MyFundedFX tests their traders’ potential with a task of passing a one-step or two-step evaluation challenge, where they are given a demo account with virtual funds to trade, while they monitor their performanc

- Unlimited trading period to complete evaluation phases

- Excellent Trustpilot rating of 4.7/5

- Maximum balance of up to $1,500,000

- 80% profit splits

- Bi-weekly payouts

- Overnight and weekend holding allowed

- News trading allowed

- Scaling account option

- Leverage up to 1:100

- A large variety of trading instruments (forex pairs, commodities, indices, cryptocurrencies)

- Trailing drawdown on one-step challenge accounts

- Lot size limitations

- No Free Trial

MyFundedFX offers traders challenge programs that aim to provide an opportunity to trade without risking their own capital. Profitable traders receive a payment based on a specific percentage of the profits they make while having no liability on the firm’s capital. They allow them to earn high profits by managing account sizes up to $300,000 and taking home profit splits of 80%. They can achieve this by trading forex pairs, commodities, indices, and cryptocurrencies.

Who are MyFundedFX?

MyFundedFX is a proprietary firm incorporated in June 2022 with an office based in the US that offers its traders a chance to merge their accounts up to $300,000 with an additional scaling plan to increase their balance even further. They are partnered with Eightcap and ThinkMarkets as their broker.

Their offices are located at 100 Crescent Court Suite 700 Dallas, TX 75201, United States.

Who is the CEO of MyFundedFX?

Matthew Leech is the founder of MyFundedFX, who is a prosperous entrepreneur in the financial and tech services sectors, as well as a skilled trader in forex, options, stocks, and cryptocurrencies. Since 2018, he has been actively involved in trading and currently holds the position of CEO in MyFundedFX, along with several other ventures.

Matt’s motivation for launching MyFundedFX stemmed from recognizing a gap in the industry. Often, proprietary trading firms prioritize developing programs that neglect the needs of individual traders. However, with MyFundedFX, the primary focus is on educating traders and facilitating their path to securing funding. Matt and the entire team are deeply committed to this objective, consistently strengthening the foundational skills required to become a funded trader.

Funding program options

MyFundedFX offers its traders three different programs to choose from:

- One-step evaluation challenge accounts

- Normal two-step evaluation challenge accounts

- Pro two-step evaluation challenge accounts

One-step evaluation challenge account

MyFundedFX’s one-step evaluation challenge account aims to identify consistent and disciplined traders who are rewarded for their consistency in a one-phase evaluation period. The one-step evaluation challenge account allows you to trade with 1:100.

| Account Size | Price |

|---|---|

| $5,000 | $50 |

| $10,000 | $100 |

| $25,000 | $200 |

| $50,000 | $300 |

| $100,000 | $500 |

| $200,000 | $950 |

| $300,000 | $1,399 |

The one-step evaluation challenge account requires a trader to reach a profit target of 10% while not surpassing their 4% maximum daily and 6% maximum trailing loss rules. You are allowed to trade for an unlimited time period. During this time, you are required to reach the profit target and while having no minimum trading day requirements.

By completing the one-step evaluation challenge, you are awarded a funded account where you have no profit targets. You are only required to respect the 4% maximum daily and 6% maximum trailing loss rules. Your first profit split will be 80% based on the profits that you made 14 calendar days after the first position was placed on your funded account. After your first payout, you will continue receiving your payouts on a bi-weekly basis.

One-step evaluation challenge account scaling plan

One-step evaluation challenge accounts also have a scaling plan. You are required to be profitable within a three-month period where you average a return of 12% profit or more over the three-month period. You will receive an account increase of 25% of the original account balance up to a maximum balance of $1,500,000.

Example:

After 3 months: If you have a $200,000 account, your account balance will increase to $250,000.

After next 3 months: Balance of $250,000 increases to $300,000.

After next 3 months: Balance of $300,000 increases to $350,000.

And so on…

Trading instruments for the one-step evaluation challenge accounts are forex pairs, commodities, indices, and cryptocurrencies.

One-step evaluation challenge account rules

- Profit target is a specific percentage of profit that a trader is required to obtain before they can complete an evaluation phase, withdraw profits, or scale their account. Profit target for the evaluation period is 10%, while the funded account has no profit targets.

- Maximum daily loss is the maximum loss a trader can reach on a daily basis before the account is violated. All account sizes have a maximum daily loss of 4%.

- Maximum trailing drawdown is the maximum drawdown that is equal to the distance between the highest account balance achieved and the maximum drawdown. All account sizes have a maximum trailing drawdown of 6%.

- Lot size limit requires traders to follow specified lot sizes for specific trading instruments. These are most usually set based on the initial account balance of the prop firm account.

- Third-party copy trading risk means that if you intend to use copy trading services, you should keep in mind that by using a third-party copy trading service, there might be other traders that are already using it and therefore exactly the same trading strategy. By using a third-party copy trading service, you potentially run the risk of being denied a funded account/withdrawal if you exceed the maximum capital allocation rule.

- Third-party EA risk means that if you intend to use an EA, you should keep in mind that by using a third-party EA, there might be other traders that are already using it and therefore using exactly the same trading strategy. By using a third-party EA, you potentially run the risk of being denied a funded account/withdrawal if you exceed the maximum capital allocation rule.

Normal two-step evaluation challenge account

MyFundedFX’s normal two-step evaluation challenge account aims to identify consistent and disciplined traders who are rewarded for their consistency in the two-phase evaluation period. The evaluation program account allows you to trade with 1:100.

| Account Size | Price |

|---|---|

| $5,000 | $50 |

| $10,000 | $100 |

| $25,000 | $200 |

| $50,000 | $300 |

| $100,000 | $500 |

| $200,000 | $950 |

| $300,000 | $1,399 |

Evaluation phase one requires a trader to reach a profit target of 8% while not surpassing their 5% maximum daily loss or 8% maximum loss rules. You are allowed to trade for an unlimited time period. During this time, you are required to reach the profit target while having no minimum trading day requirements in order to proceed to phase two.

Evaluation phase two requires a trader to reach a profit target of 5% while not surpassing their 5% maximum daily loss or 8% maximum loss rules. You are allowed to trade for an unlimited time period. During this time, you are required to reach the profit target while having no minimum trading day requirements in order to proceed to a funded account.

By completing both evaluation phases, you are awarded a funded account where you have no profit targets. You are only required to respect the 5% maximum daily loss and 8% maximum loss rules. Your first profit split will be 80% based on the profits that you made 14 calendar days after the first position was placed on your funded account. After your first payout, you will continue receiving your payouts on a bi-weekly basis.

Normal two-step evaluation challenge account scaling plan

Normal two-step evaluation challenge accounts also have a scaling plan. You are required to be profitable within a three-month period where you average a return of 12% profit or more over the three-month period. You will receive an account increase of 25% of the original account balance up to a maximum balance of $1,500,000.

Example:

After 3 months: If you have a $200,000 account, your account balance will increase to $250,000.

After next 3 months: Balance of $250,000 increases to $300,000.

After next 3 months: Balance of $300,000 increases to $350,000.

And so on…

Trading instruments for the normal two-step evaluation challenge accounts are forex pairs, commodities, indices, and cryptocurrencies.

Normal two-step evaluation challenge account rules

- Profit target is a specific percentage of profit that a trader is required to obtain before they can complete an evaluation phase, withdraw profits, or scale their account. Phase 1 profit target is 8% while phase 2 has a profit target of 5%. Funded accounts have no profit targets.

- Maximum daily loss is the maximum loss a trader can reach on a daily basis before the account is violated. All account sizes have a maximum daily loss of 5%.

- Maximum loss is the maximum loss a trader can reach overall before the account is violated. All account sizes have a maximum loss of 8%.

- Lot size limit requires traders to follow specified lot sizes for specific trading instruments. These are most usually set based on the initial account balance of the prop firm account.

- Third-party copy trading risk means that if you intend to use copy trading services, you should keep in mind that by using a third-party copy trading service, there might be other traders that are already using it and therefore exactly the same trading strategy. By using a third-party copy trading service, you potentially run the risk of being denied a funded account/withdrawal if you exceed the maximum capital allocation rule.

- Third-party EA risk means that if you intend to use an EA, you should keep in mind that by using a third-party EA, there might be other traders that are already using it and therefore using exactly the same trading strategy. By using a third-party EA, you potentially run the risk of being denied a funded account/withdrawal if you exceed the maximum capital allocation rule.

Pro two-step evaluation challenge account

MyFundedFX’s pro two-step evaluation challenge account aims to identify consistent and disciplined traders who are rewarded for their consistency in the two-phase evaluation period. The evaluation program account allows you to trade with 1:50.

| Account Size | Price |

|---|---|

| $5,000 | $70 |

| $10,000 | $135 |

| $25,000 | $250 |

| $50,000 | $375 |

| $100,000 | $575 |

| $200,000 | $1,100 |

| $300,000 | $1,600 |

Evaluation phase one requires a trader to reach a profit target of 8% while not surpassing their 5% maximum daily loss or 10% maximum loss rules. You are allowed to trade for an unlimited time period. During this time, you are required to reach the profit target while having no minimum trading day requirements in order to proceed to phase two.

Evaluation phase two requires a trader to reach a profit target of 5% while not surpassing their 5% maximum daily loss or 10% maximum loss rules. You are allowed to trade for an unlimited time period. During this time, you are required to reach the profit target while having no minimum trading day requirements in order to proceed to a funded account.

By completing both evaluation phases, you are awarded a funded account where you have no profit targets. You are only required to respect the 5% maximum daily loss and 10% maximum loss rules. Your first profit split will be 80% based on the profits that you made 14 calendar days after the first position was placed on your funded account. After your first payout, you will continue receiving your payouts on a bi-weekly basis.

Pro two-step evaluation challenge account scaling plan

Pro two-step evaluation challenge accounts also have a scaling plan. You are required to be profitable within a three-month period where you average a return of 12% profit or more over the three-month period. You will receive an account increase of 25% of the original account balance up to a maximum balance of $1,500,000.

Example:

After 3 months: If you have a $200,000 account, your account balance will increase to $250,000.

After next 3 months: Balance of $250,000 increases to $300,000.

After next 3 months: Balance of $300,000 increases to $350,000.

And so on…

Trading instruments for the pro two-step evaluation challenge accounts are forex pairs, commodities, indices, and cryptocurrencies.

Pro two-step evaluation challenge account rules

- Profit target is a specific percentage of profit that a trader is required to obtain before they can complete an evaluation phase, withdraw profits, or scale their account. Phase 1 profit target is 8% while phase 2 has a profit target of 5%. Funded accounts have no profit targets.

- Maximum daily loss is the maximum loss a trader can reach on a daily basis before the account is violated. All account sizes have a maximum daily loss of 5%.

- Maximum loss is the maximum loss a trader can reach overall before the account is violated. All account sizes have a maximum loss of 10%.

- Lot size limit requires traders to follow specified lot sizes for specific trading instruments. These are most usually set based on the initial account balance of the prop firm account.

- Third-party copy trading risk means that if you intend to use copy trading services, you should keep in mind that by using a third-party copy trading service, there might be other traders that are already using it and therefore exactly the same trading strategy. By using a third-party copy trading service, you potentially run the risk of being denied a funded account/withdrawal if you exceed the maximum capital allocation rule.

- Third-party EA risk means that if you intend to use an EA, you should keep in mind that by using a third-party EA, there might be other traders that are already using it and therefore using exactly the same trading strategy. By using a third-party EA, you potentially run the risk of being denied a funded account/withdrawal if you exceed the maximum capital allocation rule.

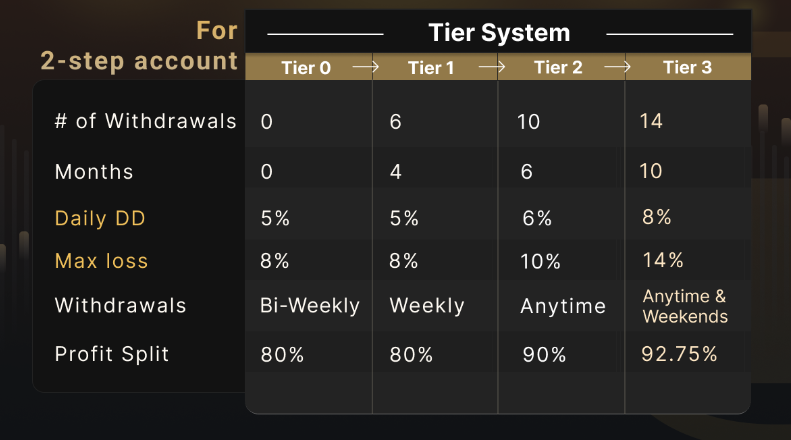

VIP Program

The VIP program is a unique feature that will award consistent and dedicated traders who do the work to obtain success. It has specific requirements that a trader is required to fulfill to become eligible.

VIP Program requirements:

- Received a minimum of 6 withdrawals

- Trading for a minimum of 4 months

- Consistent trading style through the 4 month period (all-in or high-risk trading style doesn’t qualify an individual)

- No account violations during the 4 month period

VIP Program benefits:

- Profit split up to 92.75%

- Ability to withdraw at any time, with no restrictions (the payout request button will always be active if you are in profit)

- Increased daily drawdown up to 6% with one-step evaluation accounts and up to 8% with two-step evaluation accounts

- Increased maximum drawdown up to 12% with one-step evaluation accounts and up to 14% with two-step evaluation accounts

One-step evaluation challenge VIP Program

Two-step evaluation challenge VIP Program

What makes MyFundedFX different from other prop firms?

MyFundedFX is different from most of the industry-leading prop firms by offering three different funding programs: one-step evaluation and two two-step evaluation challenges. In addition, they also have relatively relaxed trading rules. You can hold trades overnight and during the weekends and trade during news releases.

Compared to other prop firms, MyFundedFX offers a one-step evaluation challenge that requires traders to successfully complete one phase before being eligible for payouts. The profit target is 10%, with a 4% maximum daily and 6% maximum trailing loss rules. You should also note that you have no minimum or maximum trading day limitations during the evaluation period. One-step evaluation challenge accounts also have a scaling plan. Compared to other industry-leading prop firms, they have average trading rules with an unlimited trading period.

Compared to other prop firms, MyFundedFX also offers a normal two-step evaluation challenge that requires traders to complete two phases before being eligible for payouts. The profit target is 8% in phase one and 5% in phase two, with a 5% maximum daily and 8% maximum loss rules. You should also note that you have no minimum or maximum trading day limitations during the evaluation period. Normal two-step evaluation challenge accounts also have a scaling plan. Compared to other industry-leading prop firms, they have relatively low profit targets and an unlimited trading period.

Example of comparison between MyFundedFX & My Forex Funds

| Trading Objectives | MyFundedFX (Normal) | My Forex Funds |

|---|---|---|

| Phase 1 profit target | 8% | 8% |

| Phase 2 profit target | 5% | 5% |

| Maximum daily loss | 5% | 5% |

| Maximum loss | 8% | 12% |

| Minimum trading days | No minimum trading days | 5 calendar days |

| Profit split | 80% | 75% up to 90% |

Example of comparison between MyFundedFX & True Forex Funds

| Trading Objectives | MyFundedFX (Normal) | True Forex Funds |

|---|---|---|

| Phase 1 profit target | 8% | 8% |

| Phase 2 profit target | 5% | 5% |

| Maximum daily loss | 5% | 5% |

| Maximum loss | 8% | 10% |

| Minimum trading days | No minimum trading days | 5 calendar days |

| Profit split | 80% | 80% |

Example of comparison between MyFundedFX & FundedNext

| Trading Objectives | MyFundedFX (Normal) | FundedNext |

|---|---|---|

| Phase 1 profit target | 8% | 10% |

| Phase 2 profit target | 5% | 5% |

| Maximum daily loss | 5% | 5% |

| Maximum loss | 8% | 10% |

| Minimum trading days | No minimum trading days | 5 calendar days |

| Profit split | 80% | 80% up to 90% |

Compared to other prop firms, MyFundedFX also offers a pro two-step evaluation challenge that requires traders to complete two phases before being eligible for payouts. The profit target is 8% in phase one and 5% in phase two, with a 5% maximum daily and 10% maximum loss rules. You should also note that you have no minimum or maximum trading day limitations during the evaluation period. Pro two-step evaluation challenge accounts also have a scaling plan. Compared to other industry-leading prop firms, they have relatively low profit targets, average drawdown limitations, and an unlimited trading period.

Example of comparison between MyFundedFX & Finotive Funding

| Trading Objectives | MyFundedFX (Pro) | Finotive Funding |

|---|---|---|

| Phase 1 profit target | 8% | 7.5% |

| Phase 2 profit target | 5% | 5% |

| Maximum daily loss | 5% | 5% |

| Maximum loss | 8% | 10% |

| Minimum trading days | No minimum trading days | No minimum trading days |

| Profit split | 80% | 75% up to 95% |

Example of comparison between MyFundedFX & E8 Funding

| Trading Objectives | MyFundedFX (Pro) | E8 Funding |

|---|---|---|

| Phase 1 profit target | 8% | 8% |

| Phase 2 profit target | 5% | 5% |

| Maximum daily loss | 5% | 5% |

| Maximum loss | 8% | 8% (Scaleable up to 14%) |

| Minimum trading days | No minimum trading days | No minimum trading days |

| Profit split | 80% | 80% |

Example of comparison between MyFundedFX & Smart Prop Trader

| Trading Objectives | MyFundedFX (Pro) | Smart Prop Trader |

|---|---|---|

| Phase 1 profit target | 8% | 7% |

| Phase 2 profit target | 5% | 5% |

| Maximum daily loss | 5% | 4% |

| Maximum loss | 8% | 8% |

| Minimum trading days | No minimum trading days | No minimum trading days |

| Profit split | 80% | 80% up to 90% |

In conclusion, MyFundedFX is different from most of the industry-leading prop firms due to offering three different funding programs with relatively relaxed trading rules and an unlimited trading period. You can hold trades overnight and during the weekends and trade during news releases.

Is getting MyFundedFX capital realistic?

It’s essential to see how realistic the trading requirements are when looking at prop firms that best suit your forex trading style. For example, a company offering a high % profit split on a highly funded account sounds great, but if they expect high % gains per month with low % maximum drawdowns, your chances of success become close to zero.

Receiving capital from the one-step evaluation challenge accounts is realistic mostly since they have an average profit target of 10% with average maximum loss rules (4% maximum daily and 6% maximum trailing loss).

Receiving capital from the normal two-step evaluation challenge accounts is realistic mostly since they have relatively low profit targets (8% in phase one and 5% in phase two) with slightly below average maximum loss rules (5% maximum daily and 8% maximum loss).

Receiving capital from the pro two-step evaluation challenge accounts is realistic mostly since they have relatively low profit targets (8% in phase one and 5% in phase two) with average maximum loss rules (5% maximum daily and 10% maximum loss).

After considering all of that, MyFundedFX is an excellent choice to get funded since you have three different funding programs you can choose from that have realistic trading objectives to follow and conditions to receive payouts.

Payment proof

MyFundedFX was incorporated in June 2022. After getting a live-funded account, your first payout will be available in 14 calendar days. After that, traders continue to receive payouts on a bi-weekly basis.

You can find a large amount of payment proof on MyFundedFX’s Discord channel under the section ”Payout proof”.