Scalping Risk Management is an essential aspect of successful scalping trading strategies. By implementing proper risk management techniques, traders can safeguard their capital and optimize profitability.

Mastering Scalping Risk Management: Safeguarding Profits in Fast-paced Trading

When it comes to scalping, a high-risk trading strategy known for its quick trades and small profit margins, risk management becomes even more crucial. As an avid scalper, I understand the importance of implementing effective risk management techniques to protect my capital and maximize profits.

In this article, Forex Prop Reviews will share insights into the world of scalping risk management, offering strategies that will help you navigate the fast-paced environment of scalping.

Importance of Risk Management in Scalping

You need to prioritize risk management in scalping if you want to protect yourself from potential losses and ensure long-term success – it's crucial!

Scalping is a high-frequency trading strategy that aims to profit from small price movements in the market. It can be incredibly profitable, but also very risky.

Without proper risk management, you could easily wipe out your entire account with just a few bad trades. That's why it's essential to have a solid understanding of scalping risk management and implement effective strategies to mitigate potential losses.

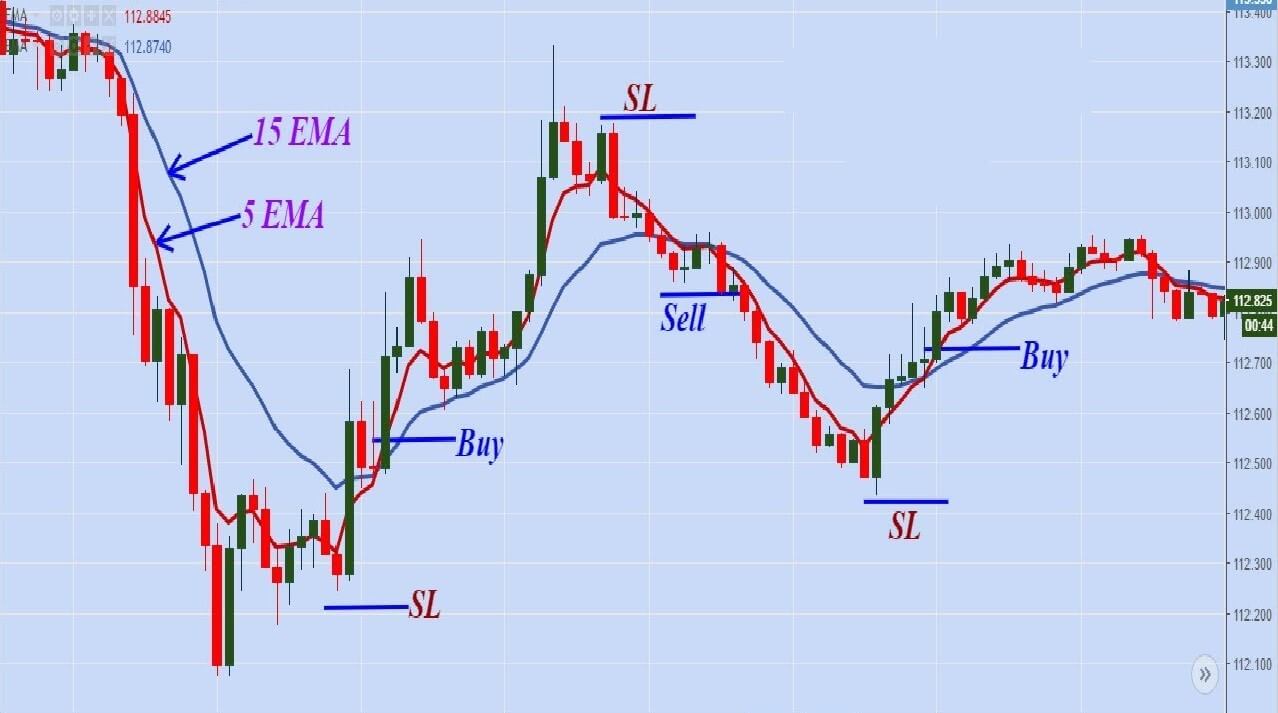

Setting Stop Loss Levels

When setting stop loss levels, it's crucial to consider your risk tolerance and use them strategically to protect your trading positions. Stop loss levels act as a safety net, preventing excessive losses and minimizing the impact of unexpected market movements.

Here are some key points to keep in mind when setting your stop-loss levels:

- Determine your risk tolerance: Before entering any trade, it's important to assess how much risk you're willing to take. This will help you set appropriate stop-loss levels that align with your comfort level.

- Consider volatility: Different markets have varying levels of volatility. It's essential to take into account the typical price fluctuations of the asset you're trading and adjust your stop loss accordingly.

- Factor in support and resistance levels: Support and resistance levels indicate areas where the price has historically struggled to move above or below. Placing a stop loss just beyond these levels can provide an additional layer of protection for your trades.

- Use technical indicators: Utilize technical indicators such as moving averages or trendlines to identify potential areas where price may reverse. Setting your stop loss near these indicators can help you exit a losing trade before it worsens.

- Regularly review and adjust: The market is dynamic, so it's important to regularly review and adjust your stop loss levels based on changing market conditions.

By incorporating these considerations into your strategy, you can effectively manage the risks associated with scalping.

Take Profit Strategies

One effective way to maximize potential gains in trades without sacrificing prudent risk management techniques is by implementing take-profit strategies. Take-profit strategies involve setting a predetermined level at which you'll close your position and lock in profits.

This allows you to capture gains when the market moves in your favor, while also protecting yourself from potential reversals or losses.

There are various take-profit strategies that traders can employ, such as using technical indicators to identify key resistance levels or setting specific profit targets based on their risk-reward ratio. By implementing these strategies, I can ensure that you’re not only managing your risks effectively but also capitalizing on favorable market conditions.

By utilizing take-profit strategies, you’re able to have a structured approach toward exiting trades at the right time. This helps you avoid making emotional decisions and allows you to stick to your trading plan more effectively.

One popular strategy is trailing stop orders, where the stop loss level is adjusted as the market moves in your favor. This allows for potential gains to be locked in while still giving room for further upward movement.

Another strategy is scaling out of positions by closing a portion of the trade at different price levels, thus securing profits along the way.

Take-profit techniques enhance risk management and maintain discipline in scalping strategies without sacrificing gains or losses.

Overall Risk Management Techniques

Implementing effective risk management techniques is crucial for me as a trader to protect my capital and ensure long-term success in the financial markets. One key technique I use is setting appropriate stop-loss orders.

These orders automatically close out my positions if they reach a certain level of loss, limiting the amount of money I can lose on any single trade.

By setting stop-loss orders, you can control your risk and prevent significant losses that could potentially wipe out your trading account. Additionally, you also carefully consider position sizing, which involves determining the number of shares or contracts to trade based on my account size and risk tolerance.

This allows you to allocate an appropriate amount of capital to each trade, ensuring that no single trade has the potential to significantly impact your overall portfolio.

Another important aspect of overall risk management techniques is diversification. Instead of putting all your eggs in one basket, you spread your trades across different instruments or asset classes.

This helps you reduce the impact of any individual trade or market event on your overall portfolio performance. Diversifying allows you to take advantage of various opportunities while minimizing the potential downside risk associated with any particular investment or strategy.

Monitoring and Adjusting Risk Management Strategies

By monitoring the market conditions and analyzing your trades, you can identify any weaknesses or areas that need improvement in your risk management techniques. This allows you to make necessary adjustments to ensure that you’re not exposing yourself to unnecessary risks.

To monitor and adjust your risk management strategies effectively, you should follow these key steps:

- Regularly review your trading performance: You analyze my past trades and evaluate their outcomes to identify any patterns or recurring mistakes. This helps you understand where you may be going wrong in managing risks and allows you to make changes accordingly.

- Stay updated with market news: Keeping up-to-date with current events and economic indicators is essential for adjusting risk management strategies. By staying informed about market trends and potential factors that could impact prices, you can adapt your approach as needed.

- Seek feedback from experienced traders: It's beneficial to connect with other traders who have experience in scalping risk management. Their insights and advice can provide valuable guidance on how to improve your strategies.

Scalping Risk Management Tools and Resources

By utilizing various tools and resources specifically designed for effective risk management in scalping, you can enhance your trading strategies and safeguard your capital while maximizing potential profits.

One such tool is a stop-loss order, which allows you to set a predetermined price at which your position will be automatically closed if the market moves against you. This helps limit your losses and ensures that you exit a trade before it becomes too risky. This helps you identify potential risks and opportunities in the market quickly.

Additionally, using technical analysis tools like charts, indicators, and oscillators can provide valuable insights into market trends and help you determine optimal entry and exit points for your trades.

These tools enable you to identify patterns or signals that indicate potential reversals or breakouts, allowing you to manage risks effectively.

Conclusion

In conclusion, implementing effective scalping risk management strategies is crucial. By setting appropriate stop-loss levels and utilizing take-profit strategies, you’re able to minimize potential losses and maximize profits.