Mitrade is a forex trading platform managed by Mitrade Global Pty Ltd, born in 2019 in Melbourne, Australia. This exchange was founded by a team of experts in the field of technology and financial trading. Mitrade's motto is to simplify all transactions and provide a friendly trading platform suitable for all investors.

Mitrade Review

After only 3 years of operation, Mitrade has excelled in winning numerous industry awards and has more than 1,100,000 accounts opened from all over the world. With Mitrade, you can trade financial instruments globally, use flexible leverage, competitive transaction costs, fast execution speed, professional customer service.

Year of establishment 2019

Regulatory Authority CIMA, ASIC, FSC

Exchange ECN

Mitrade trading platform

Forex, Indices, Commodities, Stocks Trading Tools

Minimum deposit 50$

Standard and professional account types

Maximum leverage 1:200

Spread Fee From 0.0 pips

Website language English, Vietnamese

Deposit - withdrawal method

Internet Banking

Visa/Mastercard

E-wallets Skrill, Neteller, …

Is Mitrade exchange reputable?

This is probably what traders are most interested in when learning about Mitrade or any other exchange. To evaluate whether Mitrade floor is safe or not, Tradervn has based on an objective evaluation process, including the following criteria:

Mitrade exchange license

Mitrade is authorized and regulated by various financial authorities.

Mitrade Holding is authorized and regulated by the Cayman Islands Monetary Authority (CIMA) with SIB License number 1612446.

Mitrade Global Pty Ltd is regulated by the Australian Securities and Investments Commission (ASIC) and holds an Australian Financial Services License (AFSL license number 398528).

Mitrade International is authorized and regulated by the Mauritius Financial Services Commission (FSC) with License number GB20025791.

These agencies will be responsible for managing and monitoring Mitrade's activities, in order to ensure that transactions take place openly and transparently, and at the same time protect the interests of investors.

In addition, Mitrade is also committed to complying with strict regulations, providing a comprehensive and transparent trading platform. All product information, prices, data and fees are clearly listed on the website. Therefore, investors can rest assured when trading at Mitrade floor.

Mitrade Exchange Awards

After 3 years of constantly striving and trying to bring customers the best services. The Mitrade brand has been awarded many awards by reputable organizations in the industry:

In 2019:

Forex Awards Best Mobile Trading Platform

The fastest growing exchange in Australia in 2019 as assessed by International Business Magazine.

In 2020:

Most Innovative Exchange – awarded by FxDailyInfo and Finance Derivative.

Australian Forex Broker Award for Customer Satisfaction

The best forex trading app in Australia and Asia

The fastest growing exchange in Australia.

Best Mobile Trading Platform – Forex Awards

In 2021:

“Fastest Growing Broker” and “Best Mobile App” by World Forex Award.

“The best news & analysis broker” and “Asia's best forex broker” voted by FXDailyinfo

“Asia’s Best Fintech Forex Broker” and “Most Innovative Fintech Forex Broker”, “Fastest Growing Fintech Forex Broker” by Global Brands Magazine

In 2022:

Australia's best forex trading platform

The most transparent forex exchange in the world

Global best forex training resource

Asia's Most Trusted Forex Broker

Best forex broker in Asia

Most Innovative Fintech Forex Broker

Fastest Growing Fintech Forex Broker

Asia's Best Forex Trading Experience

Regulations to protect customer money

All client funds will be kept in a separate trust account and completely separate from company funds.

Mitrade does not use client funds for hedging or for any business.

The audit will be performed by an independent external accounting firm.

Products traded on Mitrade

Currently, Mitrade offers 5 main product groups which are Forex, Indices, Commodities and Stocks and Cryptocurrencies.

Forex: 60 currency pairs including majors, crosses into exotics.

Indices: Provides 12 most popular indices in the US, Australia, Europe, Asia markets such as: UK100, HK50, NAS100, GER30, FR40, EU50, US30, AUS200,...

Commodities: Mitrade offers 13 commodities including precious metals, energy, oil…

Securities: Including 60 types of stocks of the world's leading companies such as JNJ, Google, Amazon, Facebook...

Mitrade account types

Currently, Mitrade only offers one type of account, which is the Standard account. To open a Standard account, investors must deposit a minimum of $50. This account type is suitable for most traders from novice traders to professional investors.

The Standard account gives investors access to global financial instruments with the best conditions: flexible leverage, low transaction fees, no commissions and competitive spreads.

In addition, if you want to experience Mitrade's trading environment and platform, you can sign up for a Demo account with virtual money up to $50,000. With this amount, investors will freely trade and place orders.

Mitrade trading platform

Unlike other reputable forex brokers, Mitrade does not use the MT4/MT5 platform, but only uses the proprietary Mitrade trading platform. This is a trading platform that has won many prestigious awards.

Currently, Mitrade platform has 2 main versions: web platform and mobile application (iOS and Android operating systems). With a simple, intuitive, user-friendly interface that meets the needs of all investors. However, the features and analysis tools are not as diverse and complete as the MT4 platform.

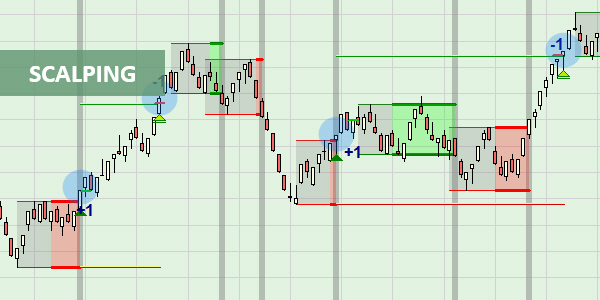

Some of the key features of the Mitrade trading platform that you can refer to include:

The Mitrade platform provides 2 types of price charts to use: bar charts and Japanese candlesticks.

Support 10 timeframes from 1m to 1M

7 chart types including 3 candlestick charts, bar charts, line, area and baseline charts.

Support trendline drawing tools like on tradingview

Does not support auto trading EAs.

Deposits and withdrawals are conducted on the platform

You can search for the Mitrade application on the App Store, Google Play or scan the QR code on the website to download the app and freely trade anytime, anywhere.

Leverage and trading fees on Mitrade

Information about leverage and transaction costs are also of great interest to many investors. Because, it directly affects the investor's trading amount. The leverage and transaction fees at Mitrade exchange are as follows:

Mitrade floor leverage

Mitrade exchange allows investors to trade with leverage up to 1:200. However, each product will have different leverage levels as follows:

For forex products, the maximum leverage is 1:200.

Commodity products have a maximum leverage of 1:100

Securities: Leverage maximum offered is 1:10

Indices: has a maximum leverage of 1:200

Mitrade floor commission fee

All transactions on Mitrade exchange are commission-free and without any hidden fees. This is also an advantage that helps Mitrade attract many investors.

Mitrade floor spread

Mitrade uses the difference between the buy and sell prices as a service fee. The spread will be reflected in the quote and calculated when you open a position. However, each trading product will have different spreads. For example, currency pairs have Floating Spreads from 0.0001 pips, commodities from 0.06 pips, stocks from 1 pip, indices from 1.6 pips and cryptocurrencies 1.65 pips.

Mitrade exchange overnight fee

In case, a trader holds a position past 10 pm (GMT 22:00), your account may be charged an overnight interest rate corresponding to each product.

For a currency pair, there are 2 currencies involved in the swap. With the currency you buy, you can get a share of the profit, for the currency you sell, you have to pay interest. The spread on the currency pair determines whether you will be charged or receive overnight interest in relation to the investment product.

Mitrade exchange bonus program

When participating in transactions at Mitrade, investors will have the opportunity to receive promotions to increase their account capital. Specifically, investors will have the opportunity to participate in promotions such as:

Earn 40% revenue share up to 1000$ when you refer a friend to trade at Mitrade However, you also need to keep in mind that the promotion is only valid if the person you refer has to join the trade.

Get rewarded for the first successful deposit with a minimum of $20

Earn points every day

Deposit - withdraw money on Mitrade . exchange

Mitrade exchange offers a wide variety of payment methods.

- For recharge:

Traders can choose to fund their accounts through the following methods:

Bank Transfer, ATM, Internet Banking.

Visa/Mastercard

E-wallets (Skrill, Momo, Zalo, Touch'n GO and Boost, etc.)

The processing time for deposit orders is fast and instant.

– For withdrawals:

Mitrade currently supports customers to withdraw money via Visa/Mastercard and bank accounts. The processing time for withdrawal orders is as follows:

Bank card: 3-5 business days

Bank account: 3 working days

– Deposit and withdrawal fees

To minimize costs for clients, in most cases, Mitrade does not charge any deposit and withdrawal fees. However, you are subject to some 3rd party fees for withdrawals and this is beyond the control of Mitrade. For example, intermediary bank fees, international credit card transactions, transfers in/out between accounts...

Customer care service of Mitrade exchange

Mitrade floor has professional and dedicated customer care service in 8 different languages, including Vietnamese. Mitrade's support staff are all experts in the financial field, always ready to answer and advise customers at any time.

If you have any questions, please contact Mitrade through the following channels:

Email: cs@mitrade.com

Chat online. Support time: 24/24 from Monday to Friday every week.

In addition, at Mitrade, there are many forex investment classes to help investors gain more knowledge and improve the success rate when participating in trading.

Conclusion about Mitrade

Above is all detailed information about Mitrade floor that Tradervn wants to send to readers. Although it has not been around for a long time, Mitrade is also a reputable trading platform worth experiencing. Hope the article has brought you a lot of useful knowledge.

Advantage

Licensed by many reputable agencies

Simple and intuitive interface

Zero commission fee, competitive spread

Diverse deposit/withdrawal methods

Professional customer service,

Low initial deposit required

Defect

There is only one type of trading account

Does not support MT4/MT5 trading platform

Support low leverage

There are not many promotions yet