Leveled Up Society tests their traders’ potential with a task of passing a 2-phase evaluation process, where they are given a demo account with virtual funds to trade, while they monitor their performanc

- Maximum balance of up to $1,000,000

- Unlimited evaluation free retries

- 80% up to 90% profit splits

- Bi-weekly payouts

- Overnight and weekend holding allowed

- Scaling account option

- Leverage up to 1:100

- A large variety of trading instruments (forex pairs, commodities, indices, cryptocurrencies)

- Trailing drawdown on one-step challenge accounts

- Martingale strategy is prohibited

- Limited news trading

Leveled Up Society is searching for passionate and experienced traders who will succeed with their funds’ help by showing skills in unpredictable market conditions. They allow them to earn high profits by managing account sizes up to $200,000 and taking home profit splits of 80%. They can achieve this by trading forex pairs, commodities, indices, and cryptocurrencies.

Who are Leveled Up Society?

Leveled Up Society is a proprietary firm incorporated in June 2022 with an office based in the US while offering its traders a chance to work with capital up to $200,000. They are partnered with Eightcap as their broker.

Their offices are located at 1001 Brickell Bay Dr #2700h, Miami, FL 33131, United States.

Video Review

Funding program options

Leveled Up Society offers its traders two different programs to choose from:

- One-step evaluation challenge accounts

- Two-step evaluation challenge accounts

One-step evaluation challenge account

Leveled Up Society’s one-step evaluation challenge account aims to identify consistent and disciplined traders who are rewarded for their consistency in a one-phase evaluation period. The one-step evaluation challenge account allows you to trade with 1:30.

| Account Size | Price |

|---|---|

| $10,000 | $109 |

| $25,000 | $209 |

| $50,000 | $309 |

| $100,000 | $519 |

| $200,000 | $979 |

The one-step evaluation challenge account requires a trader to reach a profit target of 10% while not surpassing their 3.5% maximum daily and 6% maximum trailing loss rules. You are allowed to trade for an unlimited time period. During this time, you are required to reach the profit target and while having no minimum trading day requirements.

By completing the one-step evaluation challenge, you are awarded a funded account where you have no profit targets. You are only required to respect the 3.5% maximum daily and 6% maximum trailing loss rules. Your first profit split will be 80% based on the profits that you made 30 calendar days after the first position was placed on your funded account. After your first payout, you will start receiving your payouts on a bi-weekly basis.

One-step evaluation challenge account scaling plan

One-step evaluation challenge accounts also have a scaling plan. You are required to be profitable within a three-month period where two out of the three months were profitable while also having an average of 15% profit or more return over the three-month period. You will receive an account increase of 25% of the original account balance and an increased profit split of 90% on the scaled funded account.

Example:

The required profit target for being eligible to scale your account is an average 15% return in a three-month period.

Month 1: You gain 4.2% and withdraw your profits.

Month 2: You gain 5.8% and withdraw your profits.

Month 3: You gain 6.2%% and withdraw your profits.

Your total profits have reached 16.2%, which is higher than the average 15% return requirement, meaning that it makes you eligible for a scale-up since you have reached the 15% average profit target requirement.

Trading instruments for the one-step evaluation challenge accounts are forex pairs, commodities, indices, and cryptocurrencies.

One-step evaluation challenge account rules

- Profit target is a specific percentage of profit that a trader is required to obtain before they can complete an evaluation phase, withdraw profits, or scale their account. Profit target for the evaluation period is 10%, while the funded account has no profit targets.

- Maximum daily loss is the maximum loss a trader can reach on a daily basis before the account is violated. All account sizes have a maximum daily loss of 3.5%.

- Maximum trailing drawdown is the maximum drawdown that is equal to the distance between the highest account balance achieved and the maximum drawdown. All account sizes have a maximum trailing drawdown of 6%.

- No news trading means that traders are not allowed to trade during high-impact news releases. You are restricted from opening and closing any trade 2 minutes before and after the news.

- No martingale allowed means that traders are not allowed to use any type of martingale strategy while trading.

- Third-party copy trading risk means that if you intend to use copy trading services, you should keep in mind that by using a third-party copy trading service, there might be other traders that are already using it and therefore exactly the same trading strategy. By using a third-party copy trading service, you potentially run the risk of being denied a funded account/withdrawal if you exceed the maximum capital allocation rule.

- Third-party EA risk means that if you intend to use an EA, you should keep in mind that by using a third-party EA, there might be other traders that are already using it and therefore using exactly the same trading strategy. By using a third-party EA, you potentially run the risk of being denied a funded account/withdrawal if you exceed the maximum capital allocation rule.

Two-step evaluation challenge account

Leveled Up Society’s two-step evaluation challenge account aims to identify consistent and disciplined traders who are rewarded for their consistency in the two-phase evaluation period. The evaluation program account allows you to trade with 1:100.

| Account Size | Price |

|---|---|

| $10,000 | $89 |

| $25,000 | $149 |

| $50,000 | $269 |

| $100,000 | $539 |

| $200,000 | $1,069 |

Evaluation phase one requires a trader to reach a profit target of 8% while not surpassing their 5% maximum daily loss or 8% maximum loss rules. You are allowed to trade for an unlimited time period. However, you are required to trade a minimum of 5 trading days in order to proceed to phase two.

Evaluation phase two requires a trader to reach a profit target of 5% while not surpassing their 5% maximum daily loss or 8% maximum loss rules. You are allowed to trade for an unlimited time period. However, you are required to trade a minimum of 5 trading days in order to proceed to a funded account.

By completing both evaluation phases, you are awarded a funded account where you have no profit targets. You are only required to respect the 5% maximum daily loss and 8% maximum loss rules. Your first payout is 30 calendar days from the day you place your first position on your funded account. Note that after you receive your first payout, all of your next payouts will be based on a bi-weekly basis. Your profit split will be 80% based on the profit you make on your funded account.

Two-step evaluation challenge account scaling plan

Two-step evaluation challenge accounts also have a scaling plan. You are required to be profitable within a three-month period where two out of the three months were profitable. You will receive an account increase of 25% of the original account balance.

Example:

After 3 months: If you have a $200,000 account, your account balance will increase to $250,000.

After next 3 months: Balance of $250,000 increases to $300,000.

After next 3 months: Balance of $300,000 increases to $350,000.

And so on…

Trading instruments for the two-step evaluation challenge accounts are forex pairs, commodities, indices, and cryptocurrencies.

Two-step evaluation challenge account rules

- Profit target is a specific percentage of profit that a trader is required to obtain before they can complete an evaluation phase, withdraw profits, or scale their account. Phase 1 profit target is 8% while phase 2 has a profit target of 5%. Funded accounts have no profit targets.

- Maximum daily loss is the maximum loss a trader can reach on a daily basis before the account is violated. All account sizes have a maximum daily loss of 5%.

- Maximum loss is the maximum loss a trader can reach overall before the account is violated. All account sizes have a maximum loss of 8%.

- Minimum trading days is the minimum period which you are required to trade for before you can complete an evaluation phase, or request a withdrawal. Both phases have a 5 minimum trading day requirement.

- No news trading means that traders are not allowed to trade during high-impact news releases. You are restricted from opening and closing any trade 2 minutes before and after the news.

- No martingale allowed means that traders are not allowed to use any type of martingale strategy while trading.

- Third-party copy trading risk means that if you intend to use copy trading services, you should keep in mind that by using a third-party copy trading service, there might be other traders that are already using it and therefore exactly the same trading strategy. By using a third-party copy trading service, you potentially run the risk of being denied a funded account/withdrawal if you exceed the maximum capital allocation rule.

- Third-party EA risk means that if you intend to use an EA, you should keep in mind that by using a third-party EA, there might be other traders that are already using it and therefore using exactly the same trading strategy. By using a third-party EA, you potentially run the risk of being denied a funded account/withdrawal if you exceed the maximum capital allocation rule.

What makes Leveled Up Society different from other prop firms?

Leveled Up Society is different from most of the industry-leading prop firms by offering two different funding programs: one-step and two-step challenges. In addition, they also have relatively relaxed trading rules. You can hold trades overnight and during the weekends, while news trading is slightly limited.

Compared to other prop firms, Leveled Up Society offers a one-step evaluation challenge that requires traders to successfully complete one phase before being eligible for payouts. The profit target is 10%, with a 3.5% maximum daily and 6% maximum trailing loss rules. You should also note that you have no minimum or maximum trading day limitations during the evaluation period. One-step evaluation challenge accounts also have a scaling plan. Compared to other industry-leading prop firms, they have average trading rules with an unlimited trading period.

Compared to other prop firms, Leveled Up Society also offers a two-step evaluation challenge that requires traders to complete two phases before being eligible for payouts. The profit target is 8% in phase one and 5% in phase two, with a 5% maximum daily and 8% maximum loss rules. You are also required to trade for a minimum of 5 days in each phase before becoming funded. Two-step evaluation challenge accounts also have a scaling plan. Compared to other industry-leading prop firms, they have relatively low profit targets and an unlimited trading period.

Example of comparison between Leveled Up Society & My Forex Funds

| Trading Objectives | Leveled Up Society | My Forex Funds |

|---|---|---|

| Phase 1 profit target | 8% | 8% |

| Phase 2 profit target | 5% | 5% |

| Maximum daily loss | 5% | 5% |

| Maximum loss | 8% | 12% |

| Minimum trading days | 5 calendar days | 5 calendar days |

| Profit split | 80% | 75% up to 90% |

Example of comparison between Leveled Up Society & True Forex Funds

| Trading Objectives | Leveled Up Society | True Forex Funds |

|---|---|---|

| Phase 1 profit target | 8% | 8% |

| Phase 2 profit target | 5% | 5% |

| Maximum daily loss | 5% | 5% |

| Maximum loss | 8% | 10% |

| Minimum trading days | 5 calendar days | 5 calendar days |

| Profit split | 80% | 80% |

Example of comparison between Leveled Up Society & FundedNext

| Trading Objectives | Leveled Up Society | FundedNext |

|---|---|---|

| Phase 1 profit target | 8% | 10% |

| Phase 2 profit target | 5% | 5% |

| Maximum daily loss | 5% | 5% |

| Maximum loss | 8% | 10% |

| Minimum trading days | 5 calendar days | 5 calendar days |

| Profit split | 80% | 80% up to 90% |

In conclusion, Leveled Up Society is different from most of the industry-leading prop firms due to offering two different funding programs with relatively relaxed trading rules and an unlimited trading period. You can hold trades overnight and during the weekends, while news trading is slightly limited.

Is getting Leveled Up Society capital realistic?

It’s essential to see how realistic the trading requirements are when looking at prop firms that best suit your forex trading style. For example, a company offering a high % profit split on a highly funded account sounds great, but if they expect high % gains per month with low % maximum drawdowns, your chances of success become close to zero.

Receiving capital from the one-step evaluation challenge accounts is realistic mostly since they have an average profit target of 10% with average maximum loss rules (3.5% maximum daily and 6% maximum trailing loss).

Receiving capital from the two-step evaluation challenge accounts is realistic mostly since they have relatively low profit targets (8% in phase one and 5% in phase two) with slightly below average maximum loss rules (5% maximum daily and 8% maximum loss).

After considering all of that, Leveled Up Society is an excellent choice to get funded since you have two different funding programs you can choose from that have realistic trading objectives to follow and conditions to receive payouts.

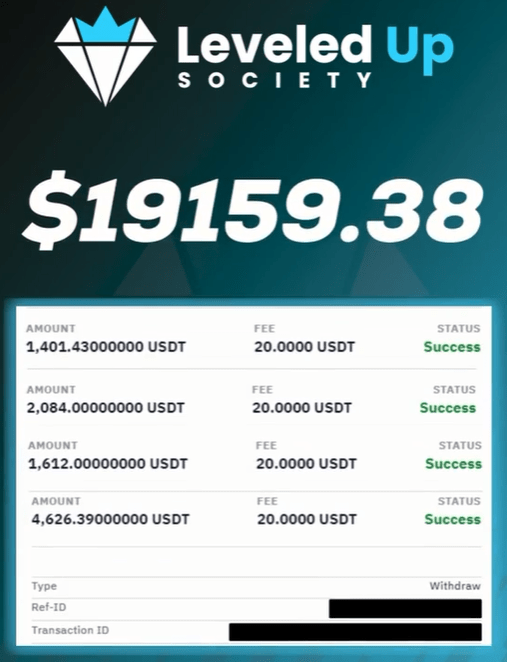

Payment proof

Leveled Up Society was incorporated in April 2021. After getting funded, your first payout will be available in 30 calendar days. After that, traders are eligible for bi-weekly payouts.

You can see examples of payment proof in the two following Instagram posts:

In addition, individuals can also find payment proof on Leveled Up Society’s Discord channel under the section ”Payouts”.

Which broker does Leveled Up Society use?

Leveled Up Society has integrated its technology with a broker Eightcap, an ASIC-regulated broker in Melbourne, Australia. They were founded in 2009 with a simple, straightforward mission to provide exceptional financial services to its clients. They have five offices around the globe and regulations in multiple locations providing clients worldwide with the ability to trade on markets across FX, indices, commodities, and shares.

Eightcap is considered average-risk, with an overall Trust Score of 73 out of 99. They have the following features:

- Forex Trading

- CFD Trading

- Cryptocurrency Trading

- Social Trading/Copy-Trading

- A total of 326 Tradeable Symbols

- A total of 45 Forex Pairs

They offer two account types, one being Raw and the other Standard. The commissions and fees will depend on which of the two you choose. Fees for Standard accounts are built into a spread and for Raw accounts into a commission. Another fee you should always consider is the overnight fee, which is an interest for holding an open position overnight in trading.

Being a MetaTrader only broker, their offers are MetaTrader 4 and the newer MetaTrader 5 platforms from MetaQuotes Software Corporation.

They deliver a personalized trading experience and create an ultra-efficient technology infrastructure for you to trade on and have been awarded the Best Global Forex MT4 Broker 2020 at the Global Forex Awards for doing so.

As for trading platforms, they allow you to trade on Meta Trader 4 and MetaTrader 5.

Trading instruments

Leveled Up Society allows you to trade forex pairs with 1:100 leverage, commodities with 1:40 leverage, indices with 1:30 leverage, and cryptocurrencies with 1:2 leverage.

| FOREX: | EURUSD | USDJPY | GBP/USD | USDCHF | USDCAD |

| AUDUSD | NZDUSD | AUDJPY | AUDNZD | CADCHF | CADJPY |

| CHFJPY | EURAUD | EURCAD | EURCHF | EURGBP | EURJPY |

| EURNZD | GBPAUD | GBPCAD | GBPCHF | GBPJPY | GBPNZD |

| NZDCAD | NZDCHF | NZDJPY | CADSGD | EURCZK | EURDKK |

| EURHKD | EURHUF | EURNOK | EURPLN | EURSEK | EURSGD |

| EURTRY | EURZAR | GBPDKK | GBPNOK | GBPSEK | NOKSEK |

| USDCNH | USDCZK | USDDKK | USDHKD | USDHUF | USDILS |

| USDMXN | USDNOK | USDPLN | USDRUB | USDSEK | USDSGD |

| USDTRY | USDZAR |

| COMMODITIES: | COPPER | XAGUSD | XAUUSD | XPTUSD |

| INDICES: | DAX | ESP35 | EUSTX50 | FRA40 | JPN225 |

| NAS100 | NGAS | SPX500 | UK100 |

| CRYPTO: | BATUSD | BCHUSD | BNBUSD | BTCUSD | DASHUSD |

| DOGEUSD | EOSUSD | ETCUSD | ETHUSD | IOTAUSD | LTCUSD |

| NEOUSD | OMGUSD | TRXUSD | UKOil | XLMUSD | XMRUSD |

| XRPUSD | ZECUSD |

Trading fees

Trading commission:

| Assets | Fee Terms |

|---|---|

| FOREX | 5 USD / LOT |

| COMMODITIES | 5 USD / LOT |

| INDICES | 5 USD / LOT |

| CRYPTO | 0.015% based on volume |

Spread:

In order to check the live spreads login to the trading account below:

| Platform | Server | Login Number | Password | Download Platform |

|---|---|---|---|---|

| MetaTrader 4 | EightcapLtd-Demo2 | 20180408 | SXhfhCnh | Click here |

Education & Support for traders

Leveled Up Society does not provide any educational content on its website.

They provide a well-structured dashboard that all of their clients can access, making it easier to manage risk with all the objectives of their statistics.

Trader dashboard – Statistics page with open positions

Traders’ Comments about Leveled Up Society

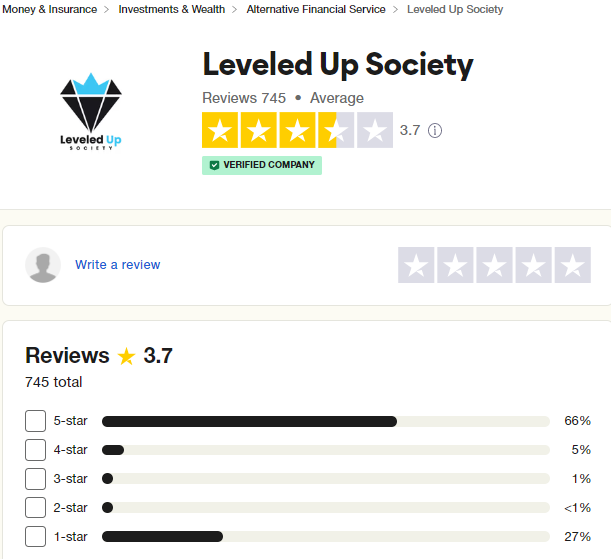

Leveled Up Society has average feedback from reviews.

On Trustpilot, they have a large variety of their community commenting and giving positive feedback with a great score of 3.7/5 out of 745 reviews. They also have a support team that will provide you with all the necessary information you require from them.

Their community praises the simple process and trading rules that they provide. In addition, Leveled Up Society has a very reliable customer support team that is patient and provides all the information an individual needs answered.

Social media statistics

Leveled Up Society can also be found on social media.

They have a:

- Instagram account with 25,7k followers, and

- Youtube channel with 5,16k subscribers with 23 uploaded videos.

Support

Leveled Up Society has a FAQ page where you might find the missing information.

The support team is available on their social media, or you can directly contact them on their email support@leveledupsociety.com.

Their live chat support team on their website is available 24/5 from Monday – Friday.

Conclusion

In conclusion, Leveled Up Society is a legitimate proprietary trading firm that offers traders a chance to choose between two funding programs: one-step challenge accounts and two-step challenge accounts. In addition, they have relatively relaxed trading rules and an unlimited trading period. You can hold trades overnight and during the weekends, while news trading is slightly limited.

One-step evaluation challenge accounts require the completion of one phase before becoming funded and eligible to earn profit splits. Leveled Up Society requires traders to reach a profit target of 10% before becoming funded. These are realistic trading objectives considering you have a 3.5% maximum daily drawdown and 6% maximum trailing drawdown rules to follow. With one-step evaluation programs, you can earn 80% up to 90% profit splits while also being able to scale your accounts.

The two-step evaluation challenge is an industry-standard two-phase evaluation challenge that requires the completion of two phases before becoming funded and being eligible to earn profit splits. Leveled Up Society requires traders to reach profit targets of 8% in phase one and 5% in phase two before becoming funded which are realistic trading objectives considering you have a 5% maximum daily and 8% maximum loss rules to follow. With evaluation programs, you can earn 80% profit splits while also being able to scale your accounts.

I would recommend Leveled Up Society to any trader who is looking for a legitimate prop firm with straightforward rules and trading objectives. They offer traders excellent conditions for a large pool of individuals with unique trading strategies. After considering everything Leveled Up Society has to offer, they are for sure one of the more potential proprietary trading firms in the industry.

This review about Leveled Up Society was lastly updated on 19.07.2023 at 12:51 (CE(S)T).

So, what do you think about the layout of the Proprietary Trading firm? Does Leveled Up Society have the instruments that you want to trade?

Let us know if you enjoyed our Leveled Up Society Proprietary Trading firm review!