In the process of managing My Forex Funds, many people are also interested in the My Forex Funds exam, so today I will guide you to register for an MFF account. You can watch the following video for visualization, easy to understand.

Instructions for Registering for My Forex Funds Exam | Open MFF Account Details

Instructions for Registering for My Forex Funds Exam | Open MFF Account Details

Article SUMMARY [Hide]

Part I. Signing Up for an Account My Forex Funds ( Evaluation )

Step 1: Sign up for a My Forex Funds (Evaluation) account

Step 2: Trade to fulfill the profit target and make sure not to violate the regulations.

Step 4: Get a real account to trade MFF funds and trade.

Part II. Frequently asked questions about the MFF Fund's Evaluation account

Part I. Signing Up for an Account My Forex Funds ( Evaluation )

Step 1: Sign up for a My Forex Funds (Evaluation) account

First, you choose the MFF fund account opening size (Evaluation) and pay a fee to participate in the MFF fund contest challenge.

Platform: You choose MT5 or MT4

After choosing the MFF fund trading platform, click Register to create an MFF fund account.

To register for the MFF fund, please fill in the following information, try to fill it correctly so that later verification of the MFF fund is easy.

TH1: Register MFF fund with Visa Card

To register for an MFF account with a visa card, you fill in the card information as instructed above.

After filling in the information, you tick the 2 boxes according to the picture above and press Register to pay.

If the bank asks to confirm the OTP code, then you get the OTP code and make the payment.

When the invoice appears, you have successfully paid, in 5 minutes there will be MT4 - MT5 login information in gmail.

As soon as you complete the payment, the MFF forex fund's system will automatically send you MT4 account information via email within 5 minutes.

You use the information sent in the email to log into your MT4 account.

Download MFF's Meta Trader 4 here.

How to read information on my forex funds website + see MFF Forex trading performance:

Select Account Analyzer

Here, you can easily view your profit target, loss limit, transaction history and many other parameters when competing for MFF funds.

Step 2: Trade to fulfill the profit target and make sure not to violate the regulations.

Round 1:

The time to complete the MFF Forex fund trading challenge is 30 days.

Profit target is 8%.

The account drop limit is 12%.

The 1-day loss limit is 5%.

The minimum number of trading days is 5 days. (If in 5 days you complete the profit target, you can switch to round 2 immediately, no need to wait 30 days)

Round 2:

My Forex Funds regulation period is 60 days.

Profit target is 5%.

The account drop limit is 12%.

The 1-day loss limit is 5%.

The minimum number of trading days is 5 days. (If in 5 days you complete the profit target, you will be granted a Live trade MFF account immediately, and proceed to earn money to share profits with the fund)

TH1: When you reach your goal of round 1 or round 2, you should stop trading.

MFF will automatically notify via email when you complete the challenge round, then you just need to click “upgrade” in the dashboard to receive the next round account.

TH2: At the end of the specified time, you did not complete the profit target, but your account grew positively and you did not violate any regulations.

You will be given an extension of time or retake the MFF fund for free.

To retake the free MFF fund, you need to wait for the allotted time (30 days for round 1), then click the "Free Retry" button to be granted a new account and start over from round 1.

Note: If the allotted time has not expired, there is no free retry option.

Step 3: Submit identity verification documents, KYC the MFF fund and sign the contract.

After completing round 2, the MFF will ask you to verify your identity, address and sign a contract.

You need to prepare:

3.1. Identification.

You choose one of the following three types of documents: identity card (national identity card), driver's license, passport.

3.2. Proof of address.

Choose one of the following documents: bank statement, electricity bill, water bill...

If you don't have a utility bill in your name, you can go to the bank and ask for a statement.

3.3. Sign a Contract with My Forex Funds

After fully preparing the above 3 documents, you send an email and attach the above 3 documents to My Forex Funds.

Send email to: verification@myforexfunds.com

They will take a few business days to process, usually 2-3 days, please rest and wait patiently during this time.

After passing round 2 you can withdraw a bonus of 2% of round 1 profit target.

Step 4: Get a real account to trade MFF funds and trade.

When you receive a real account, you proceed to log in to your MT4 account and trade.

There are two important rules you need to remember:

Account drop limit is 12%

The maximum daily loss limit is 5%.

In case of violation, the account will be revoked.

After 30 days from the time you make your first trade on your funding account, you will be able to withdraw your first profit.

For example:

You open a 200k MFF fund account, the second round profit target is 5% equivalent to $10,000.

The account purchase fee is $900 (the fee you actually pay does not include the MFF fund rebates), the profit you make after 30 days of receiving the funds is $10,000.

For the first time, you can withdraw the following funds:

– 4% 2nd round profit target: 10,000*4% = $400.

– 112% account registration fee: 900*112% = $1,008.

– 75% profit in the first month: 10,000*75% = $7500.

The total amount you can withdraw is: 400 + 1008 + 7500 = $8,908.

Starting the 2nd month you can withdraw every 2 weeks and get 80% of the profit.

From the 3rd month onwards, you get to share 85% of the profit.

Note: If, after you receive your funding account, you violate the rules and have your account revoked, you will not receive the bonus and the registration fee will be refunded.

Part II. Frequently asked questions about the MFF Fund's Evaluation account

Can I get a discount on the MFF exam?

At the payment section, enter the following discount code: forexpropreviews5

Can I trade with the EA?

Yes, you can use EAs to copy your own signals, tools for risk management, as long as they are not used in the following way:

– copy trading of other persons signals.

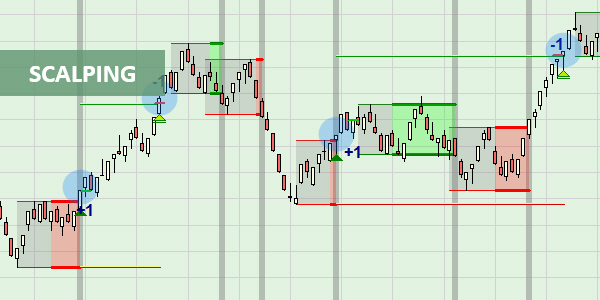

– tick scalping

– latency arbitrage trading.

– reverse arbitrage trading

– hedge arbitrage trading.

– or any use of emulators (or any use of emulators).

Violation of this rule will result in the account being cancelled, banned and non-refundable.

Can I use EA to copy signals?

Yes, you can use the EA to copy trades as long as you are copying your own trades, from your own account.

Not allowed, if you are copying a transaction from another source.

For example, another person or a trading signal provider.

When does my review start?

Your review begins when you make your first trade.

If you want to start more than 5 days later, after receiving your account credentials, please email account@myforexfunds.com to let MFF know.

How long do I have to complete the assessment?

You have 30 days to complete round 1 and 60 days to complete round 2. (times include holidays, Saturdays and Sundays).

However you don't need to wait for the timeout, once you reach your profit target and complete a minimum of 5 trading days you are eligible to move on to the next period.

What is the minimum time to complete the assessment?

The minimum requirement to pass each period is 5 trading days, not continuous.

If you have reached your profit target early, you are allowed to open a trade with a small volume of 0.01 and close it immediately to fill the remaining days.

What is a trading day?

A trading day is only counted when you close a trade on that day.

For example:

If you open a trade today and close during the day it is a trading day.

But if you open a trade yesterday and close it today, today counts as a trading day.

What if a violation has been detected on my account?

If violations on your account:

You will not be eligible to move on to the next stage.

Accounts will also not be eligible for renewal or free retry.

What trading platforms does MFF have?

Currently, MFF only offers the MT4 trading platform.

What is profit target?

Round 1 profit target is 8%.

The second round profit target is 5%.

After passing 2 rounds you get a real account and no profit target, you can earn as much as you can.

What if I hit my profit target but breach the loss limit?

Even if your account reaches the profit target, if at any point your account violates the risk rule, you will not be eligible to move on to the next stage.

Can I apply for a free extension or retry?

You can extend the time and unlimited number of free retries if your account meets the following requirements:

– The account has a positive profit compared to the initial capital.

- The account does not have any violations.

Free retry means you will be given a new account and start over from round 1.

You need to wait for the time out, then the MFF's system will have an option "Free Retry" on the control panel, you just need to click on it to get the retest account.

With a time extension option applied when you have 1-3% of your profit target left. Valid for round 1 only.

How is daily drawdown (dd) calculated?

Daily loss limit is 5% Balance (initial balance) or Equity (equity), whichever is greater is calculated according to that and it resets after 24h at 00:00 GMT+2 (5am Hourly Vietnam).

For example:

If you open an MFF fund account with balance = $100,000. The daily loss limit is 5% equivalent to $5,000.

But suppose you end day 1, you have a profit of $5,000 and have an open trade with a loss of $2,000.

On day 2, balance = $105,000 and equity = $103,000. This means that the daily decline is calculated on balance due to balance > equity.

dd =105,000*5%= $5,250.

$5,250 is your daily loss limit.

Example #1: Equity and Profit.

If equity = $103,000 but balance = $100,000, then the day loss – dd is calculated in equity (due to equity > balance).

dd = 103,000*5% = $5,150.

Example #2: Balance and Profit.

If equity = $100,000 but balance = $103,000 (balance > equity).

dd = $103,000*5% = $5,150.

Example #3: Equity and Loss.

If equity = $97,000 and balance = $95,000 (equity > balance)

dd = $97,000*5% = $4,850.

Example #4: Equity and Loss.

If equity = $95,000 and balance = $97,000 (balance >equity)

dd = $97,000*5% = $4,850.

How is the account loss calculated?

The maximum account drawdown is 12%.

For example:

If you sign up for a $100,000 MFF account, then 12% is equivalent to $12,000.

$100,000 – $12,000 = $88,000.

So if your account is less than $88,000 then your account has broken the rules.

Learn more about account drop issues – Drawdown

How many accounts can I have (Mt4)?

You can have as many accounts as you want, but the total amount of the accounts is up to $600k.

If you merge live account, the maximum capital is $300k. During the evaluation period, no account merges are allowed.

This means you can have:

– 2 accounts 200k + 2 accounts 100k.

– 6 accounts of 100k.

- 2 accounts 300k.

The maximum MFF account size that can be purchased is 200k.

The maximum consolidated MFF account size is 300k.

The maximum capital for a Trader is 600k.

Unlimited capital growth.

Can I grow my account?

If you achieve a profit of 10% or more in a 4-month period and at least 2 of those 4 months are profitable, MFF will increase your account size by 30% of the original account size.

For example:

If you sign up for a $100k MFF account, your account size increases by 30% each time.

1st growth: 100k + 30k = 130k

Second growth: 130k + 30k = 160k

….

There is no limit on the amount of growth capital.

What do I need to do to merge accounts?

You send email to email: account@myforexfunds.com

You will need to provide the MFF with the MT4 accounts to be merged for their review and approval.

Note: Only real accounts will be merged, when you receive new real accounts you should request the merge immediately.

What products can I trade?

You can trade currencies, metals, CFDs and cryptocurrencies.

Can I trade crypto on weekends?

Although cryptocurrencies are traded 24/7 in the market, MFF's servers are down on weekends, including cryptocurrencies.

Therefore, you cannot trade crypto on weekends.

Can I hold orders overnight, week over, news trading?

You are allowed to trade overnight, through the week and not limited to trading when there is news.

Are there any consistent rules?

There are no consistent rules in this scheme, MFF does not limit the trading volume. You can trade any volume and place as much as you like.

MFF has a maximum size per order but you are allowed to open multiple positions at the same time.

The limit for metals is 10 lots/order.

The limit for currencies is 30 lots/1 order.

The limit for the index is 100 lots/order.

MFF does not restrict trades, remember consistency and risk management are key to being a profitable Trader.

Conclusion: Understanding the rules when participating in the fund will help you increase your success rate and make good use of your benefits.

In this article, btcprotrading has provided you with a relatively complete process of receiving MFF funds with an Evaluation account. Wish you success in conquering the Fund.