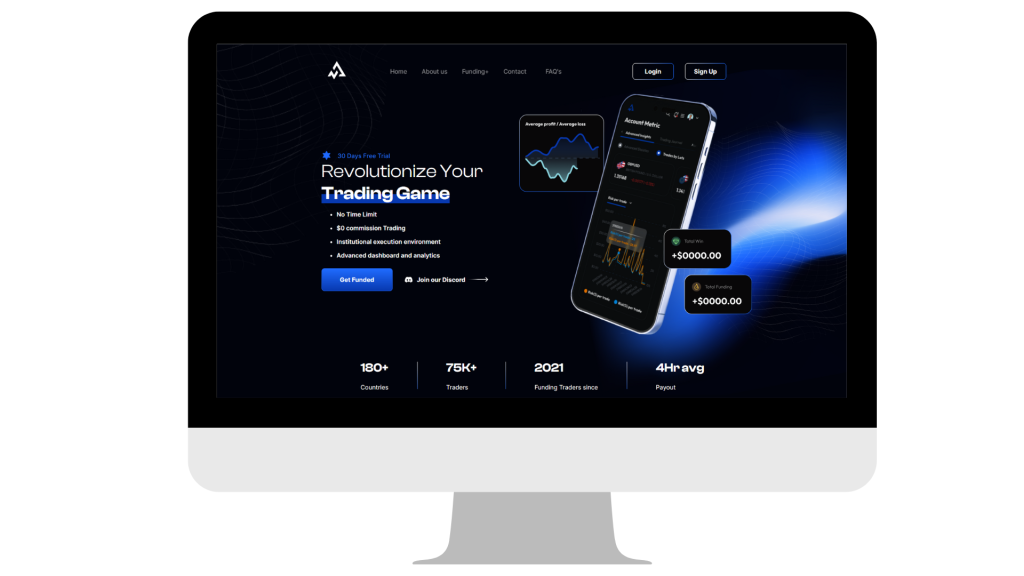

Alpha Capital Group offers to fund traders worldwide with the intention of identifying hidden talents in their community. They focus on creating unique funding opportunities, so anyone is given a chance to become a professional trader

- Free Trial

- Excellent Trustpilot rating of 4.6/5

- Unlimited evaluation free retries

- Maximum allocation capital of $2,000,000

- Profit share 80%

- Bi-weekly payouts

- Overnight and weekend holding allowed

- News trading allowed

- Scaling account option

- Leverage 1:100

- Professional trading dashboard

- Limited trading instruments: Forex pairs, commodities, indices

- Lot size limit & consistency rule

- Minimum average trade duration of 2 minutes rule

Traders at Alpha Capital Group are provided with a platform that includes educational videos, market insights, trading strategies, mentoring, and custom-built trading technology to assist traders on their journey to becoming funded and becoming one of their proprietary traders. They allow them to trade account sizes up to $200,000 and take home profit splits of 80%. They can achieve this by trading forex pairs, commodities, and indices.

Who are Alpha Capital Group?

Alpha Capital Group is a proprietary firm incorporated on the 2nd of November, 2021. They have offices located in London, UK while offering traders a chance to work with capital up to $2,000,000 with 80% profit splits. They pride themselves on the launch of their own in-house proprietary execution brokerage, ACG Markets, which offers traders excellent trading conditions.

Their headquarters are located at 10 Lower Thames Street, Billingsgate, London, England, EC3R 6AF.

Video Review

Funding Program Options

Alpha Capital Group offers its traders the following five evaluation program account sizes to choose from.

Evaluation program accounts

Alpha Capital Group’s evaluation program account aims to identify serious and talented traders who are rewarded for their consistency in the two-phase evaluation period. The evaluation program account allows you to trade with 1:100 leverage.

| Account Size | Price |

|---|---|

| $10,000 | $97 |

| $25,000 | $197 |

| $50,000 | $297 |

| $100,000 | $497 |

| $200,000 | $997 |

Evaluation phase one requires a trader to reach a profit target of 8% while not surpassing their 5% maximum daily loss or 10% maximum loss rules. When it comes to time limitations, note that you have no maximum trading day requirements during phase one. However, you are required to trade a minimum of three trading days in order to proceed to phase two.

Evaluation phase two requires a trader to reach a profit target of 5% while not surpassing their 5% maximum daily loss or 10% maximum loss rules. When it comes to time limitations, note that you have no maximum trading day requirements during phase two. However, you are required to trade a minimum of three trading days in order to proceed to a funded account.

By completing both evaluation phases, you are awarded a funded account where you have no profit targets. You are only required to respect the 5% maximum daily loss and 10% maximum loss rules. Your first payout is 14 calendar days from the day you place your first position on your funded account. All the following payouts can also be submitted on a bi-weekly basis, on the 14th & 28th of each month. Your profit split will be 80% based on the profit you make on your funded account.

Evaluation program account scaling plan

Evaluation program accounts also have a scaling plan. You can request for scaling when you achieve a 10% growth on your trading account. Note that the scaling amount will be 10% of the balance on your funded account. In addition, the trader is able to withdraw full profits that were made on the funded account while simultaneously scaling the trading account. This means that you aren’t required to give up profits in order to scale your account balance.

Example:

The scaling profit target for evaluation program accounts is 10%.

First bi-weekly payout: You gain 6% and withdraw 80% of your profits.

Second bi-weekly payout: You gain 5% and withdraw 80% of your profits.

Your total profits have reached 11%, which makes you eligible for scaling since you have reached the 10% profit target.

Trading instruments for the evaluation program accounts are forex pairs, commodities, and indices.

Evaluation program account rules

- Profit target is a specific percentage of profit that a trader is required to obtain before they can complete an evaluation phase, withdraw profits, or scale their account. Phase one profit target is 8%, while phase two has a profit target of 5%. Funded accounts have no profit targets.

- Maximum daily loss is the maximum loss a trader can reach on a daily basis before the account is violated. All account sizes have a maximum daily loss of 5%.

- Maximum loss is the maximum loss a trader can reach overall before the account is violated. All account sizes have a maximum loss of 10%.

- Minimum trading days is the minimum period which you are required to trade for before you can complete an evaluation phase, or request a withdrawal. Both phases have a 3 minimum trading day requirement. However, you have no minimum trading day requirements on a funded account.

- Lot size limit requires traders to follow specified lot sizes for specific trading instruments. These are usually set based on the initial account balance of the prop firm account. You can see the maximum lots available a trader can open across all pairs at any given time depending on their funded account size:

- $10,000 – 5 lots

- $25,000 – 10 lots

- $50,000 – 20 lots

- $100,000 40 lots-

- $200,000 – 80 lots

- No martingale allowed means that traders are not allowed to use any type of martingale strategy while trading.

- Average trade duration is a rule that requires traders to set a specific time limit for their trades to be held before closing them. The average trade duration required is 2 minutes.

- Third-party copy trading risk means that if you intend to use copy trading services, you should keep in mind that by using a third-party copy trading service, there might be other traders that are already using it and therefore exactly the same trading strategy. By using a third-party copy trading service, you potentially run the risk of being denied a funded account/withdrawal if you exceed the maximum capital allocation rule.

- Third-party EA risk means that if you intend to use an EA, you should keep in mind that by using a third-party EA, there might be other traders that are already using it and therefore using exactly the same trading strategy. By using a third-party EA, you potentially run the risk of being denied a funded account/withdrawal if you exceed the maximum capital allocation rule.

What makes Alpha Capital Group different from other prop firms?

Alpha Capital Group is different from most industry-leading prop firms due to offering five different two-step evaluation account sizes with straightforward rules. You have relatively low profit targets for both evaluation phases while also being able to trade during news, hold trades overnight, and during the weekends.

Alpha Capital Group evaluation program accounts have a two-phase evaluation that requires traders to complete two phases before being eligible for payouts. The profit target is 8% in phase one and 5% in phase two, with a 5% maximum daily and 10% maximum loss rules. In addition, you also have a 3 minimum trading days requirement in both phases before becoming funded. Evaluation program accounts also have a scaling plan. Compared to other industry-leading prop firms, they have relatively low profit targets with straightforward trading objectives and rules.

Example of comparison between Alpha Capital Group & E8 Funding

| Trading Objectives | Alpha Capital Group | E8 Funding |

|---|---|---|

| Phase 1 profit target | 8% | 8% |

| Phase 2 profit target | 5% | 5% |

| Maximum daily loss | 5% | 5% |

| Maximum loss | 10% | 8% (Scaleable to 14%) |

| Minimum trading days | 3 calendar days | No minimum trading days |

| Profit split | 80% | 80% |

Example of comparison between Alpha Capital Group & FundedNext

| Trading Objectives | Alpha Capital Group | FundedNext |

|---|---|---|

| Phase 1 profit target | 8% | 10% |

| Phase 2 profit target | 5% | 5% |

| Maximum daily loss | 5% | 5% |

| Maximum loss | 10% | 10% |

| Minimum trading days | 3 calendar days | 5 calendar days |

| Profit split | 80% | 80% up to 90% |

Example of comparison between Alpha Capital Group & My Forex Funds

| Trading Objectives | Alpha Capital Group | My Forex Funds |

|---|---|---|

| Phase 1 profit target | 8% | 8% |

| Phase 2 profit target | 5% | 5% |

| Maximum daily loss | 5% | 5% |

| Maximum loss | 10% | 12% |

| Minimum trading days | 3 calendar days | 5 calendar days |

| Profit split | 80% | 75% up to 90% |

In conclusion, Alpha Capital Group is different from other industry-leading prop firms by offering five different evaluation account sizes with straightforward rules. In addition, traders are also able to trade during news, hold trades overnight, and during the weekends.

Is getting Alpha Capital Group capital realistic?

It’s essential to see how realistic the trading requirements are when looking at prop firms that best suit your forex trading style. For example, a company offering a high % profit split on a highly funded account sounds great, but if they expect high % gains per month with low % maximum drawdowns, your chances of success become close to zero.

Receiving capital from the Evaluation program accounts is realistic mostly since they have relatively low profit targets (8% in phase one and 5% in phase two) with average maximum loss rules (5% maximum daily and 10% maximum loss).

After considering all of that, Alpha Capital Group is an excellent choice to get funded since you have five different two-step evaluation account sizes you can choose from that have realistic trading objectives to follow and conditions to receive payouts.

Payment proof

Alpha Capital Group was incorporated on the 2nd of November, 2021. After getting funded, traders are eligible for bi-weekly payouts with no minimum profit targets. To be exact, withdrawals can be requested on the 14th & 28th of each month. You can see two examples of payout proof below:

Payout proof 1

.jpg)