of my trades is crucial for evaluating performance, identifying patterns, and making informed decisions in your swing trading journey. It allows you to track the progress of each trade, analyze your strategies, and identify areas for improvement.

When you keep a record of my trades, you can easily review past trades to see what worked well and what didn't. This helps you identify patterns and trends that can inform future trading decisions.

Additionally, having detailed records allows you to evaluate the effectiveness of different strategies or indicators that you use in my swing trading approach. By keeping track of key information such as entry and exit prices, stop loss levels, and profit targets, you can assess the success rate of these strategies over time.

To grab your attention, here are four reasons why maintaining accurate trade records is essential in swing trading:

- Evaluate Performance: Tracking trades enables you to assess the success rate of your strategies and make adjustments accordingly.

- Identify Patterns: Through record-keeping, you can spot recurring patterns or market tendencies that may impact future trades.

- Make Informed Decisions: Analyzing past trades helps you make better decisions based on historical data rather than relying solely on intuition or emotions.

- Track Progress: Maintaining trade records allows you to monitor your progress over time and set realistic goals for growth.

Effective Risk Management

Ensure your financial success and protect your investments by implementing a robust strategy to mitigate potential risks in swing trading. Effective risk management is essential in swing trading as it helps you navigate the unpredictable nature of financial markets.

You can minimize potential losses and maximize gains by employing various risk management techniques. One key aspect of effective risk management is diversifying your portfolio. Spreading your investments across multiple assets reduces exposure to any single asset or market. This way, if one investment performs poorly, the impact on your overall portfolio will be minimized.

When diversifying, it's important to consider the correlation between assets. Correlated assets tend to move in the same direction, while uncorrelated assets move in opposite directions. By including a mix of correlated and uncorrelated assets in your portfolio, you can further reduce risk.

Another crucial aspect of risk management is regularly monitoring your trades. It's important to keep a close eye on trade status and adjust strategies as needed. This includes setting stop-loss orders to automatically close out trades at a certain loss level, helping minimize potential losses and prevent larger ones. However, it's important to note that stop-loss orders may not always be executed at the desired price due to market volatility or other factors.

By following these risk management practices consistently and staying disciplined in executing them, you can effectively manage risks involved in swing trading and increase your chances of success.

Conclusion

In conclusion, understanding swing trading risk management is crucial. By implementing the techniques and strategies discussed in this article, traders can minimize losses and maximize gains.