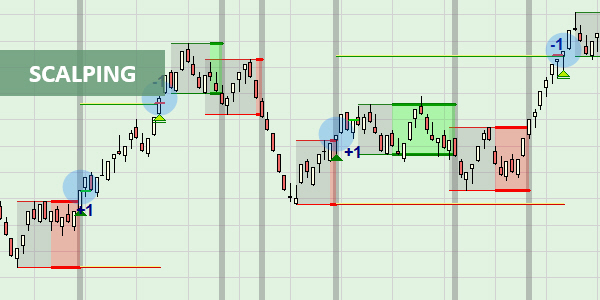

Scalping is a short-term trading strategy that tries to capture tiny profits by using short time frames. Scalpers seek to open many transactions throughout the day in order to capitalize on modest market movements.

What is Scalping Strategies in Trading? Pros and Cons

Scalping strategies and how they have revolutionized the way I navigate the financial markets! Brace yourselves, because this article is about to take you on an exhilarating rollercoaster ride through the world of high-speed trading. Get ready to uncover the secrets of scalping strategies and discover how this adrenaline-fueled approach can potentially bring in lightning-fast profits.

What is Scalping?

If you really want to make quick profits in the trading game, scalping is the strategy for you. It allows you to take advantage of those small market movements and turn them into big wins.

Scalping involves opening multiple trades throughout the day, aiming to capture small profits from each trade. Instead of waiting for a big move in the market, scalpers focus on finding short-term opportunities and capitalizing on them. This style of trading requires constant monitoring of price movements and quick decision-making skills.

By taking advantage of these small moves, scalpers can accumulate substantial profits over time.

Scalping has its own set of advantages that make it an appealing strategy for many traders. Firstly, since scalpers aim to capture small profits from each trade, they can execute a large number of trades in a single day. This high-frequency trading increases their chances of making profitable trades and maximizing their overall gains.

Additionally, because scalp trades are opened for very short periods (usually minutes or seconds), scalpers are less exposed to overnight risks or unexpected news events that could negatively impact their positions. With proper risk management techniques in place, scalping can be a highly lucrative strategy in volatile markets.

Pros of Scalping

One major advantage of scalping is that it allows me to quickly capitalize on short-term market fluctuations, potentially increasing my profits. By opening multiple trades throughout the day, I'm able to capture small moves in the market and take advantage of any price volatility. This strategy works well for me because I prefer to make quick decisions and not hold positions for too long.

Scalping provides the opportunity to make frequent trades, which means I can potentially generate more profits compared to other trading styles.

The short time frames involved in scalping allow me to minimize my exposure to market risks. Since I only hold positions for a short period of time, there's less chance of being affected by sudden market shifts or news events.

With these advantages in mind, it's important to note that scalping also has its drawbacks. However, let's now explore the cons of scalping and how it can impact my trading strategy.

Cons of Scalping

Remember, it's crucial to be aware of the downsides of scalping as they can impact your trading experience. One major drawback of scalping is that it requires constant monitoring and quick decision-making. Since scalpers aim to capture small profits in short time frames, they need to constantly watch the market and be ready to enter and exit trades at a moment's notice. This can be mentally exhausting and may lead to increased stress levels.

Additionally, the fast-paced nature of scalping can also result in higher transaction costs due to frequent trading. These costs can eat into your overall profits and make it harder to achieve consistent success.

Another downside of scalping is that it requires a high level of skill and experience. Scalpers rely on their ability to interpret price movements accurately within very short time periods. This means that they need excellent technical analysis skills and a deep understanding of market dynamics. Without this expertise, it becomes easy to make mistakes or misinterpret signals, leading to losses instead of gains. Therefore, if you are new to trading or still developing your skills, scalping may not be the best strategy for you.

How Scalping Trading Works

To successfully engage in scalping trading, you need to have a clear understanding of market dynamics and be able to interpret price movements accurately within short time periods. This requires a deep knowledge of technical analysis tools and indicators, as well as the ability to quickly analyze charts and identify potential entry and exit points.

Scalpers rely on quick decision-making and swift execution of trades, as they aim to capture small price movements that occur within seconds or minutes. It's important to stay focused and disciplined while scalping, as any delay or hesitation can result in missed opportunities for profit.

Did you know that according to a study conducted by the CFA Institute, only about 5% of active traders consistently earn profits? This statistic highlights the challenges faced by scalpers in this fast-paced trading style.

Scalping trading works by taking advantage of small price fluctuations that occur throughout the day. Traders enter positions with the goal of capturing these small moves for quick profits. However, it's essential to remember that scalping involves high-frequency trading and carries its own set of risks.

Effective risk management is crucial in scalping trading to mitigate potential losses and protect capital.

Risk Management

Ensure you have a solid risk management plan in place to protect your capital while engaging in scalping trading. Scalping involves taking multiple trades throughout the day, which can increase the potential for losses. It's crucial to set strict stop-loss orders for each trade and stick to them. This will help limit your losses and prevent them from spiraling out of control.

Additionally, it's essential to determine the appropriate position size for each trade based on your risk tolerance and account size. By risking only a small percentage of your capital on each trade, you can minimize the impact of any individual loss on your overall portfolio.

Furthermore, it's important to closely monitor market conditions and be prepared to adjust your strategy accordingly. Scalping requires quick decision-making and agility, so staying updated with market news and being aware of any upcoming economic events or announcements that could impact prices is vital.

As you develop your risk management plan, consider implementing trailing stops or profit targets as well. These tools allow you to lock in profits if the market moves in your favor but also protect against sudden reversals that could wipe out gains.

With a well-rounded risk management approach, you can navigate the fast-paced nature of scalping trading while protecting yourself from excessive losses.

By having a solid risk management plan in place, you can ensure that your capital is protected while engaging in scalping trading.

Now let Forex Prop Reviews tell you how scalping trading differs from day trading and what sets these two strategies apart from each other:

Scalping vs Day Trading

One interesting statistic that sets scalping trading apart from day trading is that scalpers aim to capture small profits from multiple trades throughout the day, while day traders typically focus on larger moves and hold positions for longer periods of time.

Scalpers thrive on quick market movements and are constantly looking for short-term opportunities to enter and exit trades. They may only hold a position for a few seconds or minutes before moving on to the next trade. This rapid-fire approach requires a high level of discipline and concentration, as well as the ability to make split-second decisions based on market conditions.

Scalping differs from day trading in terms of profit targets and timeframes. While day traders might aim for larger gains over the course of several hours or even days, scalpers are content with capturing small profits from each individual trade. The goal is to accumulate these small wins throughout the day, which can add up to significant returns over time.

However, it's important to note that scalping can also come with higher transaction costs due to the frequency of trades made. Successful scalping trading strategies involve precise entry and exit points, strict risk management measures, and an understanding of market dynamics. By mastering these strategies, scalpers can take advantage of short-term price fluctuations in their pursuit of consistent profits.

Successful Scalping Trading Strategies

Implementing effective scalping techniques involves precise entry and exit points, strict risk management measures, and a comprehensive understanding of market dynamics. As a successful scalper, I've learned that timing is everything when it comes to entering and exiting trades. I closely monitor price action and use technical indicators to identify key support and resistance levels where the market is likely to reverse or continue its momentum.

By waiting for confirmation signals, such as breakouts or pullbacks, I can increase the probability of a profitable trade.

In addition to timing, risk management plays a crucial role in my scalping strategy. I always set tight stop-loss orders to limit potential losses if the trade goes against me. This ensures that my risk-reward ratio remains favorable even with small profits on each trade. Furthermore, I never risk more than a predetermined percentage of my trading capital on any single trade. This helps me maintain consistency in my results and protect myself from excessive losses.

To enhance my success as a scalper, I constantly analyze market dynamics and adapt my strategies accordingly. This involves staying up-to-date with economic news releases, monitoring volatility levels, and adjusting position sizes based on market conditions. By being aware of upcoming events or announcements that could impact price movements, I'm able to minimize surprises and make informed decisions.

Some key points to keep in mind for successful scalping include:

- Utilizing short time frames: Scalpers focus on quick trades within minutes or seconds.

- Taking advantage of high liquidity markets: Trading during periods of high trading volume increases the chances of finding good opportunities.

- Using leverage wisely: While leverage can amplify profits in scalping, it also increases risks.

- Staying disciplined: Following a well-defined strategy without getting swayed by emotions is essential for consistent success.

- Practicing proper money management: Controlling risk exposure through proper position sizing and setting realistic profit targets helps preserve capital over the long run.

By incorporating these strategies into my scalping approach, I've been able to consistently capture small profits and achieve my trading goals. It requires discipline, adaptability, and constant learning, but with practice and experience, successful scalping can be a rewarding trading style.

Conclusion

In conclusion, scalping strategies offer traders a thrilling ride through the fast-paced world of financial markets. Like a skilled surfer riding the crest of a wave, scalpers seek to capitalize on quick opportunities and secure small but frequent profits. It's a high-energy approach that requires sharp reflexes, keen analytical skills, and a hunger for action.

So if you're ready to dive into the heart-pounding world of scalping strategies, buckle up and prepare yourself for an exhilarating journey. Each trade holds promise, and excitement awaits at every turn.