In this article, Forex Prop Reviews will delve into the basics of scalping and provide insights into effective strategies that can be employed for successful scalping.

Scalping Techniques for Beginners

Scalping techniques are a popular and dynamic approach to trading in the financial markets. As a trader, I have come to appreciate the fast-paced nature of scalping, which involves making quick trades with the objective of capturing small profits from small price movements.

In this article, Forex Prop Reviews will delve into the basics of scalping and provide insights into effective strategies that can be employed for successful scalping.

Understanding the Basics of Scalping

To fully grasp the fundamentals of scalping, you must acquaint yourself with the essential techniques and principles that underpin this intricate trading strategy.

Scalping techniques involve making quick trades in order to profit from small price movements within a short period of time. This requires a deep understanding of market dynamics and the ability to quickly analyze charts and indicators to identify potential entry and exit points.

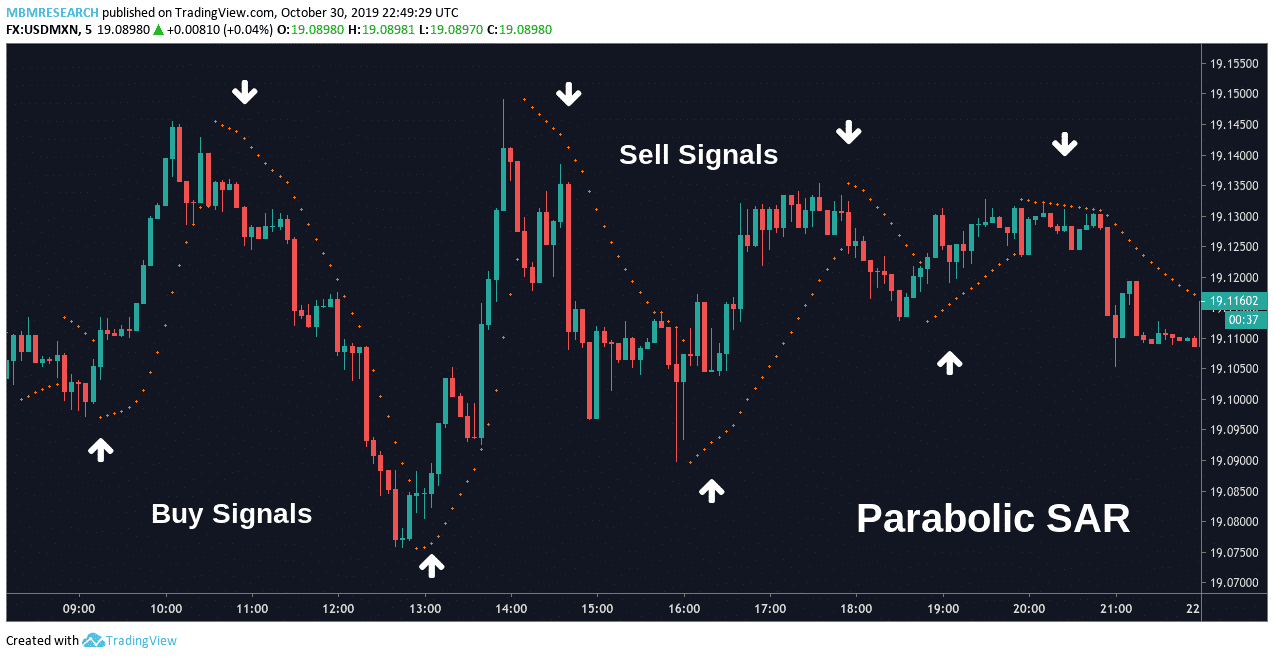

Scalping strategies are often based on technical analysis, using tools such as moving averages, oscillators, and support/resistance levels to determine optimal trade setups.

By employing various scalping techniques, traders aim to capitalize on short-term price fluctuations for quick profits. These strategies typically involve placing multiple trades throughout the day, sometimes even within minutes or seconds.

One popular technique is called 'scalp trading,' where traders take advantage of rapid price movements in highly liquid markets like forex or stocks. Another approach is 'pump and dump,' which involves buying an asset at a low price during a period of low liquidity and then selling it quickly when prices rise due to increased demand.

Forex Scalping Techniques

Scalping is carried out using three main techniques:

Followers of the traditional technique are led by a study of the disparity between the supply and demand of the traded asset in order to detect even the smallest price changes and avoid missing out on possible profit. The most typical application of it is in exchange-traded instruments.

According to the impulse technique, all markets are interconnected, therefore changes and movements in one market or segment will undoubtedly have an impact on the other market or segment. As a result, all international markets must be continuously monitored and evaluated. The effect of political and economic developments on instrument quotes should be noted in this context.

With the hybrid approach, the scalper can conduct wider and more in-depth research of the present market environment in general and the traded instrument in particular because it combines the strengths of the first two methods.

Scalping Decision Factors

The key factors that influence my decisions as a scalper are crucial for maximizing profits. One of the main factors I consider is market volatility. Scalping relies on quick trades and small price movements, so it's important to choose markets that are highly volatile. This allows me to capitalize on frequent price fluctuations and make multiple profitable trades throughout the day.

I closely monitor news releases, economic indicators, and other events that can impact market volatility to ensure I'm trading in the most favorable conditions. Another factor that plays a significant role in my decision-making process is liquidity.

As a scalper, I need to be able to enter and exit positions quickly without any slippage or delays. Therefore, I focus on trading highly liquid assets or markets where there is a high volume of buying and selling activity. This ensures that there are enough buyers and sellers available at any given time, allowing me to execute trades smoothly.

Considering these key factors helps me make informed decisions when scalping, increasing my chances of success in the fast-paced world of short-term trading. By understanding market volatility and focusing on liquid assets, I can take advantage of favorable trading conditions.

Technical Analysis for Scalping

Use technical analysis to identify patterns and trends in charts, allowing you to pinpoint optimal entry and exit points for your trades as a scalper.

By analyzing historical price data, you can look for specific chart patterns that indicate potential reversals or continuations in the market. Here are four key elements of technical analysis that you consider when scalping:

- Support and Resistance Levels: These levels represent areas where the price has historically struggled to move above (resistance) or below (support). When the price breaks through these levels, it often signifies a significant move and can be an ideal entry point.

- Moving Averages: By calculating the average closing prices over a specified period, moving averages help smooth out short-term fluctuations and reveal the overall trend direction. Crossovers between different moving averages can signal potential buying or selling opportunities.

- Momentum Indicators: These indicators measure the speed at which prices change and provide insights into overbought or oversold conditions. Examples include the Relative Strength Index (RSI) and Stochastic Oscillator, which help identify potential reversal points.

- Candlestick Patterns: Japanese candlestick charts offer valuable information about market sentiment within each trading period. Patterns like doji, hammer, shooting star, etc., can provide indications of upcoming price movements.

By incorporating these technical analysis techniques into your scalping strategy, you’re able to enhance your decision-making process when entering and exiting trades.

Executing an Effective Scalping Strategy

Executing an effective scalping strategy requires precision and quick decision-making. It also requires ensuring that profitable opportunities don't slip through your fingers.

One key aspect of executing a successful scalping strategy is having a well-defined entry and exit plan. You closely monitor the market for short-term fluctuations and look for patterns or indicators that suggest a potential price movement. Once you identify a favorable trading opportunity, you act swiftly to enter the trade at the right moment.

In addition to timely execution, risk management is crucial in scalping. Since scalpers aim to make small profits from multiple trades, it's important to set strict stop-loss orders to limit potential losses if the market moves against you. You also keep an eye on market liquidity and volatility as these factors can greatly impact the effectiveness of your strategy.

By following these guidelines, I increase my chances of capturing quick profits while minimizing risks associated with rapid market fluctuations. With this understanding of executing an effective scalping strategy, let's delve into another important aspect: going against traditional trading instincts.

Scalping: Going Against Traditional Trading Instincts

Contrary to what you may instinctively think, going against traditional trading instincts can be highly profitable in scalping.

When most traders look at the markets, they tend to follow trends and patterns, hoping to ride the wave and make a profit. However, in scalping, it is essential to have a different approach.

Instead of waiting for trends to develop or looking for confirmation from various indicators, I've found that taking quick and decisive actions based on immediate market movements can yield better results.

In scalping, it is crucial to be proactive rather than reactive. While traditional trading instincts may tell you to wait for confirmation before entering a trade, I've learned that being one step ahead can lead to more profitable opportunities.

By constantly monitoring the market and making split-second decisions based on price action and order flow, I'm able to take advantage of small price movements that other traders might overlook. This requires discipline and a keen eye for spotting potential entry points without hesitation.

It may go against conventional wisdom, but going against traditional trading instincts has proven successful for me in the fast-paced world of scalping.

Conclusion

In conclusion, scalping techniques are a fast-paced trading strategy that requires quick decision-making and precise execution. It involves taking advantage of short-term price fluctuations to make small profits on a large number of trades.

By understanding the basics of scalping and considering various decision factors such as market conditions and liquidity, traders can increase their chances of success.

.png)