cTrader is a powerful trading platform that offers a seamless and efficient trading experience. From its user-friendly interface to its advanced features, cTrader has become my go-to platform for executing trades.

What is cTrader? Instructions for using the trading platform

I have been actively trading in the forex market for quite some time now, and one platform that has truly caught my attention is cTrader.

What sets cTrader apart from other platforms is its intuitive design and functionality. The platform provides real-time market data with lightning-fast execution speeds, allowing me to make quick decisions and take advantage of market opportunities.

Stay tuned as Forex Prop Reviews delve deeper into the various features of cTrader and provide you with tips on how to make the most out of this exceptional platform.

What is cTrader?

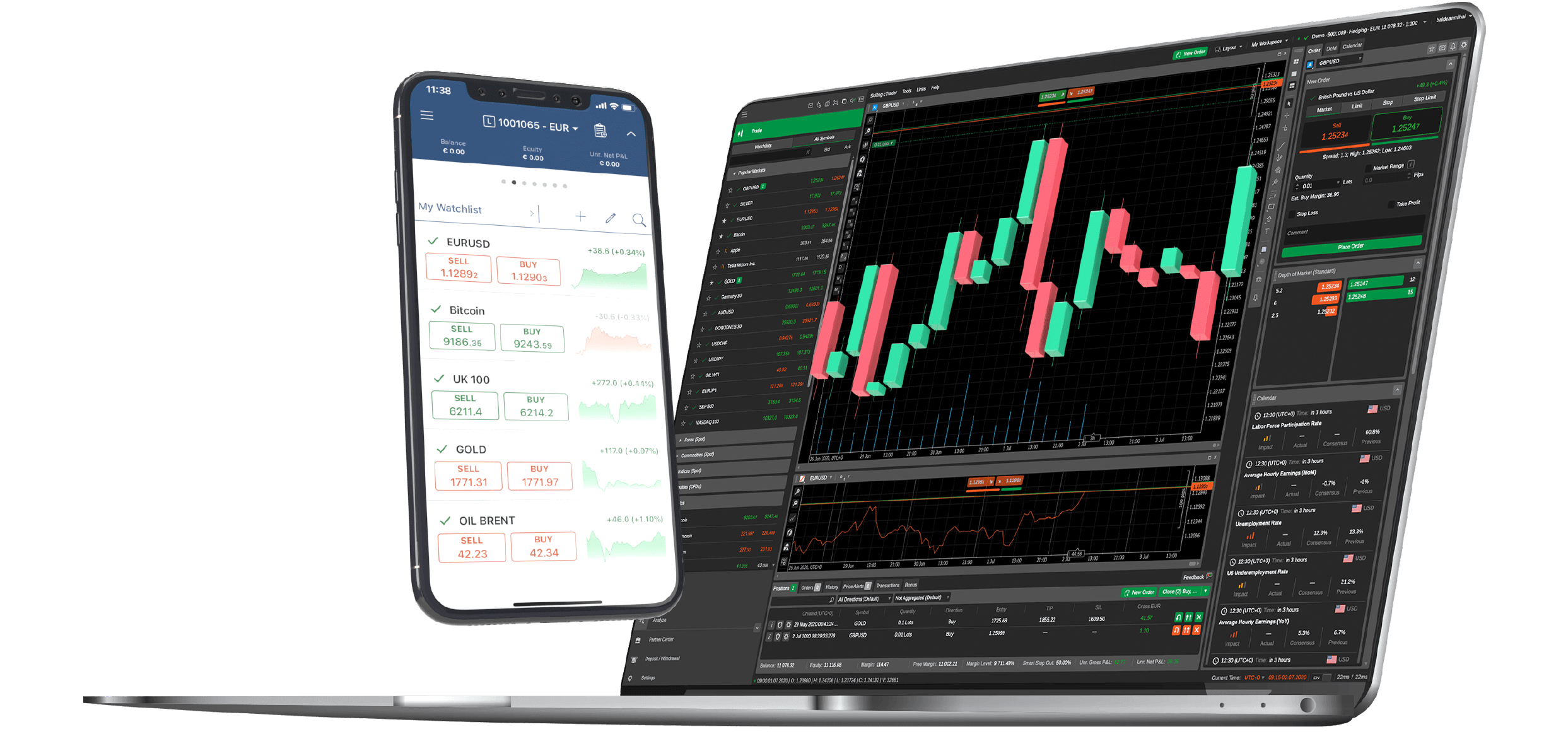

If you're curious about cTrader, let me tell you what it is! cTrader is a popular trading platform used by traders all around the world. It provides a user-friendly interface and advanced tools that make trading more efficient and enjoyable.

With cTrader, you can trade various financial instruments such as forex, stocks, indices, commodities, and cryptocurrencies.

Features of cTrader Platform

Explore the numerous features of the cTrader platform to enhance your trading experience. With its user-friendly interface and advanced functionality, cTrader offers a range of tools and options that cater to both experienced traders and beginners.

One notable feature is the customizable layout, allowing you to arrange charts, panels, and other elements according to your preference. This flexibility helps in creating a personalized workspace that suits your trading style.

Additionally, cTrader provides a comprehensive set of technical analysis tools to help you make informed trading decisions. You can access various chart types, indicators, and drawing tools to analyze market trends and patterns effectively.

The platform also offers a wide range of order types such as market orders, limit orders, stop orders, and more. These options allow for precise trade execution and risk management strategies.

Furthermore, cTrader offers an intuitive algorithmic trading environment with its integrated cAlgo feature. This allows users to create custom indicators and automated trading systems using C# programming language.

Whether you're new to coding or an experienced programmer, this feature enables you to develop complex algorithms tailored to your specific trading strategies.

Pros and Cons of cTrader Platform

Discovering the strengths and weaknesses of the cTrader platform is essential in order to fully enjoy its benefits.

Pros of cTrader Platform

One of the major pros of using cTrader is its user-friendly interface. The platform is designed to be intuitive and easy to navigate, making it accessible even for beginners.

Additionally, cTrader offers advanced charting capabilities, allowing traders to analyze market trends and make informed decisions.

Another advantage of using cTrader is its extensive range of features. The platform provides access to a wide variety of trading tools, including technical indicators, customizable charts, and risk management options. This allows traders to customize their trading experience according to their individual preferences and strategies.

Moreover, cTrader offers seamless integration with third-party applications such as trading robots or expert advisors, enhancing automation possibilities.

Cons of cTrader Platform

However, like any other platform, cTrader also has its downsides.

One disadvantage is that it may not be as popular or widely supported as some other trading platforms in the industry. This could limit the availability of certain resources or educational materials specifically tailored for cTrader users.

Additionally, while the platform does offer a mobile version for on-the-go trading, some users have reported occasional connectivity issues or slower performance compared to desktop usage.

Understanding both the strengths and weaknesses of the cTrader platform can help traders make an informed decision about whether it suits their needs and preferences.

How To Use cTrader Effectively?

To use cTrader effectively, you'll need to familiarize yourself with its various features and tools. One of the key components is the charting functionality, which allows you to analyze price movements and identify trends. You can customize the charts by adding indicators, drawing tools, and different time frames. This helps in making informed trading decisions based on technical analysis.

Additionally, cTrader offers a wide range of order types such as market orders, limit orders, stop orders, and more. Understanding how to place these orders correctly is crucial for executing trades efficiently.

Another important aspect of using cTrader effectively is understanding risk management. The platform provides built-in risk management tools like stop-loss and take-profit levels that allow you to set predetermined exit points for your trades. It's essential to use these features wisely and avoid being too greedy or impulsive when trading. Managing your risk effectively can help protect your capital and minimize potential losses.

Lastly, staying updated with market news and economic events is vital for effective trading on cTrader. The platform offers real-time news feeds from major financial sources so that you can stay informed about market-moving events that may impact your trades. By keeping an eye on economic calendars and news updates within the platform itself, you can make well-informed decisions based on fundamental analysis.

To use cTrader effectively means mastering its features and tools while implementing sound risk management strategies. Once you have a good grasp of these aspects, you'll be better prepared to navigate the fast-paced world of online trading successfully.

The Best cTrader Platform in 2023

Launched in 2011, the cTrader platform has demonstrated sufficient popularity to compete with other platforms such as MetaTrader 4 and MetaTrader 5. With advanced order protection features, market depth, enhanced timeframes, and charts, cTrader has been chosen by many ECN brokers, including:

IC Markets

IC Markets is considered the best ECN broker, regulated by ASIC, SySEC, and FSA. The cTrader trading platform integrated with IC Markets is user-friendly, offers fast order execution, and has low commissions. However, the high minimum deposit requirement of $200 is a limitation of this broker.

Pepperstone

Founded in 2010, Pepperstone is recognized as a leading ECN broker in Australia. This trading platform attracts traders with low spreads, low commissions, and fast order execution. Pepperstone supports various platforms, including cTrader. If you want to experience low spreads, consider trading with Pepperstone.

FxPro

Established in 2006, FxPro is regulated by FCA, FSCA, SCB, and SySEC. It has acquired 1,866,000 accounts in 173 countries worldwide. With its strong presence, FxPro continuously enhances the quality of trading, offers competitive spreads, no commissions, deep liquidity, and executes trades quickly. It is one of the brokerages that utilizes the cTrader platform, and it is worth considering for your trading experience.

Conclusion

In conclusion, cTrader is an innovative trading platform that offers a range of features and benefits for traders. The platform's efficient order execution and fast trade execution speed ensure that traders can take advantage of opportunities in real time.

With continuous improvements being made to enhance its functionality further, cTrader remains a top choice for both beginner and experienced traders alike who seek a reliable platform for their trading needs.