Are you a trader looking to enhance your skills and profitability in the dynamic market? Look no further! In this article, Forex Prop Reviews will be sharing valuable insights about swing trading techniques that can help you capitalize on short-term market trends and make consistent profits.

Swing Trading Techniques : Identifying Market, Backtesting the Strategy

Swing trading is a popular strategy. One of the crucial steps in swing trading is identifying the market you wish to trade in. Whether it's stocks, forex, or commodities, understanding the dynamics of the chosen market is essential for success.

By following these swing trading techniques diligently and adapting them to your own trading style, you can enhance your skills and potentially achieve consistent profitability in the dynamic market. So let's dive into each step in detail and unlock the secrets to successful swing trading with Forex Prop Reviews!

Identifying Market

Before you can develop your entry and exit strategies, you must first identify the market in which you want to trade.

Utilizing fundamental and technical analyses, you can determine the most lucrative opportunities for swing trading techniques. By analyzing the market trends, economic indicators, and company financials, you can gain a comprehensive understanding of the market's potential for profitability.

Additionally, technical analysis tools such as charts, patterns, and indicators help you identify patterns and trends that may indicate favorable entry or exit points for your trades.

Once I have identified the market using these swing trading strategies, it's crucial to transition into utilizing fundamental and technical analyses. These analyses provide valuable insights into when to enter and exit trades based on various factors such as earnings reports, news events, support levels, resistance levels, moving averages, and other technical indicators.

By incorporating both fundamental and technical analyses into your decision-making process, you can make more informed trading decisions with higher chances of success. With a solid understanding of the market's dynamics through these analyses in place, you’re ready to move forward with developing an effective entry and exit strategy for your swing trades without missing any important details.

Fundamental and Technical Analyses

When you dive into the world of swing trading, you can unleash your analytical prowess by exploring fundamental and technical analyses, which are like a compass guiding you through the intricate maze of the market. These analyses serve as powerful tools to help traders determine when to enter and exit trades with precision and confidence.

Fundamental analysis focuses on evaluating the intrinsic value of an asset by analyzing various economic, financial, and qualitative factors that may influence its price.

This involves examining company financial statements, industry trends, economic indicators, and news events that could impact the market. By understanding the fundamentals of a particular asset or market, traders can make more informed decisions about whether it's undervalued or overvalued.

On the other hand, technical analysis involves studying historical price patterns and using various indicators to forecast future price movements. Traders use charts, trend lines, moving averages, and other tools to identify potential entry and exit points. Technical analysis helps traders spot trends in the market and provides insights into supply and demand dynamics.

By combining both fundamental and technical analyses in your swing trading strategy, you can have a comprehensive view of the market conditions before making any trade decisions.

These analyses will equip you with valuable information to make educated predictions about future price movements. Once armed with this knowledge from fundamental and technical analyses, it's time to move on to setting risk parameters for your trades.

Setting Risk Parameters

To effectively manage your trades, you'll need to establish specific risk parameters that outline the maximum amount of capital you’re willing to risk and the level at which you'll exit a trade. Setting risk parameters is crucial in swing trading as it helps you protect your capital and minimize potential losses.

By determining the maximum amount of capital you’re comfortable risking on each trade, you can ensure that you don't overexpose yourself to excessive losses. In addition to establishing the maximum amount of capital at risk, setting risk parameters also involves defining the level at which you'll exit a trade. This can be based on various factors such as technical indicators or predefined profit targets.

By having clear exit points, you can prevent emotions from clouding your judgment and make rational decisions based on your predetermined strategy. With well-defined risk parameters in place, you can effectively manage your trades and make informed decisions about when to enter and exit positions.

Entry and Exit Strategy

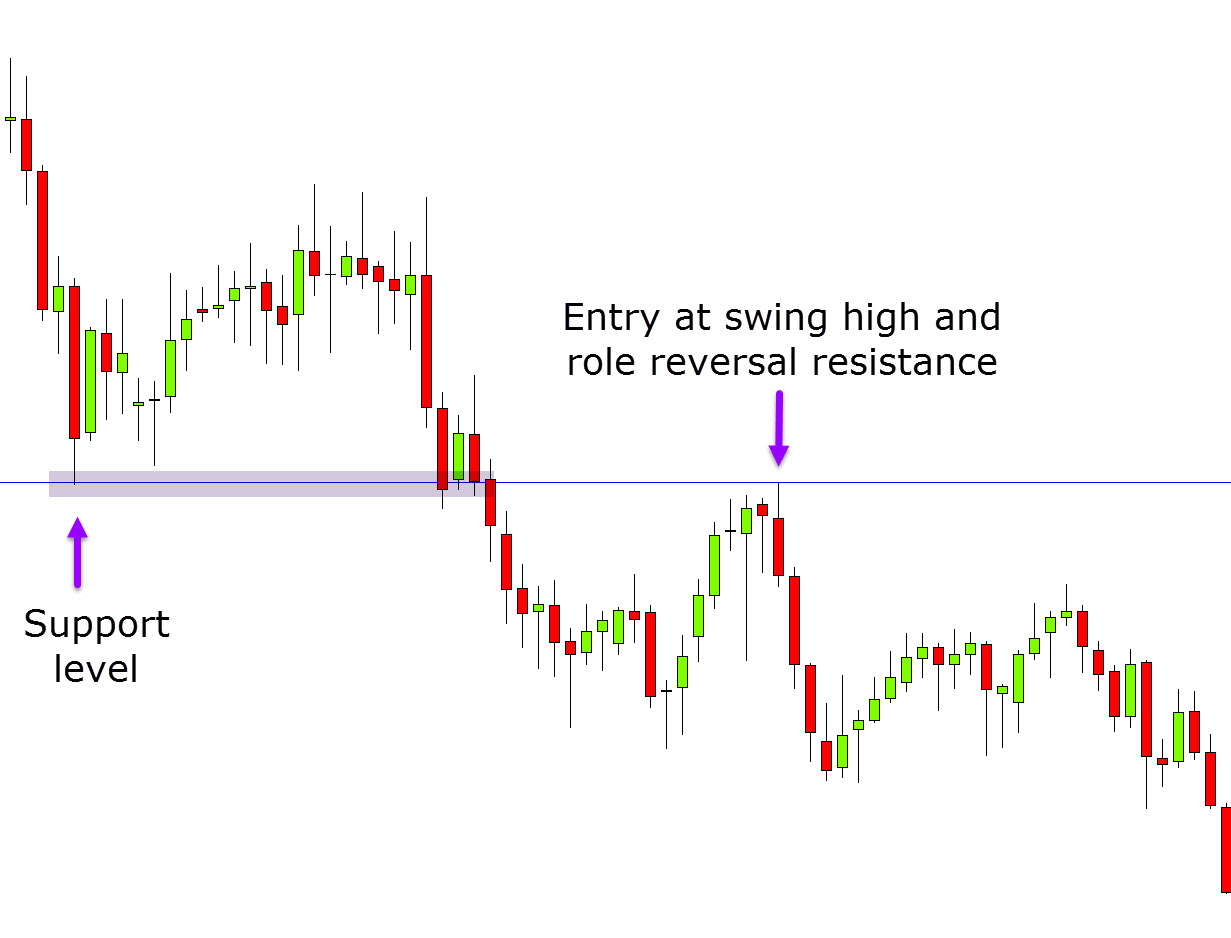

Crafting a well-defined entry and exit strategy is essential to maximizing profits and minimizing losses in swing trading. When it comes to entering a trade, you carefully analyze various technical indicators, such as moving averages, support and resistance levels, and chart patterns. These indicators help you identify potential entry points where the price is likely to move in your favor.

Additionally, you take into consideration fundamental factors that may impact the market or specific stocks you’re trading. Once you have entered a trade, you establish clear criteria for when to exit. This includes setting profit targets and stop-loss orders based on the stock's volatility and risk tolerance. By doing so, you ensure that you lock in gains when the price reaches your desired level while also protecting yourself from excessive losses if the trade goes against you.

Having a disciplined approach to exiting trades helps you avoid emotional decision-making and stay focused on your overall strategy.

Backtesting the Strategy

Evaluating the effectiveness of your entry and exit strategy through backtesting is crucial for ensuring consistent profits and minimizing losses in swing trading.

Backtesting involves using historical data to simulate trades based on a set of predefined rules. By analyzing past market movements, you can assess how well your strategy would have performed in different scenarios. This allows you to identify any flaws or weaknesses in my approach and make necessary adjustments before risking real capital in the live market.

During the backtesting process, you meticulously review each trade's outcome to determine if it aligns with your desired risk-reward ratio and overall profitability goals. If you find that certain aspects of your entry or exit strategy consistently result in unfavorable outcomes, you can make refinements to improve performance.

Additionally, by testing various parameters and variables within your strategy, such as stop-loss levels or profit targets, you can optimize its effectiveness and adapt it to different market conditions.

By thoroughly backtesting my entry and exit strategy, you gain confidence in its ability to generate profitable trades. This analysis provides valuable insights into potential challenges that may arise during live trading and helps you fine-tune your approach accordingly.

Executing the Trades

Once you've honed your strategy through backtesting, it's time to put your skills to the test and execute trades with confidence and precision. As a swing trader, executing trades involves closely monitoring the market conditions and taking advantage of short-term price fluctuations. This requires staying up-to-date with news, economic indicators, and technical analysis tools.

To execute trades effectively, you analyze various charts and indicators to identify potential entry and exit points. you look for patterns such as support and resistance levels, moving averages, or trend lines that can help you determine when to enter or exit a trade. Additionally, you pay attention to volume trends as they can indicate the strength of a price movement.

Once you've identified an opportunity, you place your trade using a reliable trading platform that offers real-time data and quick order execution.

Conclusion

In conclusion, swing trading can be a profitable strategy if approached with the right techniques and mindset. By diligently practicing these swing trading techniques and continuously refining their skills, traders can increase their chances of achieving consistent profits in this dynamic market.